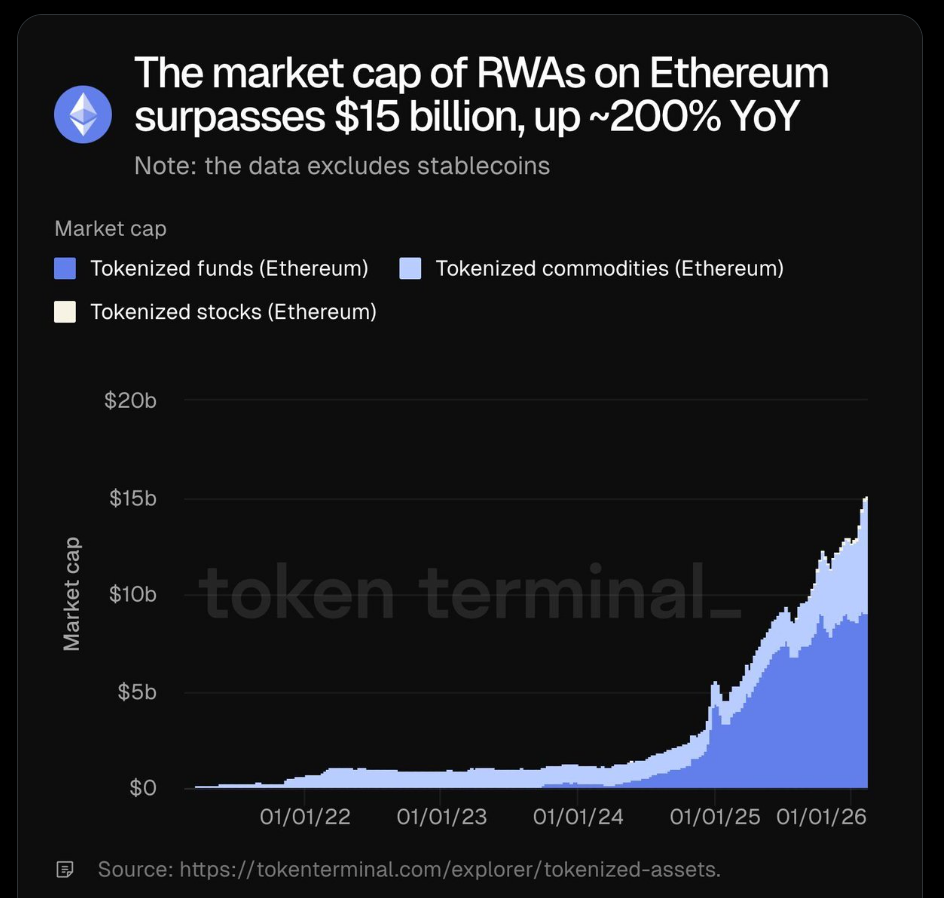

- Ethereum’s RWA market has crossed $15B, up roughly 200% yr over yr

- A lot of the development is coming from institutional tokenization of TradFi property

- The important thing debate is whether or not this strengthens DeFi or quietly centralizes it

Crossing $15 billion in tokenized real-world property on Ethereum isn’t some cute headline quantity. It’s a sign that demand is displaying up with measurement, and it’s displaying up persistently. A roughly 200% year-over-year soar means that this isn’t a one-off development pushed by a single product, it’s a broader shift in how capital is selecting to maneuver.

On the floor, it seems to be like a significant win for crypto. Ethereum is more and more being handled like a settlement layer for issues that used to reside completely in conventional finance, reminiscent of treasuries, bonds, non-public credit score, and commodity-linked property. That’s not hype anymore. That’s utilization.

Most RWA Progress Is Institutional, and That Modifications the Tone

For those who observe the cash, the story will get extra sophisticated. A lot of the RWA development on Ethereum is being pushed by establishments tokenizing conventional property and plugging them into on-chain infrastructure. This isn’t a wave of crypto-native builders reinventing finance from scratch. It’s the present monetary system taking acquainted merchandise and transferring them onto extra environment friendly rails, which is sensible, but additionally sort of… revealing.

This isn’t essentially dangerous, and it’s not one thing DeFi ought to reject outright. But it surely does shift the narrative away from disruption and towards optimization. The vibe modifications when the most important gamers will not be making an attempt to exchange the outdated system, they’re making an attempt to improve it.

Crypto DeFi Might Be Maturing, or It Might Be Getting Absorbed

There are two methods to interpret what’s occurring. One is that crypto is lastly maturing into one thing credible sufficient for severe capital to decide to. The opposite is that incumbents have discovered a manner to make use of blockchain with out surrendering management, which is arguably the extra possible end result within the early phases.

If RWAs turn into a core pillar of DeFi whereas staying permissioned, custodied, and institution-controlled, then Ethereum might find yourself internet hosting a cleaner model of legacy finance. It could nonetheless be on-chain, sure, however the energy buildings wouldn’t actually change. And if the hierarchies don’t change, the revolutionary edge begins to boring.

The Subsequent Section Will Determine What Ethereum Truly Turns into

RWAs could be the bridge that brings trillions of {dollars} on-chain over the subsequent decade. Or they may flip Ethereum into backend infrastructure for a similar establishments crypto as soon as positioned itself in opposition to. Each paths are attainable, and weirdly, each can occur on the identical time.

The expansion is actual, and it’s exhausting to argue in opposition to that. The extra essential query is what course this development takes from right here, and who finally ends up controlling the rails. As a result of if Ethereum turns into the worldwide settlement layer, the true winner gained’t simply be the tech. It’ll be whoever owns the entry.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.