WLFI’s early plunge and excessive funding charges preceded a $6.9B liquidation cascade throughout Bitcoin and Ether markets.

Crypto markets noticed considered one of their sharpest shocks of 2025 on Oct. 10, when practically $7 billion in leveraged positions had been worn out inside an hour. Bitcoin and Ether plunged, triggering compelled gross sales throughout exchanges. Evaluation from Amberdata suggests stress started hours earlier in a lesser-known token. Information exhibits World Liberty Monetary Token (WLFI) dropped sharply nicely earlier than Bitcoin reacted.

WLFI Signaled Market Stress Earlier than Main Crypto Promote-Off

Amberdata reviewed buying and selling exercise main as much as roughly $6.93 billion in liquidations. Bitcoin fell about 15% in the course of the occasion, whereas Ether dropped shut to twenty%. Smaller tokens declined by as a lot as 70% in minutes.

WLFI, a DeFi governance token, started sliding greater than 5 hours earlier than broader market costs turned decrease. At the moment, Bitcoin was buying and selling close to $121,000 and exhibited restricted indicators of pressure.

Furthermore, researchers recognized three uncommon patterns in WLFI buying and selling. First, there was a pointy spike in quantity. Hourly turnover surged to round $474 million, about 21.7 instances regular ranges, following public tariff-related political information.

Picture Supply: Amberdata

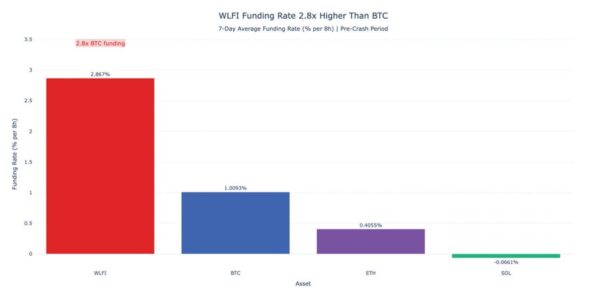

Moreover, merchants had been paying extraordinarily excessive charges to take care of WLFI futures positions. A funding charge of two.87% each eight hours is unusually steep. Over time, that provides as much as very excessive borrowing prices. Notably, such ranges sign crowded trades and robust speculative strain.

Politically Linked Token Reacts Sooner to Coverage and Regulatory Shifts

World Liberty Monetary Token (WLFI) is a cryptocurrency related to a lending platform linked to the Trump household. The asset combines digital finance with political branding, an uncommon mixture in crypto markets.

Whereas most cryptocurrencies react to technological developments or community results, WLFI responds to political information, coverage adjustments, and laws. As such, the asset’s worth is extra delicate to political occasions than typical tokens.

The possession construction of the governance token can be totally different. Whereas Bitcoin is unfold throughout tens of millions of holders worldwide, WLFI is managed by a smaller group. Giant parts are linked to insiders, together with members of the Trump household and political associates. When provide is concentrated, fewer individuals can affect worth strikes.

In the meantime, political developments could have an effect on these holders extra straight. Consequently, WLFI can reply extra shortly and extra sharply to political or regulatory information than broader crypto property.

Amberdata Warns WLFI Not But a Dependable Sign of Future Downturns

Amberdata burdened that the information doesn’t show insider exercise. As an alternative, the report factors to the WLFI market construction as a key issue. The asset’s holder base is extra concentrated amongst politically linked individuals.

Cited within the report, the exercise was described as “instrument-specific,” which means buying and selling strain stayed largely inside WLFI. Exercise centered on WLFI, as main cash didn’t transfer in unison. If tariff headlines alone had pushed the response, Bitcoin and different large-cap tokens would probably have declined sooner.

Instantly after the tariff announcement, buying and selling in WLFI elevated. That fast response suggests some merchants had been already ready to make strikes. On many crypto platforms, merchants borrow cash and use tokens reminiscent of WLFI as collateral.

When WLFI’s worth fell, the worth of that collateral dropped. To keep away from automated liquidation, merchants needed to shortly promote different property, reminiscent of Bitcoin and Ether. These emergency gross sales pushed costs down. Falling costs then triggered additional compelled promoting, leading to billions of {dollars} in liquidations over a brief interval.

As well as, the report acknowledged that WLFI’s volatility reached about eight instances increased than Bitcoin’s in the course of the crash. This means that WLFI responded far more aggressively to market stress.

Researchers imagine that fragile and extremely leveraged tokens could decline first throughout shocks. Smaller tokens with concentrated possession can shortly exert strain on bigger property.

Amberdata cautioned towards treating WLFI as a reliable sign of future downturns. These findings are primarily based on a single occasion, and extra circumstances could be wanted to verify a constant sample.