Markets are processing a managed but persistent selloff as Bitcoin worth at this time trades in a zone the place bearish momentum meets rising contrarian curiosity.

1. Market Thesis – The place We Stand Now

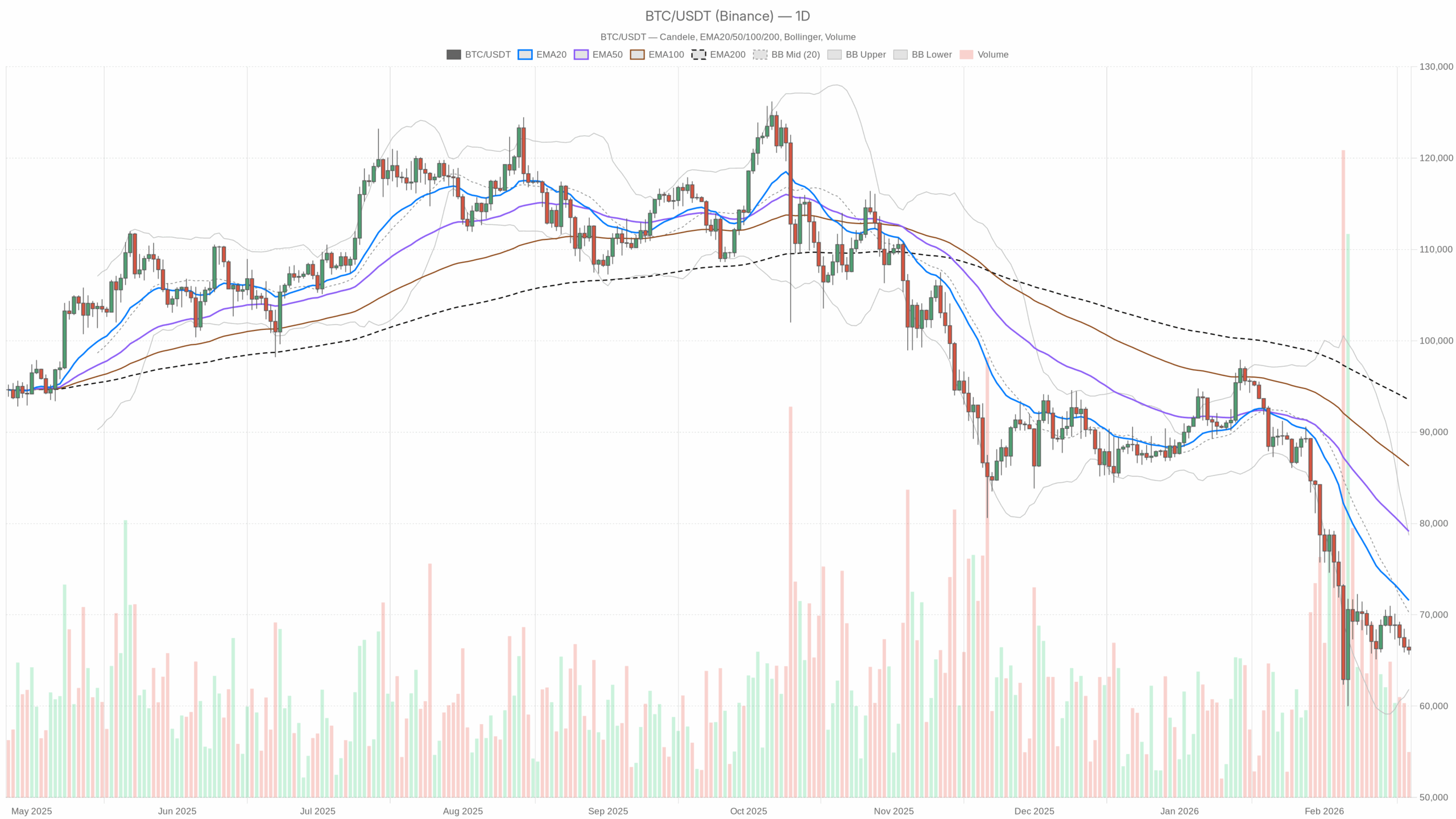

Bitcoin worth at this time is buying and selling round $66,100–66,200 (BTC/USDT) after a number of weeks of managed however persistent promoting. The every day pattern is clearly bearish, however what issues right here is how we’re promoting off: it has been regular, not panic-driven, and we are actually coming into ranges the place the market normally begins to argue with itself.

