- A whale withdrew practically 20,000 ETH value $40M, including to prior massive accumulation, signaling deliberate capital deployment.

- Ethereum trade reserves fell 6.47%, tightening obtainable provide and reinforcing accumulation tendencies.

- Binance prime merchants present a 3.33 Lengthy/Brief ratio whereas funding charges stay constructive, reflecting sustained leveraged demand for ETH.

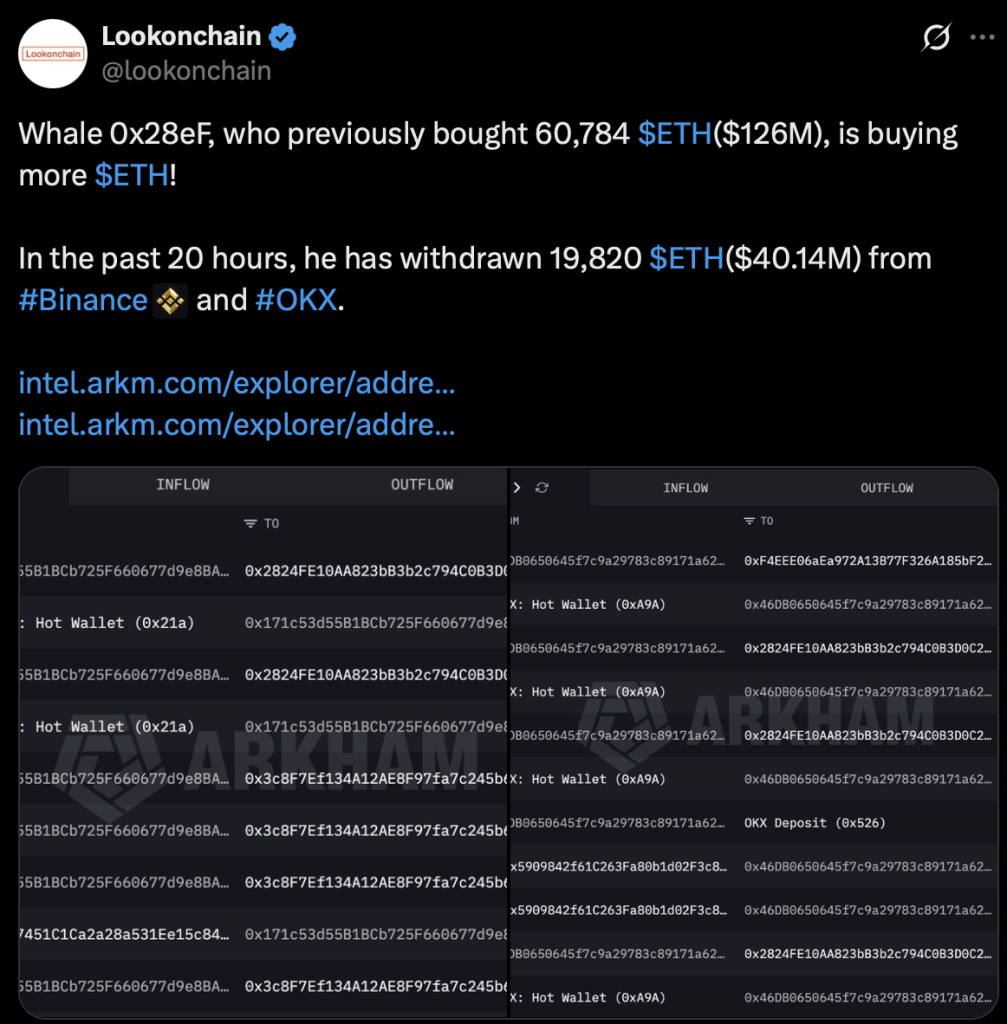

A serious Ethereum whale simply made one other transfer, and it wasn’t small. Roughly 19,820 ETH, value about $40.14 million, was withdrawn from Binance and OKX, stacking on prime of an earlier 60,784 ETH buy valued close to $126 million. That form of sequencing doesn’t appear like informal dip-buying. It appears deliberate.

On the similar time, one other massive dealer pushed $1 million USDC onto Hyperliquid and opened a 20x leveraged ETH lengthy. Sure, that very same dealer additionally holds a 20x SOL lengthy, however this recent capital was pointed straight at Ethereum. When spot accumulation and high-leverage derivatives publicity line up like that, it’s hardly ever random. It suggests construction. Intent.

