Market circumstances stay fragile as Solana value trades in a decisive downtrend, with volatility elevated and sentiment deeply damaging throughout crypto.

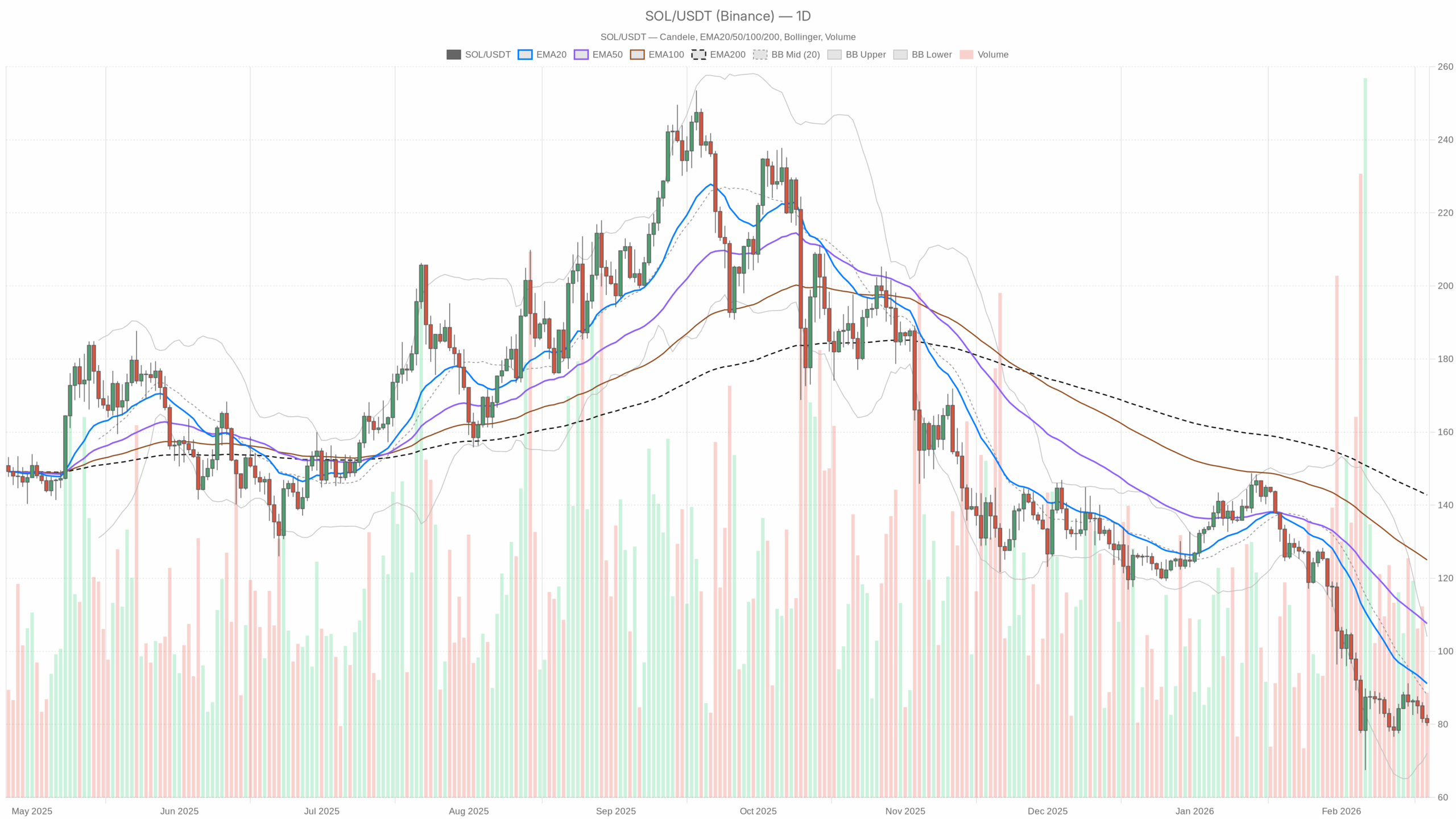

Day by day Chart (D1): Macro Bias – Clearly Bearish, However Getting Stretched

Development Construction: EMAs

- Worth (shut): $80.48

- EMA 20: $91.19

- EMA 50: $107.60

- EMA 200: $142.78

- Regime: bearish

Solana is buying and selling nicely under the 20, 50 and 200-day EMAs, with a clear bearish stack (value < EMA 20 < EMA 50 < EMA 200). The 20-day sits ~13% above present value, which alerts the short-term down-move is already prolonged however nonetheless very a lot intact. Furthermore, trend-followers are in management; any bounce in direction of $90–$100 is technically a rally into overhead provide, not a confirmed development change.

Momentum: RSI (Day by day)

Day by day RSI is hovering simply above classical oversold territory. Bears nonetheless have the higher hand, however draw back momentum is beginning to look drained. That is the zone the place development merchants can hold brief publicity, but early dip-buyers will begin sniffing round for potential imply reversion. It’s weak, not but capitulative.

