- ZEC rallied above $300 however slipped again beneath after Bitcoin rejected close to $70.9K, displaying how intently ZEC tracks broader threat sentiment.

- On-chain information reveals privateness narrative development in 2025 coincided with rising shielded transaction exercise and better community utilization.

- Shielded provide grew from 3.2M to 5M ZEC in 2025, representing about 30% of circulating provide, signaling stronger privacy-driven adoption.

ZCash has been a volatility machine these days, with value swinging laborious and merchants getting pulled in each instructions. In latest protection, AMBCrypto famous that the protection of the $187 degree was a key second, as a result of it acted as an vital weekly retracement assist. And as soon as that degree held, ZEC didn’t simply bounce. It launched.

Zooming in, the previous few days noticed ZEC rip above $300, pushing into the type of value territory that often drags consideration again to the privateness coin narrative. However that energy didn’t final lengthy. After Bitcoin was rejected close to $70.9K on Sunday, February 15, ZEC slipped again below the $300 psychological degree and likewise dropped beneath a 4-hour imbalance zone round that very same space.

Earlier expectations recommended ZEC bulls nonetheless had the short-term energy to focus on $360. On the identical time although, the warning was clear: if BTC weakens, ZEC tends to really feel it quick. And that’s precisely what performed out. ZEC’s spot promoting stress remained lively, with the Spot Taker CVD displaying taker promote dominance, which means sellers have been hitting bids extra aggressively than patrons have been lifting asks.

So the short-term scenario seems combined. However the greater query is extra fascinating: why did ZCash start such a large rally in September 2025 within the first place, and what would want to occur for a repeat?

The September 2025 ZEC Rally Wasn’t Simply Random

The rally wasn’t constructed purely on technicals. A giant driver was narrative. Beginning in August 2025, the privateness coin theme started gaining severe mindshare, and by October it had change into one of many hottest discussions in crypto. As that narrative caught fireplace, on-chain utilization additionally elevated.

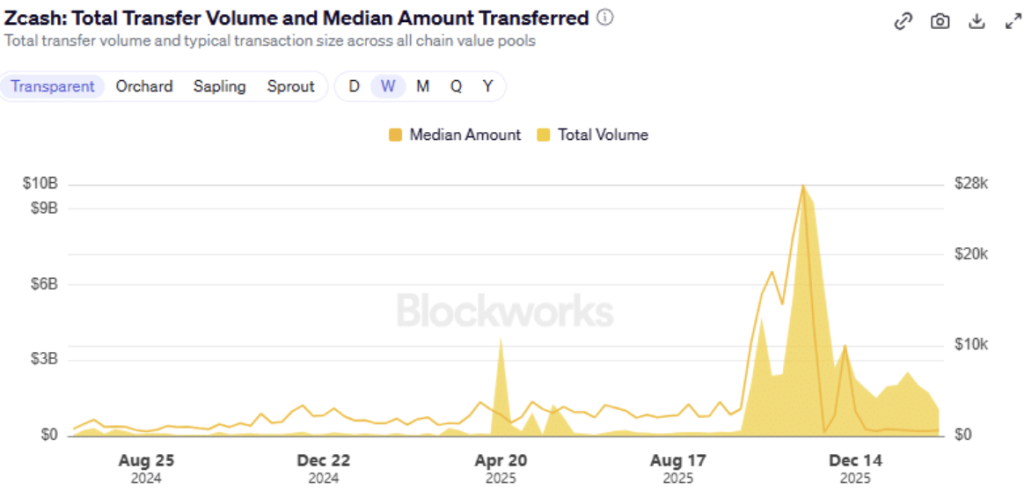

ZecHub switch quantity information confirmed whole switch exercise rising, significantly in unshielded transactions. That alone indicators extra community motion and extra customers participating with ZEC. However it didn’t cease there. Privateness-focused utilization additionally elevated, and that’s the place shielded transactions change into the important thing piece.

Shielded transactions encrypt transaction particulars similar to sender, receiver, and quantity utilizing zero-knowledge proofs. That is mainly ZCash’s core differentiator, the explanation it exists. When shielded utilization rises, it’s an indication the privateness narrative isn’t simply being talked about. It’s getting used.

