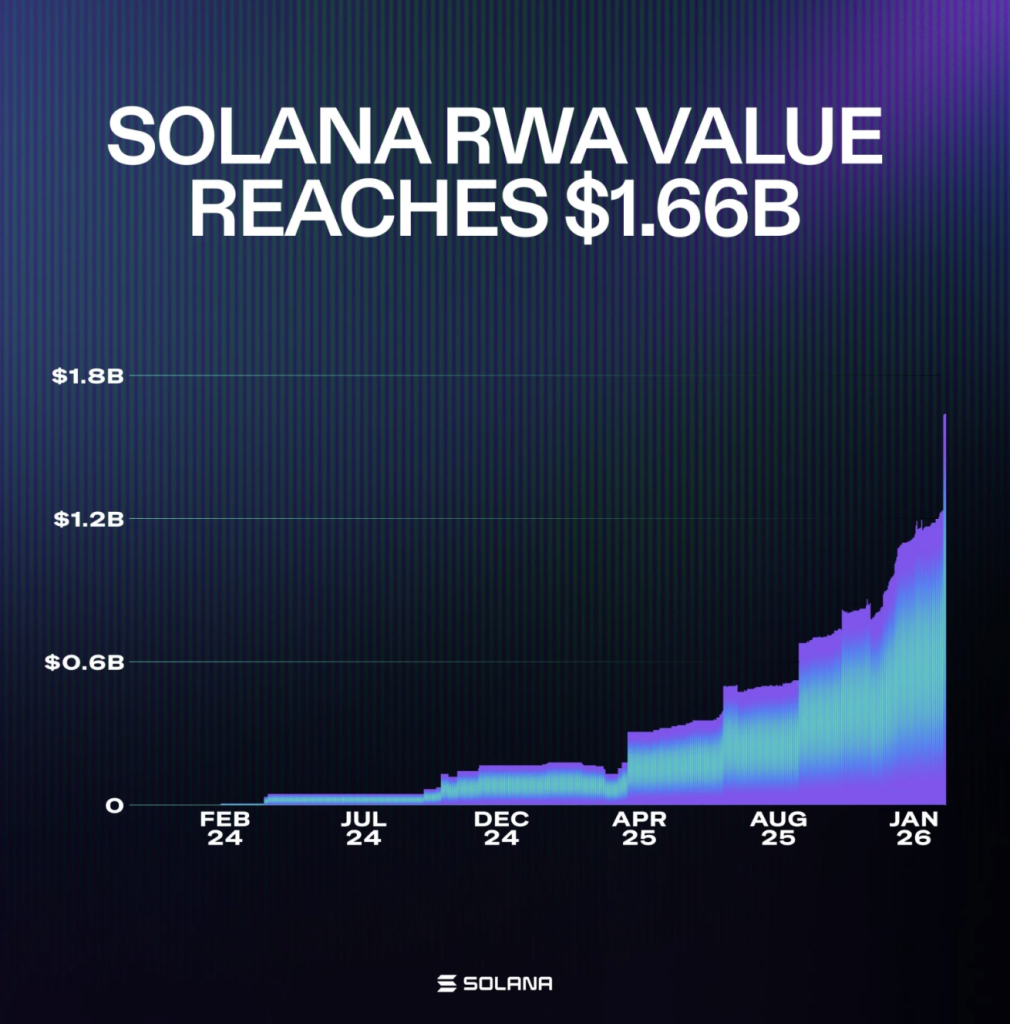

- Solana’s RWA ecosystem surpassed $1.66 billion in tokenized belongings, reflecting rising institutional and DeFi participation.

- SOL is testing key $90 resistance, with a confirmed 4H shut above that degree wanted to validate a breakout.

- Momentum indicators assist restoration, however overbought indicators increase the danger of a short-term pullback towards $82.5 or $77.

Solana’s real-world asset ecosystem simply hit a recent milestone. On Sunday, February 15, tokenized belongings on the community climbed previous $1.66 billion, marking a brand new all-time excessive. That’s not only a headline quantity both, it displays a gradual move of capital transferring on-chain, not a one-day spike.

Establishments and on-chain traders alike are leaning into Solana’s high-throughput, low-fee infrastructure to entry tokenized treasuries, personal credit score, and different yield-generating conventional belongings. In easy phrases, they’re utilizing the blockchain as settlement rails for real-world finance. And that shift says one thing about the place the business is heading.

Tokenization Momentum Is Selecting Up

This surge in RWAs isn’t occurring in isolation. It’s a part of a broader tokenization wave throughout crypto, the place conventional monetary devices are being issued and traded on-chain. Solana has been one of many foremost beneficiaries, partly as a result of its community velocity and value construction make it interesting for high-volume exercise.

DeFi integrations on Solana have additionally expanded, giving these tokenized belongings extra utility as soon as they’re issued. Robust developer adoption provides one other layer of confidence, as a result of infrastructure solely works long-term if builders hold constructing. And proper now, they’re.

As extra capital rotates into on-chain RWAs, Solana is quietly strengthening its place within the race to modernize monetary markets. Ethereum nonetheless dominates in lots of areas, however Solana’s development in tokenization exhibits it’s not simply competing, it’s carving out its personal lane.

SOL Value Now Faces a $90 Choice Level

Whereas the ecosystem celebrates a milestone, SOL’s worth is battling a technical wall. On February 15, the token pushed into the $90 resistance zone, a degree that has repeatedly stalled bullish makes an attempt in current classes. It’s change into a form of short-term ceiling.

Crypto analyst Crypto Pulse identified that an actual breakout would require a clear four-hour candle shut above $90. Not only a fast wick, not a short spike. A detailed. With out that affirmation, the breakout thesis stays fragile.

If SOL fails to safe that 4H shut above resistance, a short-term pullback turns into extra possible. The primary draw back space to observe sits across the $82.5 Truthful Worth Hole, the place worth might transfer to rebalance that technical inefficiency. If promoting stress accelerates past that, the $77 zone comes into view, an space the place aggressive consumers beforehand stepped in.

Momentum Is Bettering, However Not With out Threat

In response to TradingView information from February 15, SOL is hovering close to $90 after recovering from an early February drop that dragged worth from the $115–$120 vary right down to roughly $74. That slide was sharp. The bounce that adopted lifted SOL again into the mid-$80s, the place it consolidated in a uneven sample of decrease highs and better lows.

Just lately, momentum has turned optimistic once more, with worth testing the $92–$94 resistance area. That zone represents the subsequent provide space if $90 will be decisively cleared. However bulls are cautious right here, and you’ll really feel it within the worth motion.

The RSI (14) is sitting round 70, which displays robust shopping for stress but additionally indicators that the asset is approaching overbought territory within the quick time period. The MACD, however, exhibits a bullish crossover with increasing inexperienced bars, suggesting that upside momentum remains to be constructing. It’s a blended sign scenario, power with a facet of warning.

If SOL can maintain above the $88–$90 vary, the trail towards $94 and presumably $100 opens up. But when resistance holds agency and momentum fades, a retrace again into the mid-$80s, and even deeper, wouldn’t be stunning. For now, Solana’s fundamentals look robust, however the chart is demanding affirmation earlier than the subsequent leg larger.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.