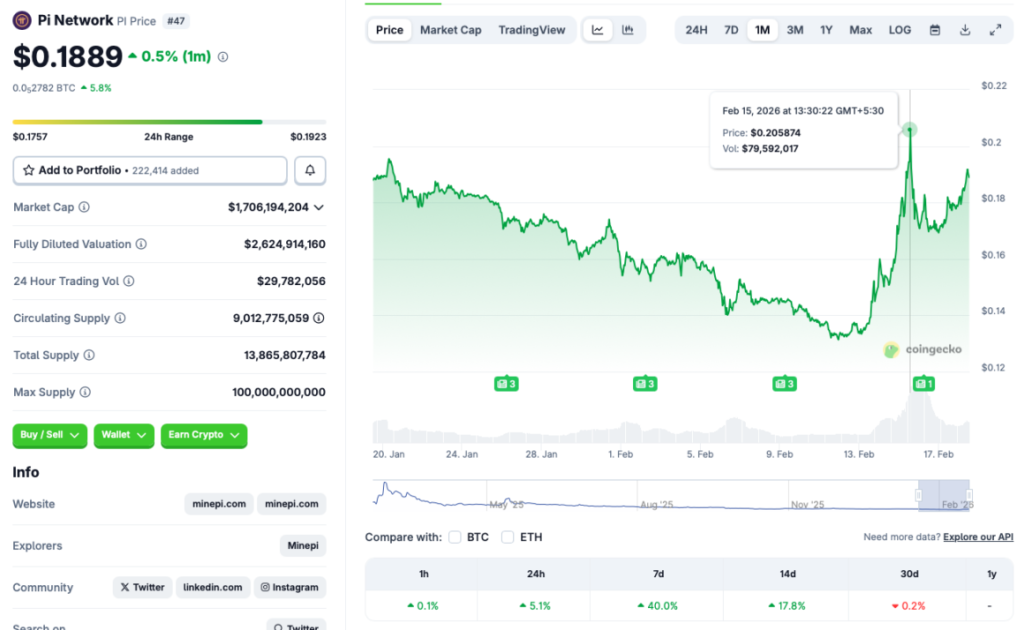

- PI is up 5.1% in 24 hours, 40% in every week, and 17.8% over 14 days

- The rally seems tied to Pi Community’s mainnet launch and Feb. 15 upgrades

- Forecasts nonetheless warn of a possible correction towards $0.13 this month

Pi Coin (Pi Community/PI) has turn out to be one of many strongest performers in crypto proper now, and it’s doing it loudly. In response to market information, PI is up 5.1% over the previous 24 hours, roughly 40% over the past week, and almost 18% on the 14-day chart. That sort of transfer immediately pulls consideration, particularly when Bitcoin and Ethereum are struggling to pattern cleanly.

What makes this much more noticeable is that PI is outperforming main belongings like BTC, ETH, and XRP throughout the identical window. In a market the place most tokens are preventing for liquidity, something exhibiting energy like this turns into a magnet for merchants.

The Foremost Driver Seems Like Pi Community’s Mainnet Push

The best rationalization for the rally is that Pi Coin lastly has a catalyst that feels actual. PI’s newest transfer seems tied to its mainnet launch and key upgrades that kicked off round Feb. 15, 2026. The undertaking has framed this part as a step towards deeper decentralization, and the market tends to reward something that appears like progress, particularly when it’s tied to infrastructure.

PI additionally caught a tailwind from broader crypto inflows over the weekend. Bitcoin briefly reclaimed $70,000 on Sunday earlier than sliding again towards the $67,000 vary. Though BTC didn’t maintain the breakout, that quick burst of market energy probably helped PI get its first leg greater.

The Rally Might Fade if Bitcoin Stays Weak

Even with the hype, PI continues to be buying and selling in a market the place Bitcoin controls the temper. BTC struggling to regain momentum usually results in market-wide dips, and smaller belongings often really feel it first. That’s why there’s an actual likelihood PI’s rally cools off shortly, particularly if merchants begin taking earnings after such a pointy weekly run.

That is the half meme-style and hype-driven rallies at all times run into. They transfer quick, however additionally they appropriate quick. PI’s energy is actual, however the broader market backdrop continues to be fragile, and that issues greater than folks wish to admit.

FOMO and Seasonal Liquidity Might Preserve PI Scorching Longer

That mentioned, PI could have one thing else going for it: pure FOMO. When a token is among the solely issues transferring, merchants rotate into it just because they need motion. That dynamic can maintain rallies alive longer than fundamentals would recommend, typically for weeks, particularly if the market stays bored elsewhere.

There’s additionally the concept that liquidity might improve as billions of {dollars} in tax refunds start returning to family accounts. If even a small slice of that capital flows into crypto, speculative belongings like PI may benefit disproportionately. It’s not assured, however it’s the sort of macro tailwind merchants watch intently in Q1.

Analysts Nonetheless Anticipate a Pullback Towards $0.13

Regardless of the rally, not everybody believes PI can maintain this transfer. CoinCodex analysts have projected a bearish short-term outlook, anticipating PI to fall towards $0.13 by the top of the month. If that performs out, it could indicate a correction of roughly 31.5% from present ranges.

That doesn’t imply PI is “executed.” It simply means the rally could also be forward of itself. In crypto, robust strikes usually include equally sharp pullbacks, and PI’s surge has been quick sufficient {that a} reset wouldn’t be stunning in any respect.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.