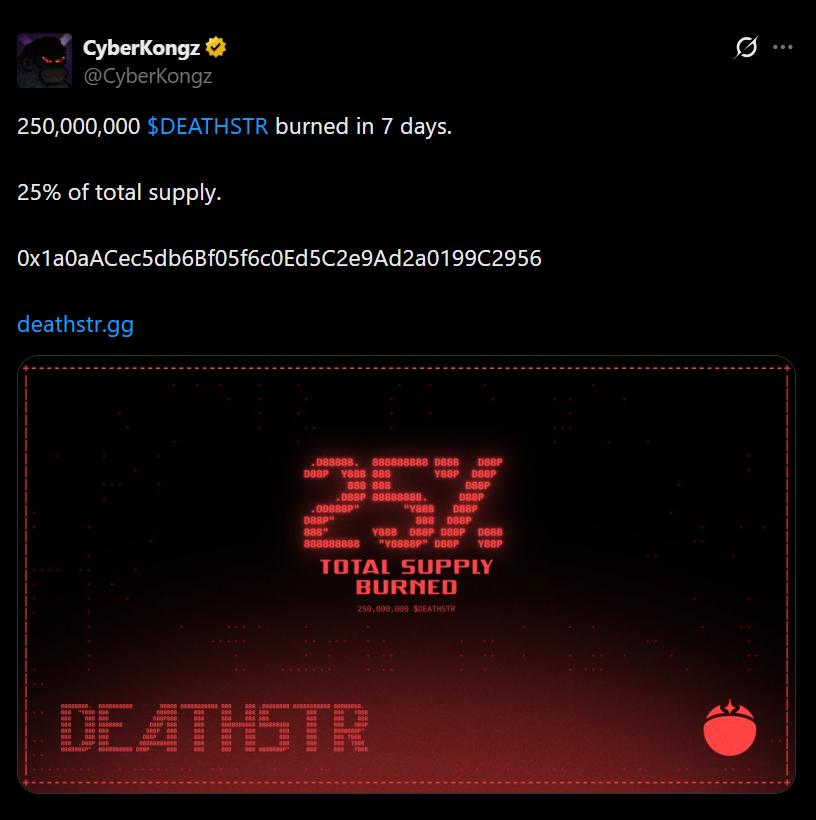

- DEATHSTR burned 250M tokens in 7 days, or 25% of complete provide

- The token gates discounted NFT entry by lock-and-vote mechanics

- Its high-velocity burn and resale loop units it other than typical technique tokens

DEATHSTR is an ERC-20 token on Ethereum with a most provide of 1 billion tokens. Launched by CyberKongz as an experimental “NFT buying and selling machine,” the core thought is straightforward however very crypto-native: focus buying and selling quantity, seize charges, purchase NFTs, burn tokens, and repeat the cycle quick.

The token migrated to a brand new contract in February 2026, requiring holders to transform 1:1 by way of the official website. The acknowledged objective was to stop third-party liquidity swimming pools from siphoning off charges and to re-center exercise contained in the supposed loop. That transfer alone indicators the undertaking’s obsession with conserving quantity contained and costs inside.

The Burn Loop Is the Headline, however Velocity Is the Engine

The strongest verified datapoint thus far is that 250,000,000 DEATHSTR had been burned in seven days, framed as 25% of complete provide. A 26% determine is commonly cited, however 25% is the clearest official quantity. With a max provide of 1 billion, that means roughly 750 million tokens remaining at that time limit.

Burns alone don’t transfer worth. Markets care about demand, not labels. However provide compression does matter when paired with sustained exercise. If quantity stays concentrated and costs proceed flowing again into buybacks and burns, the efficient float shrinks whereas participation stays energetic. That mixture can amplify worth strikes, particularly at decrease market caps.

The Actual Hook Is Discounted NFT Entry

The place DEATHSTR diverges from many technique tokens is its entry mechanic. To take part in NFT raffles, customers should lock no less than 1,000,000 DEATHSTR. Every extra million will increase raffle entries. The system runs in 36-hour cycles, with 24 hours of voting and a 12-hour cooldown, continuously shifting focus to new NFT targets.

