Market circumstances are fragile as Solana value trades in a late-stage downtrend with excessive worry, stretched sentiment, and rising scope for sharp countertrend squeezes.

loading=”lazy” />

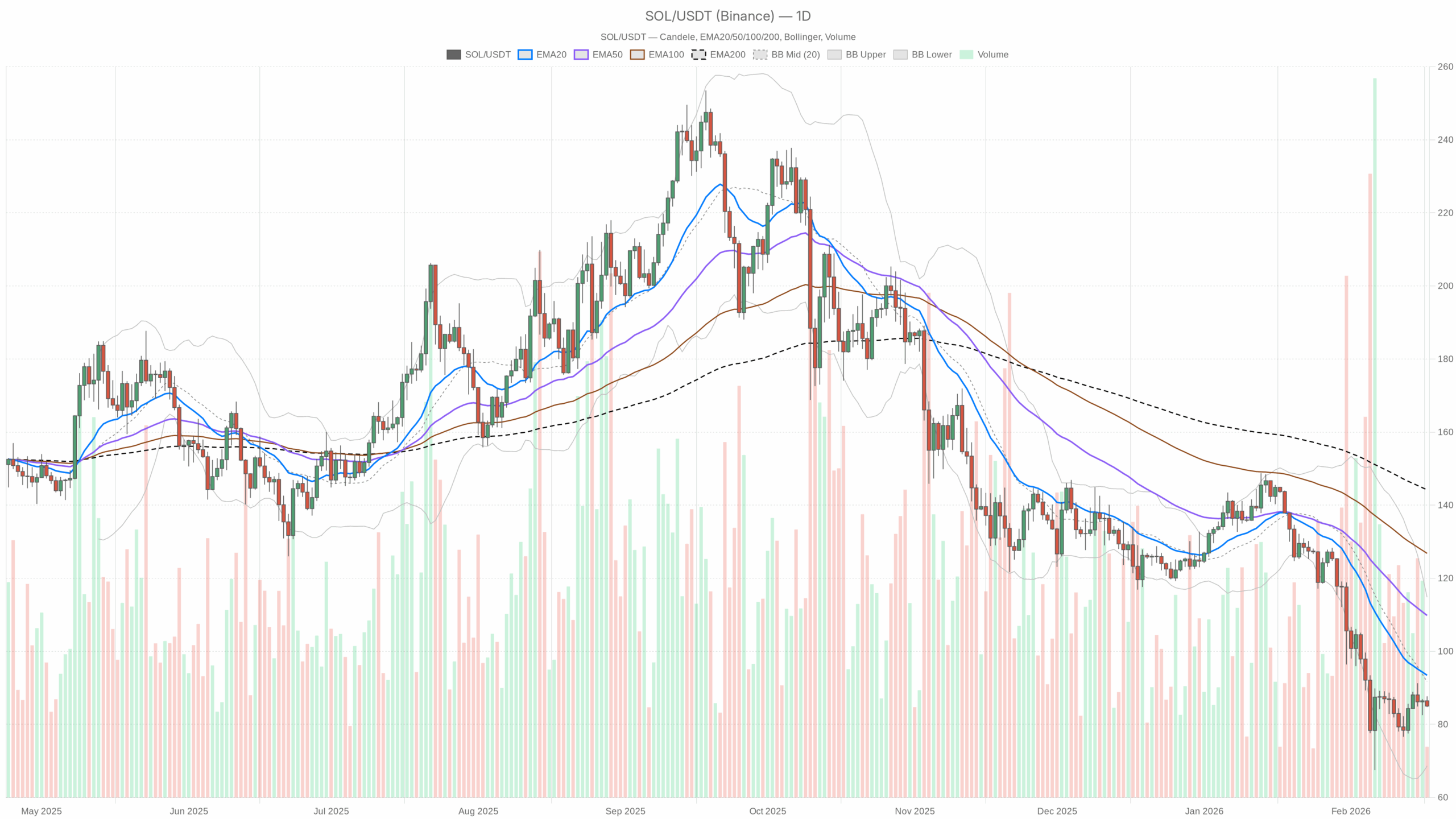

loading=”lazy” />Major State of affairs from the Day by day Chart: Bearish Bias

The each day timeframe (D1) units the tone, and right here the message is easy: the first regime is bearish.

