- Trevor Flipper argues HYPE nonetheless has upside, however says most merchants take pointless danger by utilizing bare lengthy positions.

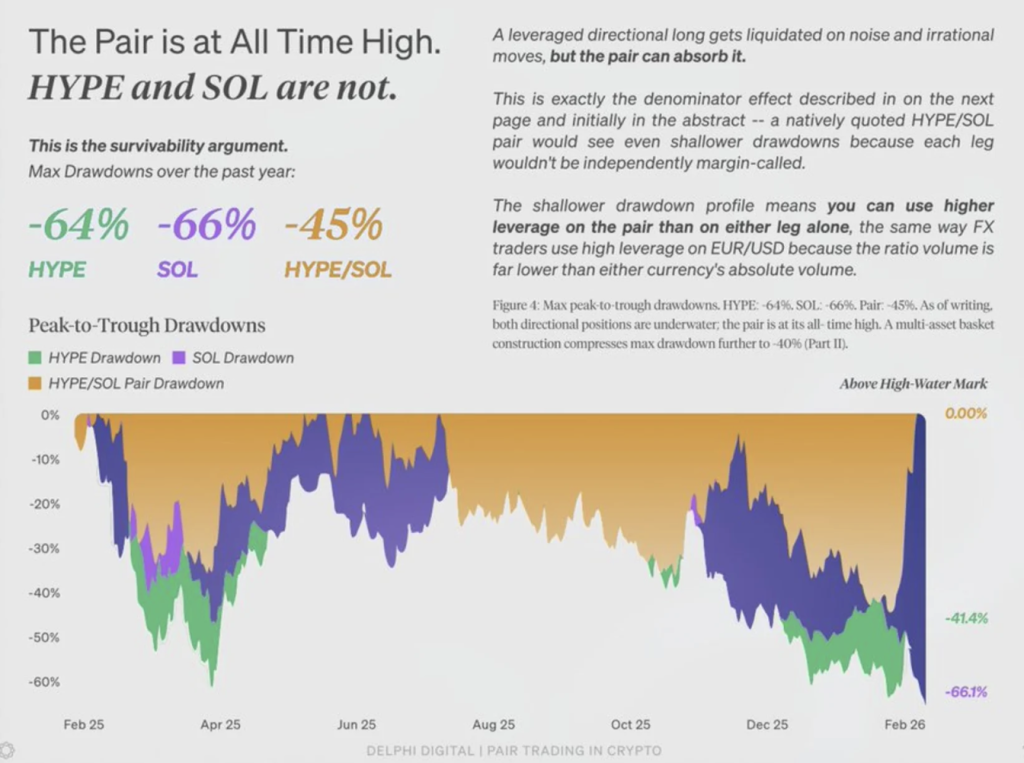

- The HYPE/SOL pair hit an all-time excessive even whereas each property stay under their peaks, displaying cleaner relative energy efficiency.

- Pair buying and selling improved Sharpe ratio and diminished drawdowns, with basket trades doubtlessly reducing volatility even additional.

Crypto analyst Trevor Flipper not too long ago shared a fairly sturdy take: he nonetheless thinks HYPE has room to run. However the attention-grabbing half wasn’t the bullish name itself. It was the best way he framed the larger downside, which is that almost all merchants construction their positions in a approach that quietly stacks danger towards them, even when their thesis is appropriate.

And yeah… that stings, as a result of it’s true extra usually than individuals need to admit.

The Actual Drawback Isn’t Timing, It’s Commerce Construction

Flipper’s argument is easy. On Crypto Twitter, merchants continuously discuss relative energy. They’ll say issues like, “Asset A will outperform Asset B,” or “This coin is clearly stronger than that one.” However as an alternative of truly buying and selling the distinction, most individuals simply purchase the asset they like and hope the market cooperates.

That’s the place issues get messy.

A unadorned lengthy place exposes you to the complete market. Bitcoin dumps? You are feeling it. Liquidity dries up? You are feeling it. Random wick on a Sunday night time? Yep, you are feeling that too. Even when your core concept was appropriate (that one asset is stronger than one other), you may nonetheless get chopped up by volatility that has nothing to do together with your thesis.

Flipper’s level was that the problem isn’t at all times leverage, or entry timing, and even dangerous danger administration. Typically the commerce is simply constructed improper from the beginning.