Momentum: MACD (Day by day)

- MACD line: -9.37

- Sign line: -10.41

- Histogram: +1.04

The MACD traces are deep in damaging territory, confirming a sustained bearish part. Nevertheless, the MACD line has crossed above the sign line, giving a constructive histogram. That’s an early signal that draw back momentum is easing; consider it because the brakes being tapped on the selloff, not but a full U-turn. In a robust downtrend, this sort of MACD enchancment typically fuels countertrend rallies that fail into resistance.

Volatility & Positioning: Bollinger Bands (Day by day)

- BB mid (20-period foundation): $88.05

- BB higher: $104.02

- BB decrease: $72.08

Solana value is buying and selling under the Bollinger mid-band and within the decrease half of the band construction, nearer to the decrease band at $72. Worth has already made a run towards the decrease band, which is in line with an ongoing downtrend. The truth that it isn’t pinned onerous to the band suggests sellers are in management however not in full capitulation mode. There’s room for a tag of the decrease band close to $72 if sentiment weakens additional, however equally, a snap-back in direction of the mid-band round $88 is believable if shorts get crowded.

Volatility Gauge: ATR (Day by day)

With ATR round $6.5, the everyday day by day vary is roughly 8% of present value. That’s elevated however not excessive for Solana. Virtually, it means each draw back flushes and upside squeezes may be violent inside a single day. Subsequently, place sizing and stops want extra buffer than throughout calmer phases.

Brief-Time period Day by day Ranges: Pivots (D1)

- Pivot Level (PP): $80.92

- R1: $82.23

- S1: $79.17

Worth is barely under the day by day pivot at $80.92, hovering between PP and S1. That’s an intraday-bearish skew on the upper timeframe: the market is buying and selling underneath its short-term equilibrium, with $82–83 appearing as the primary band of resistance and $79 the fast assist to look at for a possible flush towards the decrease Bollinger band close to $72.

Day by day takeaway: The principle state of affairs is bearish. The market is in a mature downtrend with early indicators of promoting fatigue. Till Solana can reclaim and maintain above the day by day 20 EMA (~$91), any bounce is structurally a rally inside a downtrend.

1-Hour Chart (H1): Tactical Bias – Bearish, However Sliding Into Help

Development: EMAs (H1)

- Worth (shut): $80.61

- EMA 20: $81.59

- EMA 50: $82.77

- EMA 200: $84.29

- Regime: bearish

On the hourly, Solana can also be buying and selling under all key EMAs, that are easily fanned out above value. That’s in line with a managed intraday downtrend slightly than a panic dump. Any transfer again into $82–84 on the hourly chart will hit a wall of moving-average resistance the place short-term sellers are probably ready.

Momentum: RSI (H1)

Hourly RSI sits in bearish-but-not-oversold territory. There’s nonetheless room for one more leg decrease with out requiring an instantaneous bounce. Bulls do not need momentum but; the perfect they’ll argue is that the draw back is not accelerating.

Momentum: MACD (H1)

- MACD line: -0.65

- Sign line: -0.61

- Histogram: -0.04

The hourly MACD is marginally damaging, with the road just below the sign line. Momentum is weakly bearish and drifting slightly than sharply trending. That always aligns with a grind decrease or sideways chop, not with a robust reversal try. Bulls would need to see this cross again above the sign with an increasing constructive histogram earlier than speaking a few critical intraday shift.

Bollinger Bands & Volatility (H1)

- BB mid: $81.43

- BB higher: $82.54

- BB decrease: $80.33

- ATR 14 (H1): $0.75

Worth is close to the decrease hourly Bollinger band at $80.33, with ATR round $0.75. That places Solana close to short-term assist after a current push down. Intraday, that is the place you typically see both a short bounce or a band stroll. Given the broader bearish context, a sluggish crawl alongside the decrease band is extra probably than a clear V-shaped restoration except macro circumstances all of the sudden enhance.

Hourly Pivots

- Pivot Level (PP): $80.44

- R1: $80.94

- S1: $80.12

Worth is sitting mainly on the hourly pivot ($80.44–80.61 space), that means the market is at a neighborhood resolution level. A sustained push above R1 (~$80.94) would open the door for a take a look at of the hourly EMAs close to $81.5–82. Failing right here and dropping S1 (~$80.12) would validate continuation stress towards $79 and the day by day S1 zone.

15-Min Chart (M15): Execution Context – Vendor Management, No Clear Base But

Development: EMAs (M15)

- Worth (shut): $80.58

- EMA 20: $80.88

- EMA 50: $81.37

- EMA 200: $82.84

- Regime: bearish

The 15-minute chart mirrors the upper timeframes: value underneath all EMAs, with a transparent bearish alignment. Brief-term rallies into $81–82 are prone to meet sellers rapidly. For intraday merchants, that space is the apparent battleground for fade setups except construction adjustments.

Momentum: RSI (M15)

On the 15-minute, RSI is weak however not oversold. That helps a sluggish grind or delicate intraday bounces, not a clear development reversal. Momentum throughout all three timeframes is persistently on the bearish facet, simply not at extremes.