- Day by day shut: $85.01

- Regime flag: bearish

- Market backdrop: BTC dominance ~56%, whole market cap down ~0.8% 24h, volumes down greater than 12%, and sentiment at Excessive Worry.

In plain phrases: capital is clustering in Bitcoin, danger urge for food is skinny, and altcoins like Solana are nonetheless within the “promote rallies, not purchase dips” bucket on the upper timeframe. Till SOL can reclaim and maintain above its key each day transferring averages, the trail of least resistance stays down or sideways-to-down.

Day by day Timeframe (D1): Construction, Momentum, and Volatility

Exponential Transferring Averages (EMA) – Development Nonetheless Firmly Down

- EMA 20: $93.44

- EMA 50: $109.81

- EMA 200: $144.20

- Value: $85.01

Value is buying and selling properly under the 20, 50, and 200-day EMAs, with a clear bearish stack (value < EMA20 < EMA50 < EMA200). This defines a mature downtrend. Each rally in the direction of the 20-day EMA across the low-90s is, by default, a possible promoting zone till that construction is damaged.

In human phrases: the large cash continues to be positioned on the brief and defensive aspect on the each day. Solana is in “bounce inside a downtrend” territory, not but in “bottomed and reversing” territory.

RSI (14) – Weak, However Not But Washed Out

Day by day RSI is sitting within the low-to-mid 30s, under impartial however not deeply oversold. That tells us momentum continues to be bearish, however essentially the most aggressive part of promoting could also be easing.

Translation: there may be room for yet another leg down earlier than you hit true capitulation readings, however we’re already in a zone the place recent shorts need to be extra cautious. The draw back vitality is there, however it’s not limitless.

MACD – Bearish Section, Early Indicators of Stabilisation

- MACD line: -9.82

- Sign line: -10.94

- Histogram: +1.13

Each MACD line and sign are damaging, which is according to a downtrend. Nevertheless, the MACD line is now barely above the sign line (constructive histogram). That often factors to shedding draw back momentum inside a broader bearish construction.

In different phrases: the development continues to be down, however the selloff will not be accelerating anymore. Circumstances are ripe for both a consolidation part or a corrective bounce, not essentially a direct development reversal.

Bollinger Bands – Buying and selling within the Decrease Half

- Center band (20-day foundation): $91.71

- Higher band: $114.81

- Decrease band: $68.61

- Value: $85.01

Solana is buying and selling under the mid-band and comfortably above the decrease band. Prior touches of the decrease band (across the excessive 60s) appear like a volatility excessive, and we are actually rebounding contained in the decrease half of the band construction.

Virtually: the market has already punished late longs, however it has not but rewarded dip patrons in an enormous approach. Value is within the restore zone, the place you often both grind sideways or stage a countertrend transfer again in the direction of the mid-band within the low 90s.

ATR (14) – Elevated however Not Explosive Volatility

A median true vary of about $7.6 in opposition to an $85 price ticket implies roughly 9% each day swings are regular proper now. Volatility is clearly elevated in contrast with quiet uptrends, however we aren’t in full capitulation mode.

In plain phrases: merchants must be ready for large intraday ranges and deeper wicks on each side. Stops that labored in calmer circumstances are doubtless too tight right here.

Day by day Pivot Ranges – Brief-Time period Map Contained in the Downtrend

- Pivot level (PP): $85.82

- Resistance 1 (R1): $86.88

- Help 1 (S1): $83.94

Value is at the moment sitting barely under the each day pivot (round $85.8), leaning in the direction of the help aspect. If SOL retains buying and selling underneath the pivot, the intraday bias leans bearish. A push via the pivot and a maintain above R1 would trace at a short-term try to squeeze greater throughout the bigger downtrend.

For lively merchants: the pivot offers a close-by line within the sand for intraday sentiment, however it doesn’t override the general bearish each day construction.

Hourly Timeframe (H1): Impartial Regime, Compressed Round Worth

- Shut: $85.00

- Regime: impartial

EMAs on H1 – Flat Cluster, No Clear Intraday Development

- EMA 20: $85.81

- EMA 50: $85.85

- EMA 200: $85.29

On the 1-hour chart, all three EMAs are tightly clustered across the mid-85s, with value solely a bit under them. That is traditional vary behaviour, not a powerful intraday development.