The HYPE/SOL Pair Commerce Exhibits a Cleaner Option to Categorical the Thesis

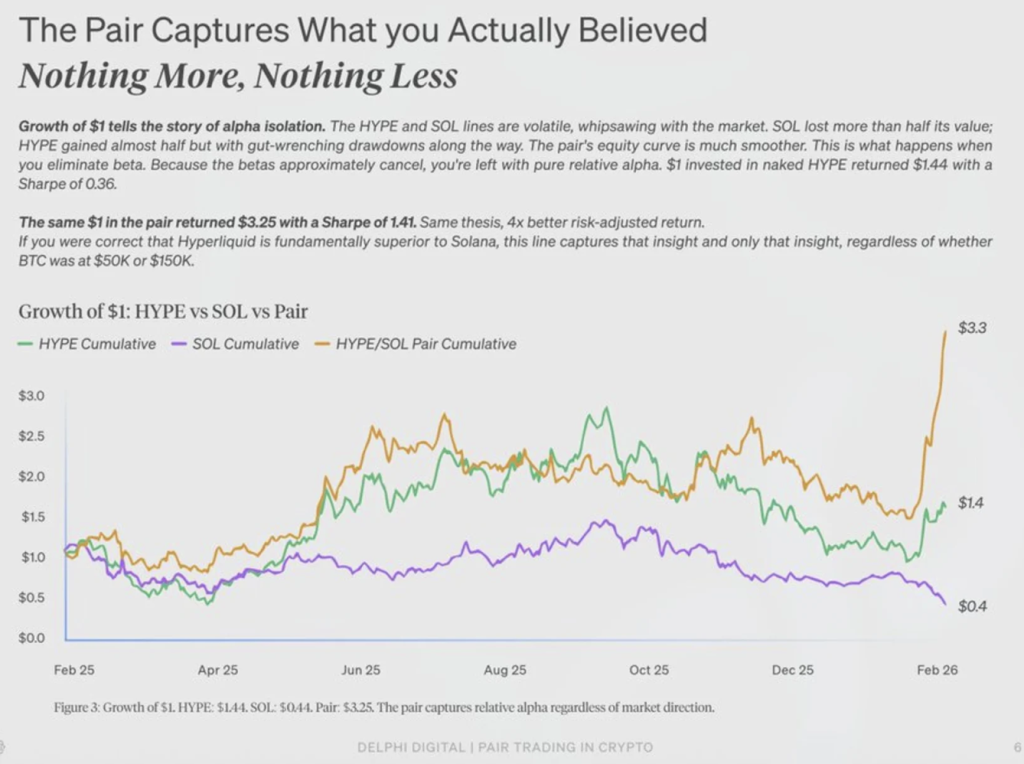

To display this, Flipper used a case examine evaluating HYPE towards Solana, particularly by the HYPE/SOL buying and selling pair. This relative commerce has been widespread in some kind for a lot of the previous yr, and the outcomes have been fairly telling.

Although HYPE remains to be round 40% under its all-time excessive, the HYPE/SOL pair is at present sitting at an all-time excessive. Solana can also be under its peak, however that doesn’t matter to the pair in the identical approach. The pair solely tracks the relative efficiency between the 2 property, which is your complete level.

That’s the important thing benefit: the commerce doesn’t care if Bitcoin is at $60,000 or $120,000. It doesn’t care if the entire market is euphoric or depressing. It solely cares whether or not Hyperliquid is outperforming Solana. In case your thesis is “HYPE beats SOL,” the pair commerce expresses that straight, with out dragging you thru the complete market rollercoaster.

Flipper defined that if the underlying assumption is appropriate, the pair place rewards it cleanly. You don’t want the entire market to go up. You simply want your stronger asset to maintain being stronger.

Threat-Adjusted Returns Look Dramatically Higher

Over practically a yr, Flipper famous that the HYPE/SOL pair achieved a Sharpe ratio of 1.45, which he described as “institutional high quality.” In distinction, a dealer who merely went lengthy HYPE (even with the right concept) would have posted a Sharpe ratio of simply 0.35.

That’s not a small distinction. That’s a totally completely different commerce.

The pair setup additionally diminished most drawdown from -64% to -45%, and reduce volatility by about 21%. And the wild half is that it didn’t require sophisticated derivatives or fancy timing. It simply required including one brief leg on Solana to neutralize broader market swings. With that one adjustment, the risk-adjusted returns have been practically 4 occasions higher.

Flipper mentioned this framework got here from frustration. Being proper essentially however nonetheless getting wrecked throughout downturns is among the most typical experiences in crypto. Pair buying and selling, in his view, strips out market noise and lets the alpha present by.

Why This May Matter Extra as Crypto Grows Up

Flipper additionally advised that such a positioning might grow to be much more beneficial as crypto matures. Because the market evolves, weaker tasks are likely to get weeded out, whereas the strongest gamers broaden and doubtlessly develop into trillion-dollar corporations. In that surroundings, relative energy methods might grow to be a extra constant strategy to seize upside with no need to gamble on general market path.

Wanting forward, Flipper’s broader objective is to broaden this strategy into multi-asset basket trades. Early knowledge, in keeping with him, suggests volatility might drop even additional, from round 104% in bare trades to 82% in pairs, and right down to 57% in basket-style constructions. On the identical time, Sharpe ratios might climb towards 1.80, which is the type of profile conventional funds truly search for.

It’s not a magic trick, and it doesn’t take away danger completely. Nevertheless it’s a reminder that in crypto, the way you categorical the concept can matter simply as a lot as the concept itself.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.