- WLFI surged 16% in 24 hours regardless of broader crypto weak spot

- A high-profile Mar-a-Lago occasion could also be fueling short-term demand

- The token stays down 28% over the previous month

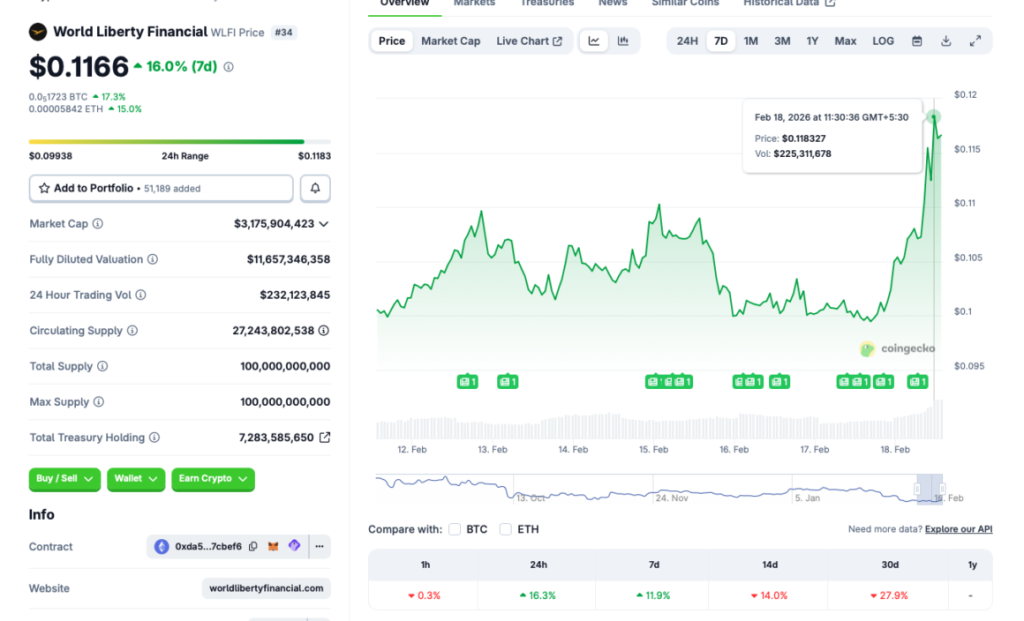

Trump family-backed World Liberty Monetary (WLFI) simply posted a pointy 16% achieve in a single day, at the same time as the broader crypto market continues to battle for route. Based on market information, WLFI is up 16.3% during the last 24 hours and almost 12% over the previous week. That form of transfer stands out, particularly when Bitcoin remains to be preventing to reclaim momentum.

Zoom out a bit, although, and the larger image appears to be like much less explosive. WLFI stays down roughly 14% on the 14-day chart and almost 28% over the previous month. The rally feels highly effective within the brief time period, however it’s occurring inside a broader downtrend.

Mar-a-Lago Occasion Might Be Fueling Hypothesis

One probably catalyst behind WLFI’s spike is an invite-only occasion scheduled at Mar-a-Lago, President Trump’s long-owned Florida property. Reviews recommend round 400 attendees, together with high-profile figures reminiscent of Coinbase CEO Brian Armstrong, NYSE President Lynn Martin, Nasdaq CEO Adena Friedman, and Goldman Sachs CEO David Solomon.

When that degree of conventional finance presence overlaps with a Trump-linked crypto undertaking, hypothesis follows shortly. Markets typically commerce forward of visibility and entry, not fundamentals. Even the notion of alignment between political affect and monetary infrastructure can set off aggressive short-term shopping for.

Controversy Nonetheless Hangs Over the Venture

Regardless of the rally, WLFI isn’t with out baggage. Critics have questioned President Trump’s involvement in crypto-related ventures, though he has publicly denied direct operational involvement in World Liberty Monetary. That ambiguity alone retains the narrative heated.

Latest stories {that a} royal UAE investor bought a 49% stake within the undertaking added one other layer of consideration. Worldwide capital, political connections, and crypto hardly ever combine quietly. The thrill might assist with visibility, however it additionally raises regulatory and reputational questions that don’t disappear in a single day.

Can WLFI Maintain Momentum in a Bear Market?

The larger problem is macro. Bitcoin continues to battle with sustained upside, and most altcoins are transferring in BTC’s shadow. In bear market situations, short-term rallies typically fade as liquidity thins and merchants rotate again into safer positions.

WLFI’s resilience is notable, however sustaining features in a fragile surroundings is more durable than igniting them. If Bitcoin stabilizes or turns greater, WLFI may journey that wave. If BTC rolls over once more, this rally might begin to seem like a pointy however short-term spike fairly than a structural shift.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.