- Japan is more and more positioning XRPL as monetary infrastructure, with SBI reportedly investing throughout XRP, identification, compliance, and lending layers.

- Decentralized identification and zk-credential methods like XDNA might develop into important for regulated adoption past easy funds.

- XRP’s bridge-asset design stays central, particularly as stablecoin swaps and tokenized FX narratives develop round on-chain settlement.

Japan is beginning to seem like one of the critical nations with regards to constructing the following model of finance on-chain. The combination is fairly distinctive: a comparatively sturdy regulatory surroundings, proactive institutional participation, and a rising urge for food for blockchain-based monetary infrastructure. And in that greater image, the XRP Ledger is more and more being positioned as greater than only a funds community. It’s being framed as core infrastructure.

Crypto analyst Stellar Rippler claimed on X {that a} senior banker from the Financial institution of Japan, Kazuo Ueda, reportedly acknowledged that SBI Holdings has invested in XRP, XRPL-native identification protocols, compliance tooling, and lending-related initiatives. That’s already an enormous assertion, however the context received even louder when SBI Holdings CEO Yoshitaka Kitao stated the agency holds hidden belongings value greater than its formally disclosed 9% stake, which is valued at over $10 billion.

Whether or not you’re bullish or skeptical, the message is evident: Japan, and SBI particularly, isn’t treating XRPL like a aspect experiment. They’re treating it like a platform.

Japan’s XRPL Curiosity Is Shifting Past Funds

The strategic course turns into so much clearer while you view it by means of the identification lens. Ripple president Monica Lengthy has described decentralized identification on XRPL as a solution to flip private data right into a safe, transportable digital token, one thing customers can carry globally and selectively share. The thought is to switch the previous mannequin, the place identification information sits in centralized databases and will get leaked each few years like clockwork.

This isn’t only a “nice-to-have” idea. For establishments, identification is mainly the inspiration of compliance. You may’t do lending, regulated transfers, or critical monetary merchandise with out it. So if XRPL can assist identification and compliance layers in a method that’s personal however verifiable, that turns into an actual infrastructure benefit.

One instance talked about is DNAOnChain’s XDNA, which applies zero-knowledge proofs to transform identification and compliance information into verifiable zk-credentials. These credentials can affirm eligibility and regulatory standing with out exposing delicate private data. In different phrases, establishments can confirm “sure, this consumer qualifies” with out seeing all the pieces about them. That’s the type of tooling that truly makes regulated blockchain finance attainable.

And if SBI’s hidden asset publicity extends past XRP itself, it suggests the agency could also be positioning round that identification + compliance layer too, not simply the token.

XRP’s Function as a Bridge Asset Is Nonetheless the Core Mechanism

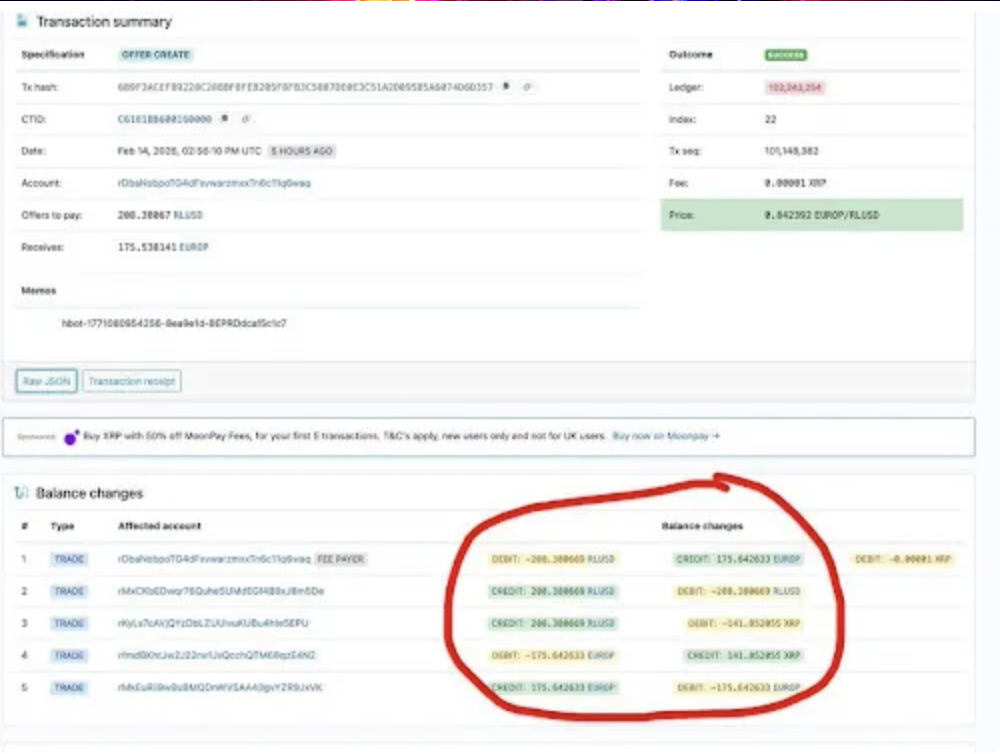

Even with the identification narrative rising, XRP nonetheless performs its unique position contained in the community. It’s actively used as a bridge forex for liquidity on XRPL, alongside stablecoins that act as issued belongings. An analyst often called Vet on X pointed to current XRPL DEX exercise displaying RLUSD being exchanged for EUROP, a euro-denominated stablecoin, with XRP functioning because the middleman bridge asset.

That’s vital, as a result of it exhibits how liquidity truly strikes. As an alternative of needing a direct market between each pair of stablecoins, XRP can sit within the center, bettering capital effectivity and decreasing fragmentation. It’s mainly the “connector” that lets issued belongings swap extra easily throughout the community.

This design additionally advantages market makers. They’ll make markets between XRP pairs whereas holding an asset that’s counterparty-free, which in principle makes it one of the environment friendly methods to supply liquidity. It’s not an ideal system, however the logic is coherent. And establishments are likely to care about coherent.

The Tokenized FX Future Is The place This Will get Large

RippleBullWinkle, founding father of Lux Lions NFT, highlighted that the worldwide international alternate market strikes roughly $9.6 trillion in day by day quantity. That quantity is huge, and it’s one of many causes folks hold citing tokenized FX because the “actual” long-term use case for blockchain.

The thought being mentioned by insiders is an on-chain FX system the place native forex stablecoins from totally different nations can settle instantly in opposition to greenback stablecoins on-chain. If that mannequin expands, you instantly have a world the place cross-border forex alternate turns into a programmable settlement layer, not a sluggish banking course of.

And that is the place XRP’s unique design turns into related once more. XRP was constructed particularly to behave as a bridge asset between currencies. So if tokenized FX turns into an actual factor, and never only a convention slide, XRP’s position stops being theoretical and begins being practical.

Japan’s positioning, SBI’s involvement, and the rising deal with identification and compliance all level towards the identical theme: XRPL isn’t simply being handled as a funds chain. It’s being handled as infrastructure for regulated, tokenized finance. Whether or not the market costs that in quickly or not is one other query totally.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.