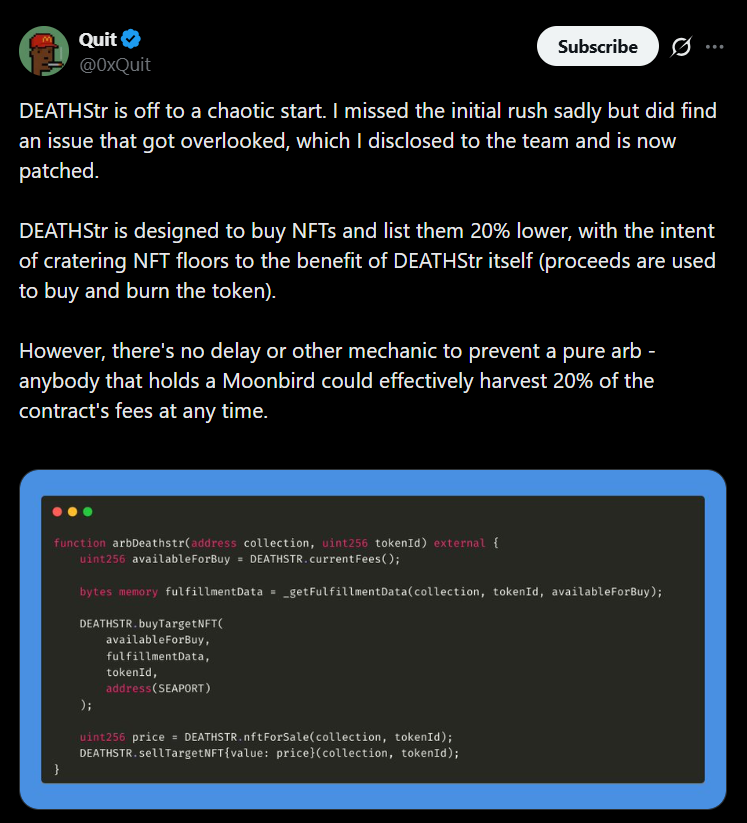

The technique sometimes buys NFTs and lists them at costs beneath prevailing ground ranges, usually described as round a 20% {discount}. If that {discount} holds in apply, it creates tangible utility. Holders are usually not simply speculating on burns. They’re shopping for a shot at buying fascinating NFTs at favorable pricing. That turns DEATHSTR from a pure burn narrative into an entry token with shortage measured in entry items.

Why the 10x Case Isn’t Pure Hype

A 10x transfer from a low single-digit million market cap places DEATHSTR within the mid-eight-figure vary. That valuation sits comfortably inside the bounds of different established NFT technique tokens, not in some absurd outlier territory. It doesn’t require class domination, simply significant share inside a distinct segment that already helps comparable valuations.

DEATHSTR’s differentiation is velocity. Markup-based NFT methods depend on robust markets and affected person consumers. DEATHSTR’s discount-driven resale mannequin goals to clear stock rapidly, reset capital, and spin the loop once more. If cycles stay tight and buying and selling quantity stays targeted, the burn fee stays significant. If NFT liquidity fades or merchants lose curiosity, the flywheel slows.

What Truly Determines If It Goes Larger

The early 10x displays a market that understands the mechanics. Concentrated buying and selling feeds charges. Charges fund NFT purchases and burns. Burns scale back efficient float. However sustainability depends upon execution, not headlines.

The actual take a look at is whether or not stock retains clearing and participation stays energetic. If the raffle-gated {discount} continues to draw lockers relatively than simply short-term merchants, DEATHSTR maintains its edge. If quantity fragments or NFT demand weakens, the loop loses drive.

A path increased doesn’t require extraordinary assumptions. It requires sustained participation, ongoing provide compression, and sufficient demand to justify valuations already seen within the NFT technique class. Whether or not DEATHSTR turns into an enduring Ethereum area of interest play or only a sharp early-cycle spike will depend upon one factor: constant velocity.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.