Elevated open curiosity and ETF outflows left Bitcoin uncovered to a fast lengthy liquidation cascade.

Bitcoin got here beneath heavy promoting on the U.S. market open, dropping $1,500 in about 20 minutes. Promoting picked up rapidly as consumers pulled again and lengthy merchants had been pressured to exit. Nevertheless, market knowledge recommend it was primarily a pressured liquidation transfer, not widespread panic promoting.

Bitcoin Drops 2.2% in Minutes as Lengthy Liquidations Speed up

On the 1-minute BTCUSDT chart shared by Ted Pillows, Bitcoin was buying and selling round $68,300 to $68,400 earlier than sturdy promoting entered the market. Giant purple candles adopted, sending the value down rapidly to the $66,800–$66,900 space.

$BTC dropped $1,500 in simply 20 minutes after the US market open.

The sellers are again. pic.twitter.com/Z9yUOLxgcP

— Ted (@TedPillows) February 17, 2026

Notably, this marked a 2.2% drop inside a compressed window. On the identical time, consumers offered little assist because the market declined. Extra so, momentum mirrored sustained market promoting somewhat than a single volatility spike.

Liquidity knowledge reveals a fragile construction earlier than the breakdown. Liquidation heatmaps confirmed dense clusters above $68,500 and into $69,000–$70,000. Worth failed to succeed in these higher pockets. As a substitute, it rotated decrease into thinner bid zones.

As soon as $68,000 gave method, acceleration adopted. Worth moved via a liquidity vacuum, triggering pressured lengthy liquidations. Bitcoin’s fall to $66,800 occurred the place many lengthy positions had been more likely to be liquidated under intraday assist. In easy phrases, too many merchants had been overexposed on the lengthy facet.

These trades had been pressured to shut as costs declined. As these positions had been liquidated, extra stop-loss orders had been triggered. And this pattern pushed the value down even sooner.

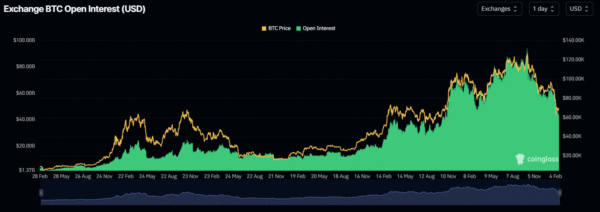

Open curiosity knowledge confirms the unwind. OI had remained elevated forward of the session, reflecting heavy speculative positioning. In the course of the sell-off, OI declined alongside the value. Worth down with OI down alerts lengthy liquidation.

Picture Supply: CoinGlass

Recent brief positioning didn’t dominate the transfer. Overleveraged longs had been pressured to shut. That dynamic explains the pace and vertical nature of the decline.

Funding charges add one other layer of context. OI-weighted funding stayed persistently optimistic earlier than the drop. As well as, merchants had been paying to take care of lengthy publicity.

ETF Outflows and Elevated OI Go away BTC Susceptible to Liquidations

Constructive funding mixed with excessive OI typically creates structural fragility. When momentum stalls beneath these situations, even modest volatility can set off sharp squeezes. U.S. market open offered that volatility sparks.

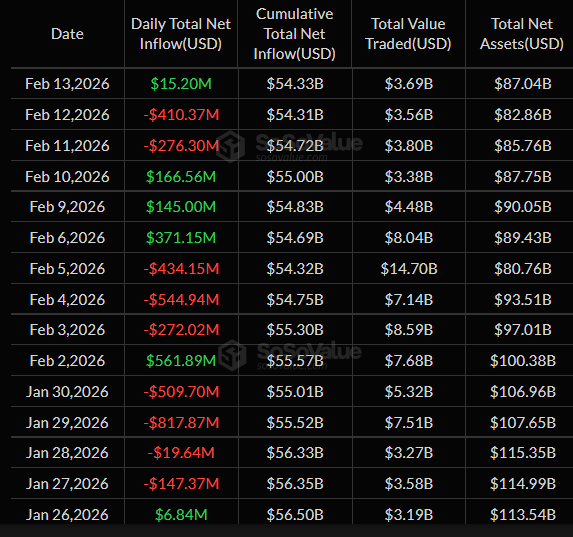

In the meantime, spot Bitcoin ETFs recorded notable web outflows on Feb. 12 and 11, totaling $410 million and $276 million. Feb. 13 noticed solely a modest $15 million influx. Trying on the knowledge, institutional demand seems to have slowed.

Picture Supply: SoSovalue

And with fewer sturdy spot consumers out there, worth drops are more durable to soak up. As such, leveraged merchants had been left uncovered when key assist ranges broke. Moreover, promoting strain elevated quickly.

Futures buying and selling continues to dominate over choices within the present market. As per knowledge, most positions are concentrated in perpetual and futures contracts. Oftentimes, this setup will increase the danger of sudden liquidation waves.