XRP reserves fall as whale inflows gradual, signaling provide absorption regardless of weak momentum.

XRP has tanked from its early-year highs after sellers ramped up actions. And because of this, the coin’s worth motion and momentum stay weak. Even so, latest on-chain information exhibits a possible flip in investor conduct.

Trade Balances Shrink Regardless of Weak Momentum

Trade reserve tendencies usually supply early indicators of investor intent. Based on market analyst Darkfost, information exhibits a transparent contraction in XRP provide held on Binance. Often, rising reserves sign intent to promote. However declining reserves point out that holders are transferring property into non-public custody.

🗞️ XRP Trade provide ratio decline indicators renewed investor accumulation

“Over the previous ten days, the XRP provide ratio on Binance has recorded a notable decline, dropping from 0.027 to 0.025. Throughout this era, roughly 200 million XRP have left the platform.

It’s price… pic.twitter.com/4dFSxeLtcz— Darkfost (@Darkfost_Coc) February 19, 2026

Latest figures present Binance’s XRP trade provide ratio dropped from about 0.0274 to 0.0255 inside ten days. Throughout that very same interval, reserves fell from roughly 2.74 billion XRP to 2.55 billion XRP. Practically 200 million XRP left the trade in a brief span.

On February 9, the coin noticed a pointy structural decline in balances. After the sharp drop, trade reserves leveled off and stayed low, with no sturdy bounce again. That sample pointed to withdrawals as a substitute of inner trade transfers. When balances stay low, it usually exhibits that holders desire to maintain their XRP off buying and selling platforms.

Notably, this provide drop occurred whereas the worth was falling. XRP declined from above $1.90 to the $1.15–$1.20 space earlier than settling close to $1.40. Typically, accumulation throughout a correction usually factors to a long-term play by merchants.

Supply: TradingView

In the meantime, the RSI on decrease timeframes has bounced from oversold ranges. Nevertheless, it stays under the 50 mark, which signifies that patrons are but to achieve higher hand. As per Darkfost, this factors to accumulation taking place whereas momentum stays weak.

XRP Down 40%, However On-Chain Knowledge Suggests Accumulation Part

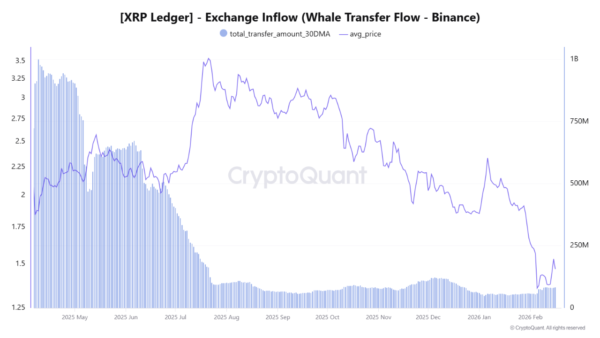

Whale exercise affords extra perception into present market conduct. Giant XRP transfers to Binance haven’t elevated through the latest correction. As an alternative, the 30-day common of whale inflows has dropped to multi-month lows.

Supply: CryptoQuant

Heavy promoting often exhibits up as clear spikes in trade deposits. Regular low inflows recommend massive holders will not be shifting rapidly to promote.

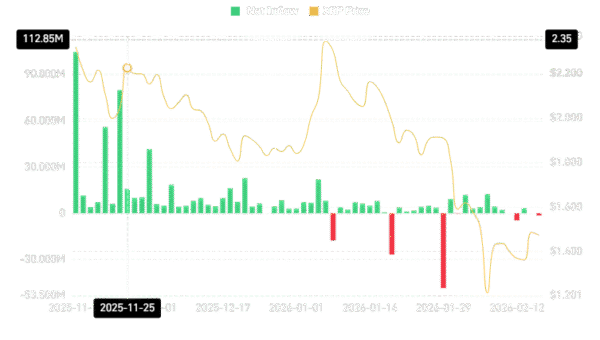

Institutional flows add extra perspective to latest worth motion. Spot XRP ETF merchandise recorded sturdy inflows when the worth traded above $2.00 earlier within the 12 months. As markets corrected, redemptions elevated. Latest information now exhibits these outflows have slowed, with small inflows returning as worth begins to stabilize.

Supply: CoinGlass

Slower redemptions don’t but level to sturdy institutional shopping for. Nonetheless, lowered promoting strain from funding automobiles helps scale back draw back threat. Even at that, the present setup resembles post-capitulation absorption relatively than energetic distribution.

XRP is down about 40% for the reason that begin of the 12 months. Oftentimes, drops of this magnitude usually entice long-term patrons who soar on decrease costs. The present range-bound buying and selling suggests a steadiness between cautious sellers and regular accumulators.

Darkfost maintains that falling trade provide alone doesn’t assure a fast rally. He added that the worth nonetheless wants stronger demand and higher momentum to verify an actual reversal. Even so, previous cycles present that regular reserve declines throughout weak worth intervals usually come earlier than renewed shopping for curiosity.