Shielded Transactions Climbed, Even If It Regarded “Small” on Paper

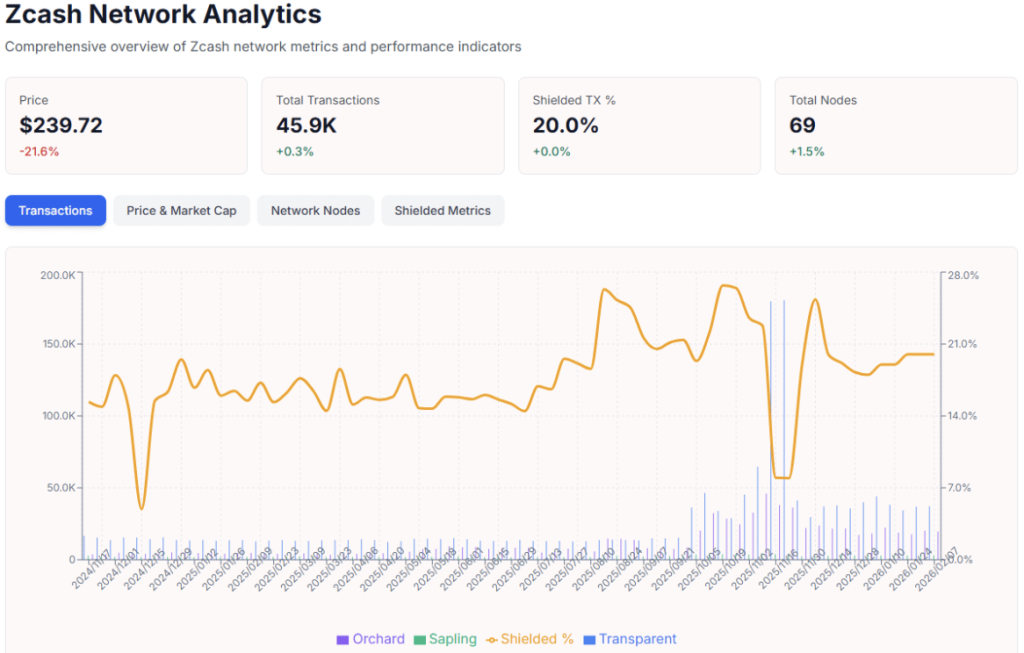

ZecHub shielded stats present that the proportion of shielded transactions stayed round 14.5% to 19.6% between April and July 2025. Then it began lifting. In August, shielded transactions hit an area peak round 26.3%, and in October, they reached about 26.7%.

On paper, that doesn’t sound like a loopy soar. However in actual phrases, it issues rather a lot. When a community already has a big base of transactions, even a couple of proportion factors symbolize a significant wave of customers shifting into privacy-preserving exercise. It’s not only a quantity. It’s conduct altering.

And when conduct modifications on the identical time the narrative will get loud, value tends to reply.

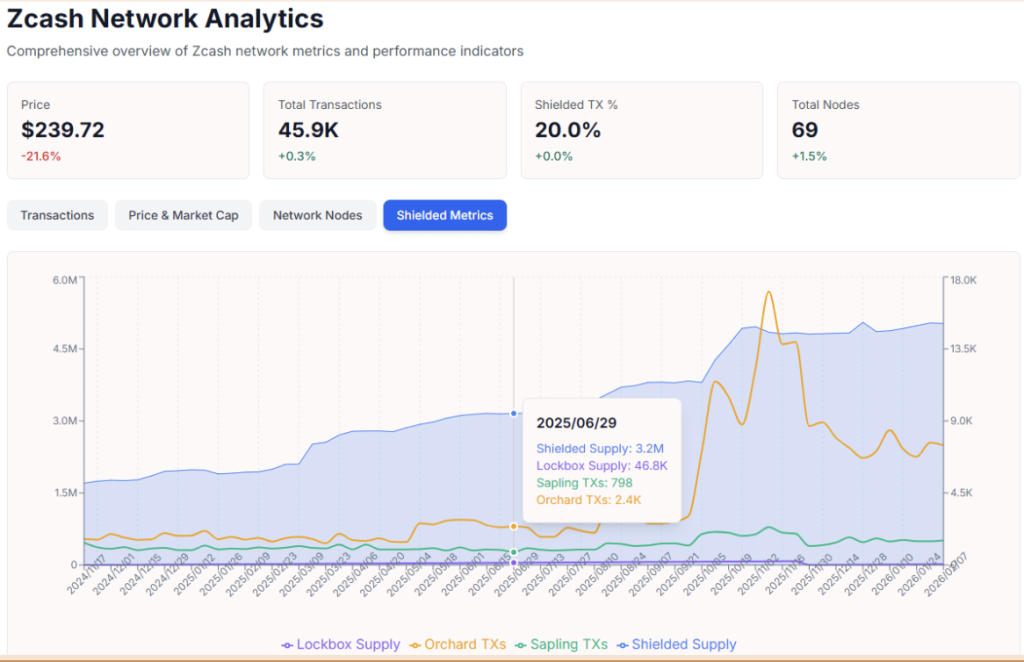

Shielded Provide Progress Is the Greater Sign

Probably the most hanging metric is shielded provide, which represents the ZEC held inside privacy-preserving Sapling and Orchard swimming pools. In June 2025, shielded provide sat round 3.2 million ZEC. By November, it had climbed to five million, and it remained round that degree on the time of writing.

That’s a giant shift.

ZEC, like Bitcoin, has a hard and fast max provide of 21 million. So 5 million ZEC in shielded swimming pools represents roughly 30.24% of circulating provide. That’s dramatic development in comparison with November 2024, when the shielded provide determine was round 11.25%.

In different phrases, a a lot bigger chunk of the community’s provide has moved into privacy-preserving swimming pools over the previous yr. That’s not one thing you see if individuals are solely speculating. That’s long-term utilization and storage conduct.

What Must Align for One other ZEC Run?

If ZCash goes to repeat a September-style rally, the circumstances possible have to line up once more. The privateness narrative has to regain mindshare. Shielded utilization has to proceed rising, not simply staying flat. And Bitcoin must cooperate, as a result of BTC weak point tends to create risk-off circumstances the place high-volatility altcoins get bought first.

There are additionally a few broader catalysts that would matter. The 2024 halving and the narrative shift look like the principle elementary modifications ZCash has seen over the previous yr. However a much bigger market-level growth, like spot ETF choices or broader regulatory modifications round privateness cash, may change the panorama totally.

For now, ZEC stays a market that strikes in bursts. When the narrative hits, it hits laborious. However when Bitcoin turns weak, ZEC hardly ever will get a free move.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.