The dominant drive proper now’s risk-off positioning from bigger gamers after the Wall Road-driven ETF wave cooled and macro/geopolitical pressure picked up. You see that within the headlines, however you additionally see it in construction: worth is properly under the most important transferring averages, RSI is depressed however not but washed out, and the worry & greed index is sitting at Excessive Worry (9). That is the a part of the cycle the place pattern followers are nonetheless quick or flat, whereas contrarians are quietly beginning to plan entries, not as a result of issues look good, however as a result of issues lastly look uncomfortable.

2. Greater Timeframe Bias (Every day – D1)

On the every day chart, the system labels the regime as bearish. The burden of proof is on the bulls.

Worth vs EMAs (Pattern Construction)

- Shut: $66,139.49

- EMA 20: $71,578.15

- EMA 50: $79,127.61

- EMA 200: $93,541.55

Worth is buying and selling properly under all three EMAs. Brief-term pattern (20 EMA), medium-term pattern (50 EMA), and long-term pattern (200 EMA) are all above worth and successfully appearing as a stacked zone of overhead provide.

What it implies: Structurally, we’re in a mature pullback inside a larger-cycle bull market. You don’t get worth that far under a rising 200 EMA in the course of a euphoric blow-off; you see it throughout deeper corrections the place late longs are being cleaned out. The gap to the 20 and 50 EMAs means any bounce has room to run earlier than it even threatens the broader down-leg.

RSI (Momentum / Exhaustion)

Every day RSI is sitting simply above classical oversold territory.

What it implies: Momentum is bearish however not but capitulative. Sellers are in management, however we’re coming into a zone the place recent shorts carry larger threat of getting squeezed. It’s the form of studying the place the pattern can push a bit decrease, however the risk-reward begins shifting in opposition to newly established aggressive shorts until we see one other sharp leg down.

MACD (Pattern Momentum & Inflection)

- MACD line: -4,597.9

- Sign line: -4,926.81

- Histogram: +328.91

MACD is unfavourable, in keeping with the downtrend, however the histogram is constructive, which means the MACD line is beginning to creep again towards the sign line.

What it implies: Pattern momentum remains to be down, but the price of draw back is easing. Bears are now not accelerating the transfer; they’re urgent an current benefit. That is usually how bases or short-term reduction rallies start: not with prompt reversals, however with a lack of draw back momentum first.

Bollinger Bands (Volatility & Location)

- Center band (20 SMA proxy): $70,266.69

- Higher band: $78,702.41

- Decrease band: $61,830.96

- Worth (shut): $66,139.49

Bitcoin is buying and selling within the decrease half of the bands, however not pinned to the decrease band.

What it implies: We’re in a downside-biased volatility regime, however with no full volatility blowout. Worth shouldn’t be hugging the decrease band, which tells you we’re not within the straight-line liquidation part. There may be nonetheless room for a push towards the decrease band close to $61.8k if sentiment worsens, but in addition room for imply reversion again towards the mid-band round $70k if sellers lose focus.

ATR (Every day Volatility)

Every day ATR is about $3.6k, which is elevated however not excessive by Bitcoin requirements.

What it implies: We’re in a excessive however manageable volatility setting. Every day ranges round 5–6% are on the desk. Place sizing must assume {that a} $3–4k intraday swing is routine, not distinctive.

Every day Pivot Ranges

- Pivot Level (PP): $66,363.77

- Resistance 1 (R1): $67,095.72

- Help 1 (S1): $65,407.55

Worth is sitting simply underneath the every day pivot level.