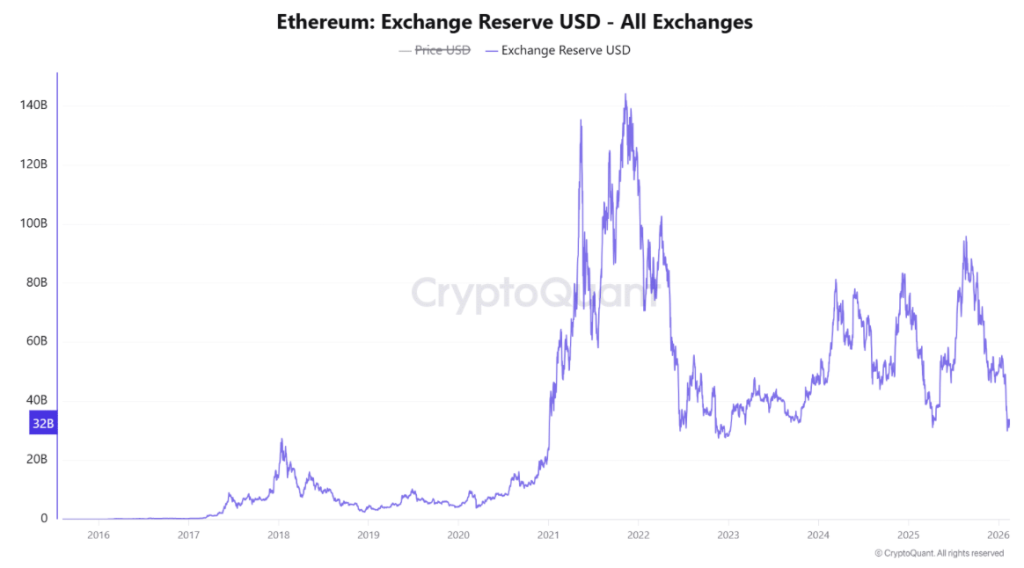

Alternate Reserves Maintain Shrinking

Ethereum’s trade reserves now sit round $31.843 billion after dropping 6.47%. That decline may not sound dramatic in isolation, however context issues. When whales pull belongings off centralized exchanges, they scale back the instantly tradable provide. Fewer cash sitting on exchanges means much less stock able to be bought on brief discover.

And that shifts the stability.

Sustained reserve declines usually align with longer-term holding habits. Giant traders don’t usually withdraw tens of thousands and thousands in ETH simply to flip it tomorrow. Extra usually, it’s about custody, consolidation, or strategic positioning. The latest drop in reserves mirrors the noticed whale withdrawals, reinforcing the concept that this isn’t opportunistic churn. It feels deliberate.

Alternate balances naturally fluctuate, certain. However when the route stays constant, the narrative strengthens. Ethereum is quietly migrating into fewer, extra concentrated arms.

High Binance Merchants Lean Closely Lengthy

Binance information provides one other layer. Round 76.91% of prime dealer accounts are holding lengthy positions, in comparison with simply 23.09% brief. That creates a Lengthy/Brief ratio of three.33, which is a noticeable skew.

Now, account-based ratios don’t measure actual capital dimension. They mirror positioning distribution, not essentially whole {dollars} deployed. Nonetheless, these “prime dealer” accounts aren’t random retail wallets. They have a tendency to handle threat fastidiously and transfer dimension strategically.

A ratio this tilted towards longs alerts conviction. It’s not simply gentle optimism. However right here’s the catch: when positioning turns into crowded, volatility threat will increase. If sentiment flips unexpectedly, those self same aligned positions can unwind shortly. For now although, superior merchants seem comfy leaning lengthy somewhat than hedging defensively.

Funding Charges Affirm Leveraged Urge for food

Funding charges are additionally telling a narrative. At press time, Ethereum funding printed 0.007286, up practically 21%, that means longs are paying shorts to take care of positions. That’s how perpetual futures markets stability themselves. When demand for lengthy publicity exceeds brief curiosity, funding turns constructive.

The present fee isn’t excessive. It’s elevated, however not overheated. That distinction issues.

Constructive funding, rising Open Curiosity, declining trade reserves, and visual whale withdrawals all lining up collectively is just not frequent coincidence. It factors towards coordinated positioning throughout spot and derivatives layers. Merchants aren’t simply holding ETH passively. They’re including publicity and absorbing leverage prices to do it.

Strategic Conviction or Tactical Setup?

When deep spot accumulation, shrinking trade reserves, dominant lengthy positioning, and rising funding converge, it paints a transparent image. Giant gamers look like structuring Ethereum publicity deliberately. This doesn’t appear like reactive buying and selling. It appears methodical.

In fact, markets can shock anybody. Crowded longs carry threat. However these sorts of aligned behaviors hardly ever develop accidentally. Whether or not it’s long-term conviction or a calculated tactical wager, Ethereum is attracting critical capital in a structured manner.

And when whales, leverage, and liquidity dynamics begin shifting in sync, it often means one thing larger is being constructed beneath the floor.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.