In observe: the market has stopped trending arduous down on the hourly and is as an alternative oscillating round a short-term truthful worth space. It’s a digestion part after the prior drop, and it typically precedes a bigger transfer in both course.

RSI and MACD on H1 – Mildly Weak, Not Damaged

- RSI 14 (H1): 42.56

- MACD line: -0.02, Sign: 0.08, Histogram: -0.09

Hourly RSI is barely under impartial, hinting at a light bearish lean however nothing excessive. MACD is hovering close to zero with a barely damaging histogram, once more exhibiting a modest downward bias inside a principally sideways surroundings.

Human translation: bears nonetheless have the sting on the hourly, however they aren’t urgent it. It’s extra of a gradual drift decrease than an lively liquidation wave.

Bollinger Bands and ATR on H1 – Tightish Vary

- Bollinger mid: $85.76, higher: $87.48, decrease: $84.05

- ATR 14 (H1): $0.90

The bands are usually not extraordinarily slim, however they’re additionally not flaring aggressively. Mixed with a roughly $0.90 hourly ATR, we’re coping with contained intraday volatility across the mid-80s.

For intraday merchants, it is a fade-the-edges surroundings greater than a chase-breakouts one, at the very least till we see a transparent growth in volatility or a decisive escape of this band construction.

Hourly Pivot – Micro Bias Gauge

- Pivot level (PP): $85.02

- R1: $85.30

- S1: $84.73

Value is sitting nearly precisely on the hourly pivot round $85. That reinforces the concept of a impartial, balanced intraday tape. A sustained transfer under S1 would tilt the short-term circulate again to the draw back, whereas reclaiming R1 and holding above it might give bulls some tactical room to push in the direction of the high-80s.

15-Minute Timeframe (M15): Brief-Time period Weak spot for Execution Timing

- Shut: $85.00

- Regime: bearish

EMAs on M15 – Micro Downtrend In opposition to a Flat Hourly

- EMA 20: $85.65

- EMA 50: $85.89

- EMA 200: $86.07

On the 15-minute chart, value is clearly under the brief, medium, and lengthy intraday EMAs, all sloping down. That could be a micro downtrend nested inside a impartial hourly vary and a bearish each day development.

Execution-wise: this favours brief entries on bounces into the M15 EMAs in case you are buying and selling with the broader each day bias, however it does so inside an surroundings the place the hourly will not be in sturdy development mode. That raises whipsaw danger for overly aggressive intraday merchants.

RSI and MACD on M15 – Close to-Time period Oversold Lean

- RSI 14 (M15): 30.9

- MACD line: -0.34, Sign: -0.24, Histogram: -0.10

RSI on quarter-hour is hovering simply above the oversold threshold, and MACD is damaging with a damaging histogram. Brief-term momentum is clearly pointing down.

In easy phrases: the very short-term window is weak and stretched. Chasing new shorts at these ranges on a 15-minute foundation is late; the higher entry is often after a bounce again in the direction of the intraday transferring averages.

Bollinger Bands and ATR on M15 – Micro Volatility Pockets

- Bollinger mid: $85.81, higher: $86.88, decrease: $84.74

- ATR 14 (M15): $0.35

Value is buying and selling nearer to the decrease band, according to the short-term oversold studying. With a modest $0.35 ATR, the market is permitting for small however frequent flicks throughout the tighter band. Count on fast intraday reversions slightly than easy traits on this timeframe.

15-Minute Pivot – Very Tight Intraday Ranges

- Pivot level (PP): $85.04

- R1: $85.10

- S1: $84.95

Value is sitting just below the 15-minute pivot, and the R1 and S1 vary is extraordinarily tight. This displays a short-term battle on the margin. For execution, these ranges are extra noise than construction, however they will matter for very short-term scalps.

Macro and On-Chain Context for Solana

Solana’s share of whole crypto market cap is round 2.0%, with SOL-related DeFi venues like Raydium, Orca, Meteora, and BisonFi all exhibiting pullbacks in price technology during the last 7–30 days, with a few exceptions on BisonFi and Orca on a 30-day foundation. Charge compression on main Solana DeFi protocols often strains up with decrease on-chain exercise and fewer speculative leverage, according to the present risk-off sentiment.

