- XRP briefly reclaimed $1.64 earlier than dealing with renewed promoting strain

- South Korean quantity spiked as Bitcoin touched $70K

- Key resistance and macro sentiment now form the subsequent transfer

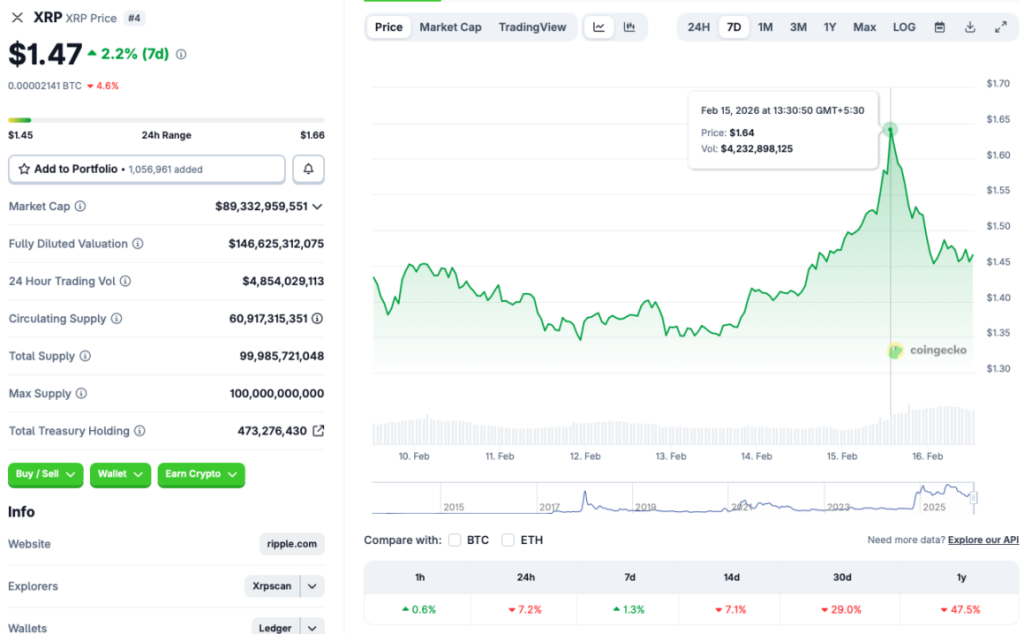

Ripple’s XRP managed to reclaim the $1.64 stage throughout the weekend rally, driving the identical momentum that pushed Bitcoin to $70,000. That bounce felt constructive at first. However as BTC slipped again towards $68,000, XRP adopted virtually instantly.

Based on CoinGecko information, XRP is now down 7.2% within the final 24 hours, 7.1% over two weeks, and almost 29% previously month. The weekly chart nonetheless exhibits a modest 1.3% achieve, which suggests consumers haven’t totally stepped away. Nonetheless, the rejection close to $1.65 exhibits that conviction stays fragile.

$1.65 Is the Line That Issues

Technically, $1.65 is performing as a transparent resistance ceiling. XRP has tried to push via however hasn’t managed to carry above it. On the draw back, the $1.40 zone seems to be the instant assist space the place consumers are stepping in.

If XRP breaks cleanly above $1.65 with sustained quantity, the trail towards $1.90 opens up rapidly. However failure to carry $1.40 might invite one other leg down, particularly if Bitcoin weakens additional. For now, the asset is boxed between these ranges.

South Korea’s Quantity Spike

One notable catalyst behind the weekend rally was a surge in South Korean buying and selling exercise. Upbit and Bithumb reportedly processed round $1.20 billion in XRP quantity inside 24 hours. That sort of regional participation usually provides short-term momentum.

Nonetheless, volume-driven rallies can fade simply as quick if broader sentiment cools. With out sustained international inflows, regional spikes are likely to create volatility moderately than long-term development shifts.

ETFs and Institutional Angle

The post-SEC settlement atmosphere has clearly strengthened XRP’s institutional narrative. Spot XRP ETFs launched in late 2025, and corporations like Goldman Sachs reportedly maintain vital publicity, together with round $152 million in XRP-linked ETF positions.

That institutional presence provides structural credibility. Nonetheless, ETF inflows are likely to speed up in bullish situations and gradual throughout risk-off phases. Macro sentiment and broader crypto flows will probably decide how rapidly capital returns.

Conclusion

XRP’s skill to reclaim $1.65 will outline the short-term outlook. A breakout might unlock momentum towards $1.90, whereas failure to carry assist close to $1.40 will increase draw back threat. The broader crypto market, notably Bitcoin’s stability, stays the dominant affect. For now, XRP is ready on macro readability as a lot as technical affirmation.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.