What it implies: Brief-term management is within the arms of sellers so long as worth stays under $66.4k. The pivot acts as an intraday line within the sand: reclaiming it with momentum would trace at a short-covering day, whereas repeated rejections hold the trail open towards $65.4k and under.

3. Intraday Context – H1 and M15

Hourly (H1) – Confirming the Downtrend

- Shut: $66,148

- EMA 20: $66,716.85

- EMA 50: $67,161.95

- EMA 200: $68,157.46

- RSI 14: 37.35

- MACD line: -238.59

- MACD sign: -190.63

- MACD hist: -47.96

- BB mid: $66,626.86 • higher: $67,322.41 • decrease: $65,931.31

- ATR 14: $395.62

- Pivot PP: $66,000.12 • R1: $66,368.4 • S1: $65,779.71

On H1, worth can be under all key EMAs, and the regime is flagged as bearish. RSI is weak however not oversold, and the MACD histogram is barely unfavourable.

What it implies: The hourly chart is aligned with the every day downtrend. Sellers are nonetheless leaning on intraday rallies, however momentum shouldn’t be in free fall. The hourly ATR close to $400 means intraday swings round 0.5–0.7% are typical, and the hourly pivot at $66k is appearing as a gravitational level. Temporary spikes above the pivot that fail close to R1 round $66.37k are traditional spots the place short-term merchants re-join the prevailing downtrend.

15-Min (M15) – Execution Layer

- Shut: $66,125.34

- EMA 20: $66,423.36

- EMA 50: $66,656.87

- EMA 200: $67,192.10

- RSI 14: 35.93

- MACD line: -236.28

- MACD sign: -178.2

- MACD hist: -58.08

- BB mid: $66,513.08 • higher: $67,212.48 • decrease: $65,813.68

- ATR 14: $256.4

- Pivot PP: $65,992.56 • R1: $66,353.3 • S1: $65,764.61

M15 exhibits worth grinding underneath its quick EMAs with gentle draw back momentum. RSI is weak, and the MACD histogram is unfavourable however not collapsing.

What it implies: The microstructure is managed promoting slightly than panic. Dips are being bought, however bounces usually are not fully lifeless. For intraday merchants, the band between the 15-minute pivot round $65,993 and R1 close to $66,353 is a short-term battlefield: above R1 you begin to see proof of a squeeze; under the pivot the trail of least resistance stays decrease towards $65.7k after which the every day S1 area.

4. Market Context: Dominance, Sentiment, and DeFi

BTC dominance is excessive at 56.18%, whereas whole crypto market cap is down about 1.7% in 24 hours. Worry & Greed sits at 9 (Excessive Worry).

What it implies: Cash shouldn’t be rotating into altcoins; it’s both sitting in BTC, transferring to stablecoins, or leaving the area completely. Excessive worry at these ranges normally seems within the later phases of a drawdown slightly than the start. It doesn’t assure a backside, however it tells you that compelled sellers and late bears are more and more driving the tape. DeFi payment spikes on main DEXs, for instance Uniswap v3 up sharply on the day, level to heightened on-chain exercise, according to repositioning and de-risking.

5. Most important State of affairs for Bitcoin Worth Right now

Based mostly on the every day pattern construction and aligned decrease timeframes, the principal state of affairs is bearish. Nonetheless, it’s a late-stage bearish setting characterised by momentum loss and elevated worry, which is often the place inflection setups begin to kind.

Bearish State of affairs (Major)

Within the lively bearish path, Bitcoin fails to reclaim the every day pivot at about $66.4k with authority. Each take a look at of that space and the close by hourly resistance band round $67k is met with promoting. H1 and M15 EMAs proceed to cap worth, and the market grinds decrease in a stair-step sample.

Below this state of affairs:

- Intraday, the H1 S1 close to $65.78k and every day S1 at about $65.41k ranges get examined and doubtlessly damaged.