Together with Excessive Worry readings, this tells you participation is low and merchants are defensive. That’s precisely the form of backdrop the place huge strikes can emerge from comparatively small flows, each to the draw back, if liquidity thins out, and to the upside, if brief positioning is crowded.

Solana Value Eventualities

Bullish State of affairs for SOLUSDT

The bullish case is a countertrend rally inside a broader downtrend, not a full-blown reversal, at the very least not but.

For bulls to realize traction:

- Maintain above or reclaim the each day pivot round $85.8 and keep away from a clear break of S1 at $83.9.

- Hourly EMAs flip to help, value must get again above the H1 20, 50, and 200 cluster round $85.8–$86 and keep there.

- Push in the direction of the each day Bollinger mid-band at about $91.7, ideally turning that right into a consolidation zone slightly than instant rejection.

- RSI on the each day climbs again above the 45–50 zone, exhibiting momentum is shifting from weak downtrend to extra balanced circumstances.

On this situation, Solana value might stage a squeeze in the direction of the low-to-mid 90s first, and if the broader market stabilises, probably lengthen in the direction of the psychological $100 space the place the declining 50-day EMA, close to $110, could be the following huge take a look at.

What invalidates the bullish situation?

A decisive each day shut under $84 that’s adopted by continued weak point into the low 80s would undercut the concept of a direct aid rally. A rollover of the hourly chart again right into a clear downtrend, with value pinned underneath all H1 EMAs with RSI sub-40 and increasing damaging MACD, would additionally sign that bears have reasserted management.

Bearish State of affairs for SOLUSDT

The bearish case is a continuation of the upper timeframe downtrend, with the present pause resolving decrease.

For bears to remain in cost:

- Keep value underneath the each day 20 EMA, close to $93.4. Each push into the low 90s that will get offered is a affirmation that the longer-term development continues to be down.

- Break and shut under each day S1 round $83.9, changing that space into resistance on retests.

- See RSI caught within the 30–40 band on the each day, exhibiting persistent draw back bias and not using a sturdy imply reversion.

- MACD on each day rolls again with a rising damaging histogram, the present delicate enchancment fades and the strains diverge once more.

Beneath this path, Solana value can revisit the decrease Bollinger space within the low 70s and probably probe in the direction of the prior extremes close to the excessive 60s, across the decrease band at about $68.6. In an surroundings of maximum worry and falling volumes, slippage and air pockets decrease are very potential if bids skinny out.

What invalidates the bearish situation?

A clear each day shut again above $95, comfortably over the 20-day EMA, adopted by continuation slightly than instant rejection would weaken the bearish narrative. If that transfer comes with each day RSI reclaiming 50 and MACD crossing into constructive territory, the character of the development shifts from downtrend to at the very least sideways, if not early accumulation.

Impartial and Indecision State of affairs

There’s a actual danger that neither aspect wins shortly and Solana merely ranges between roughly $80 and $95, digesting the prior selloff.

In that case:

- The each day development stays technically bearish, with EMAs above value, however momentum indicators stay blended and non-committal.

- Hourly EMAs maintain clustering round mid-range and act as a mean-reversion magnet.

- Bollinger Bands slowly contract, signalling volatility compression forward of the following massive transfer.

That is the form of surroundings the place swing merchants typically get chopped up, and the place persistence often pays greater than aggressive positioning.

Positioning, Danger, and Uncertainty

Proper now, Solana is caught between structural bearishness on the each day and early indicators of promoting fatigue on the decrease timeframes. The tape will not be screaming capitulation backside, however it’s removed from a clear, orderly downtrend as properly.

For individuals pondering when it comes to danger:

- Volatility is elevated, with each day ATR round $7.6, so place sizing has to account for large swings.

- Sentiment is excessive, and worry at these ranges can gas each panic flushes and violent brief squeezes.

- Timeframe battle issues: each day says respect the downtrend, hourly says we’re consolidating, and 15-minute information says near-term stretched. Entries and exits that ignore this hierarchy are extra uncovered to whipsaws.

Briefly, Solana value continues to be in a downtrend, however that downtrend is ageing. Bears stay in management on the upper timeframe, but they’re not unchallenged. Merchants have to resolve whether or not they’re taking part in the macro development, fading rallies, or the micro exhaustion, fading extremes throughout the vary, after which dimension their danger accordingly in a market that’s fearful, skinny, and unstable.