- PIPPIN surged to $0.7593 whereas Bitcoin fell again to $68,000

- Open curiosity climbed to $290M with longs dominating positioning

- The rally lacks main elementary catalysts, elevating correction dangers

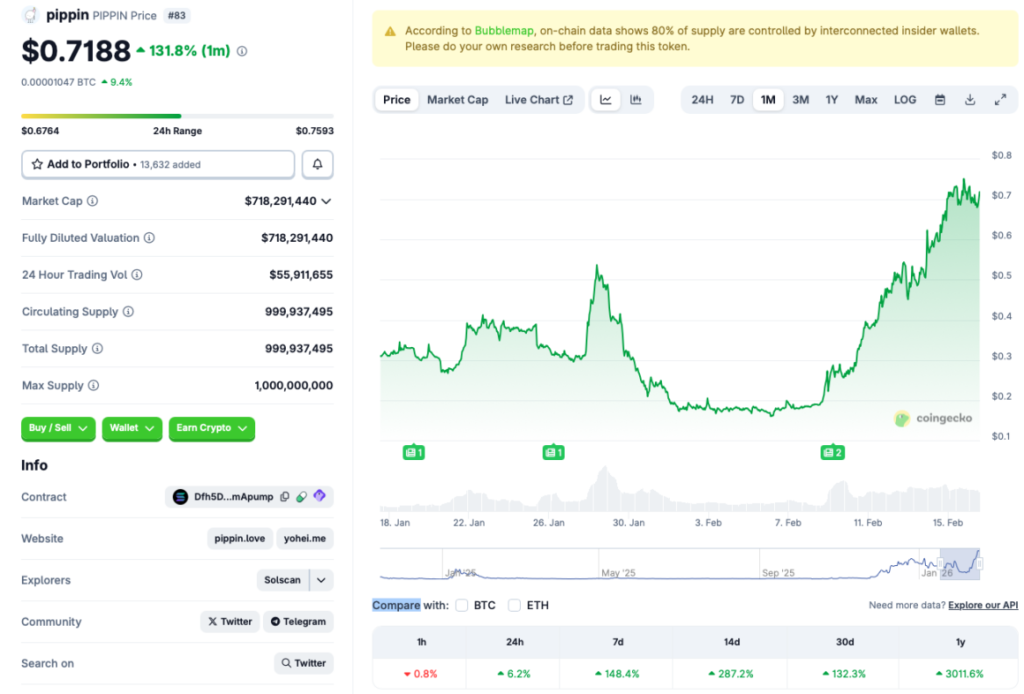

Whereas Bitcoin briefly reclaimed $70,000 earlier than sliding again to the $68,000 vary, Pippin (PIPPIN) moved in the wrong way. The AI agent token climbed to a brand new all-time excessive of $0.7593 on Feb. 15, 2026. In accordance with CoinGecko, the token is up 6.2% within the final 24 hours, 148% during the last week, and greater than 3,000% since February 2025.

That sort of efficiency stands out, particularly in a market the place most main property are nonetheless nursing deep drawdowns. When smaller tokens rally whereas Bitcoin struggles, it often alerts aggressive speculative positioning fairly than broad market energy.

Open Curiosity Is Fueling the Transfer

One of many greatest drivers behind PIPPIN’s surge seems to be derivatives exercise. CoinGlass information reveals open curiosity climbing to roughly $290 million. On the identical time, the long-short ratio stays above one, that means merchants are leaning bullish and anticipating additional upside.

That mixture can create a suggestions loop. Extra longs push value greater, which attracts extra momentum merchants, which pushes value greater once more. However that very same construction can unwind rapidly if sentiment shifts.

We’ve seen this film earlier than.

The December Parallel Shouldn’t Be Ignored

Pippin additionally hit a earlier all-time excessive in December 2025, throughout one other fragile market atmosphere. That rally was controversial, with some observers questioning whether or not the transfer was fueled by natural demand or extra coordinated speculative exercise.

The present surge appears comparable in a single key method: it’s occurring with out a clear elementary catalyst. There have been no main improvement bulletins, no breakthrough integrations, and no ecosystem growth headlines driving the transfer.

When value outruns narrative, volatility tends to observe.

Macro Circumstances Nonetheless Favor Warning

Broader market situations stay risk-sensitive. Traders are nonetheless cautious, with many shifting towards gold and silver as defensive performs. Liquidity situations are tight, and Bitcoin’s lack of ability to carry above $70,000 reveals that confidence isn’t absolutely restored.

In that atmosphere, high-beta tokens like PIPPIN can rally quick, however they will additionally right even sooner.

Conclusion

Pippin’s rally is undeniably sturdy, and open curiosity suggests merchants are betting on additional upside. However with out clear elementary drivers, the transfer appears closely momentum-driven. If Bitcoin stabilizes and sentiment improves, PIPPIN might lengthen positive factors. If broader threat urge for food fades once more, a pointy correction wouldn’t be shocking.

For now, this appears much less like structural adoption and extra like leveraged enthusiasm.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.