- Volatility (ATR) retains every day ranges massive sufficient to threaten the decrease Bollinger Band close to $61.8k.

- RSI can sink into the 25–30 zone on the every day if we see a clear leg towards or barely by means of $60k, aligning with the current information narrative about liquidation triggers round that degree.

What strengthens this state of affairs at this time: staying pinned under the cluster of intraday EMAs, extra unfavourable MACD histograms on H1 and M15, and any pickup in every day ATR with out constructive response from patrons.

Bearish state of affairs invalidation:

- A sustained transfer again above $70k, roughly the every day mid Bollinger and close to the 20 EMA, would significantly injury the rapid bearish thesis.

- On decrease timeframes, a collection of upper highs and better lows on H1 above the $66.5–67k band, accompanied by MACD crossing firmly constructive and RSI pushing by means of the mid-50s, would sign that sellers have misplaced management of the short-term tape.

Bullish / Imply-Reversion State of affairs (Secondary)

The counter-scenario takes the view that excessive worry plus slowing draw back momentum is organising a reduction rally slightly than one other waterfall. Right here, Bitcoin defends the mid-$65k space and begins to grind larger intraday.

Below this path:

- Worth reclaims the every day pivot at $66.4k and holds above it on a closing foundation.

- The primary upside magnet is the hourly mid-Bollinger and EMAs round $66.7–67.2k, adopted by the every day mid-Bollinger close to $70k.

- Every day RSI strikes again above 40, and the MACD histogram on D1 stays constructive and grows, signaling a extra convincing slowdown of the prior downtrend.

This state of affairs shouldn’t be about calling a brand new macro bull leg; it’s about pricing in a short-covering rally and maybe a retest of damaged help ranges from above.

Bullish state of affairs invalidation:

- A clear break and every day shut under the decrease Bollinger trajectory, round $61.8k, or a quick flush towards $60k with out robust shopping for response would undercut the mean-reversion thought and reopen the door for a deeper correction.

- If H1 repeatedly fails on the $66–67k zone and rolls over with rising quantity, the bounce case weakens rapidly.

Impartial / Vary-Constructing Variant

There’s a real looking center path: Bitcoin might merely begin constructing a variety between roughly $62k and $70k, with volatility compressing over time. In that case, every day EMAs would progressively drift down whereas worth chops sideways, and indicators like RSI would hover within the 40–50 space.

What would help this: declining ATR, flat-to-slightly constructive MACD histogram, and a collection of failed breakouts and breakdowns on each side of the vary.

6. Positioning, Threat, and Uncertainty

The present setup is one the place pattern followers nonetheless have the sting, however their edge is diminishing as momentum cools and sentiment hits excessive worry. The every day construction helps a bearish bias, but the indications are clear: this isn’t the beginning of the downtrend; it’s the extra mature part the place late shorts and compelled liquidations are likely to battle with early dip patrons.

For any lively strategy, the secret is timeframe alignment:

- If you happen to lean into the bearish view, you need H1 and M15 to stay capped by their EMAs and pivots, with every day staying under $70k. Sharp squeezes into these transferring averages are the high-risk zones to handle.

- If you’re anticipating a bounce, your first affirmation is the power of worth to reclaim and maintain above pivots, at this time round $66–66.5k, after which begin closing candles above the quick EMAs on H1.

Volatility is excessive sufficient that place sizing and liquidity selection matter greater than ordinary. A transfer of $3–4k both manner in a session is properly throughout the regular vary proper now, so any plan constructed on tight stops or over-leverage is successfully a guess on noise, not path.

Above all, that is an setting the place narratives shift rapidly. A transfer from excessive worry to reluctant optimism can occur in a handful of classes if worth bounces exhausting, simply as one other wave of macro risk-off might push BTC towards the $60k liquidation pocket. The one fixed right here is uncertainty, so any directional stance must be paired with clear invalidation ranges and respect for the present volatility regime.