Momentum: MACD (M15)

- MACD line: -0.40

- Sign line: -0.35

- Histogram: -0.06

The 15-minute MACD is mildly bearish with a small damaging histogram. Sellers stay in management, however there isn’t any robust thrust; it’s managed stress slightly than aggressive dumping. This often favors shorting failed bounces slightly than chasing breakdowns at native lows.

Bollinger Bands & ATR (M15)

- BB mid: $80.99

- BB higher: $82.17

- BB decrease: $79.81

- ATR 14 (M15): $0.46

Solana is buying and selling just under the mid-band on M15, not pressed into extremes. Intraday volatility round $0.46 per 15-minute bar is significant however not chaotic. This construction favors range-trading or trend-follow setups slightly than betting on fast violent reversals.

M15 Pivots

- Pivot Level (PP): $80.44

- R1: $80.91

- S1: $80.10

The 15-minute pivot roughly coincides with the hourly pivot, reinforcing the $80.4–80.6 zone because the short-term resolution space. So long as M15 candles are closing under R1 (~$80.91) and the 20 EMA, the very short-term stream stays in favor of sellers.

Bullish State of affairs for Solana Worth (Countertrend Bounce)

A bullish case from right here is countertrend solely on present knowledge. It hinges on promoting stress lastly exhausting on this $78–81 band and the broader market stabilizing.

What bulls need to see:

- A transparent intraday larger low above roughly $79, seen on the 1H and 15m charts, slightly than a straight-line bleed.

- Hourly RSI pushing again above 45–50 with MACD crossing constructive and increasing, exhibiting recent upside momentum slightly than only a dead-cat bounce.

- Worth reclaiming and holding above the H1 EMA 20 (~$81.6) first, then the H1 EMA 50 (~$82.8). That will sign bears are dropping grip on the intraday development.

- A push towards the day by day Bollinger mid-band round $88, and ideally a take a look at of the day by day EMA 20 close to $91. That’s the logical first upside goal zone for any reduction rally.

If Solana can shut a number of day by day candles again above $91 (the 20-day EMA) with RSI lifting towards impartial (40s–50s) and MACD staying in a constructive cross, the dialog shifts from a dead-cat bounce to a possible medium-term base forming.

Bullish state of affairs invalidation: A decisive break and day by day shut under the decrease day by day Bollinger band space, roughly $72, would critically injury the bounce setup and level to a recent leg decrease. Additionally, continued failure to reclaim even the H1 EMA 20 whereas BTC dominance grinds larger would hold bulls firmly on the again foot.

Bearish State of affairs for Solana Worth (Development Continuation)

The principle state of affairs, given the information, remains to be development continuation to the draw back. The construction throughout D1, H1, and M15 is aligned: value under EMAs, bearish regimes on all timeframes, and a macro atmosphere of maximum concern with BTC dominance rising.

What bears are in search of:

- Failure of value to carry above the intraday pivots at $80.4–80.6, adopted by a clear lack of the $79–80 space (day by day S1 and native assist band).

- Hourly and 15-minute RSI staying weak (sub-45) on any bounce, exhibiting no actual momentum shift.

- Hourly and day by day MACD remaining in damaging territory even when the histogram flips round zero, that means rallies with out structural development change.

- A transfer towards the day by day decrease Bollinger band area round $72. If concern deepens, value can overshoot that band earlier than any lasting reduction.

Under $72, there’s a threat of a momentum break the place compelled liquidations and cease runs speed up the draw back. With day by day ATR at $6.5, a one- or two-day slide of $10–15 is fully doable if liquidity thins out.

Bearish state of affairs invalidation: Bears begin dropping the narrative if Solana can:

- Reclaim the H1 EMA 200 (~$84.3) and maintain above it, turning it into assist.

- Push into the $88–91 zone (day by day mid-band and EMA 20) and consolidate there as an alternative of immediately rejecting.

- Present a day by day RSI drift again into the 40s–50s with MACD holding a sustained constructive cross.

Beneath these circumstances, shorting each bounce turns into harmful; the market can be shifting from a pure development part into a possible vary or early accumulation.

Assume About Positioning Now

Solana is in a transparent downtrend on the day by day, hourly, and 15-minute charts, with all EMAs stacked bearishly and momentum weak throughout the board. On the identical time, day by day RSI close to 32 and a MACD that’s beginning to curl up point out the straightforward a part of the brief commerce could also be behind us. That is typically the part the place development followers nonetheless have the sting, however the threat of sharp, painful squeezes will increase.

In follow:

- Any energy into the $82–88 band is at present a take a look at of resistance, not a confirmed development reversal.

- The primary actual structural shift can be a sustained reclaim of the day by day EMA 20 round $91.

- The draw back magnet within the present construction is the $72 day by day decrease Bollinger band area, with volatility excessive sufficient to succeed in it rapidly if sentiment worsens.

Volatility is elevated, market-wide concern is excessive, and BTC is absorbing dominance. That mixture can produce each deep flushes and violent bear-market rallies. No matter your bias on Solana value, the information argues for respecting threat, as ranges are broad, reversals may be abrupt, and certainty is low even when the present development is clearly down.