Dogecoin is flashing a uncommon weekly “bearish cross” simply as merchants debate whether or not final week’s $0.08 washout was the cycle’s reset or merely the primary leg decrease. The setup issues past DOGE itself as a result of memecoin flows are more and more being handled as a proxy for threat urge for food throughout crypto.

Is The Dogecoin Backside In?

A chart shared by Charting Man exhibits the 20-week EMA crossing beneath the 200-week EMA, a technical occasion he argues has traditionally aligned with DOGE capitulation. “DOGE usually bottoms round when the 20 weekly EMA crosses beneath the 200 weekly EMA. That occurred final week” he wrote, including that he “elevated my place by 50% on the lows” and that his group acquired purchase alerts.

That framing is colliding with extra cautious range-based reads from different analysts watching spot construction as a substitute of the moving-average sign alone.

Associated Studying

Daan Crypto Trades described the post-dip bounce as constructive, however explicitly framed it as vary commerce relatively than development affirmation. “DOGE Respectable worth motion right here over the previous few days after the large $0.08 check final week. At present seeing this $0.08-$0.13 space as a wide variety,” he posted.

“Something above that time would make me assured in an extra transfer in direction of the Every day 200MA/EMA. At present close to the center so laborious to essentially assume a course right here the best way it’s buying and selling.”

On his chart, DOGE/USDT was sitting across the center of that band close to $0.10–$0.11, with the higher vary marker round $0.132 and the decrease boundary close to $0.088. In different phrases: not a clear development, not a clear imply reversion, only a market ready for a push.

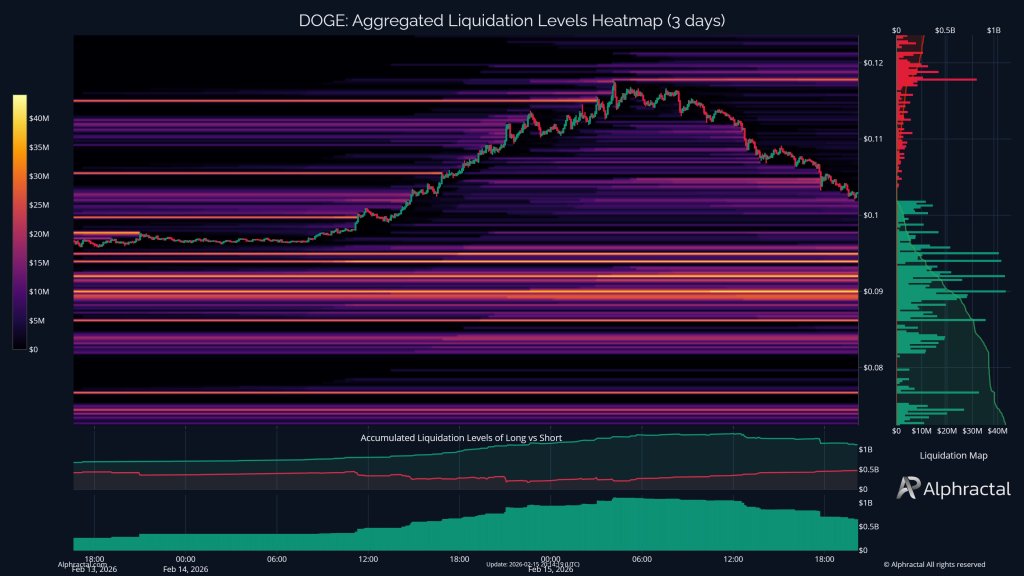

That “ready” may be costly in a leverage-heavy coin. CEO of Aphractal João Wedson struck a stark tone, warning: “If you’re lengthy on Doge, you’ll possible be liquidated quickly!”

Associated Studying

An aggregated liquidation heatmap shared by Alphractal highlights why this warning resonates with derivatives merchants: thick bands of potential liquidation ranges sit beneath present worth over the previous three days, suggesting stop-driven strikes may cascade if DOGE begins trending as a substitute of chopping.

Wedson additionally argued that DOGE rallies can perform as a broader volatility inform for Bitcoin, calling them “a threat sign for Bitcoin” and saying it “normally occurs when Bitcoin is transferring sideways.”

Alphractal echoed the rotation narrative in an extended word on flows. “Over the previous few days, memecoins have considerably outperformed BTC and different altcoins. What stood out probably the most was Dogecoin, the place the variety of trades surpassed all others in its class,” the account wrote. “Nonetheless, in the previous couple of hours, memecoins have began to appropriate whereas BTC stays comparatively secure.”

The near-term map is clear even when the conviction isn’t. Bulls want a decisive reclaim of the highest of the $0.08–$0.13 vary to credibly reopen the trail towards the each day 200 MA/EMA that Daan flagged. Bears, in the meantime, will concentrate on whether or not the market revisits the $0.08 space and whether or not that degree holds on a second check with liquidation clusters in play.

At press time, Dogecoin traded at $0.10.

Featured picture created with DALL.E, chart from TradingView.com