The present crypto atmosphere is risk-off, and the XRP value displays that temper with a managed drift decrease fairly than a panic transfer.

Market Thesis: XRP Worth in a Managed Descent, Not a Panic Dump

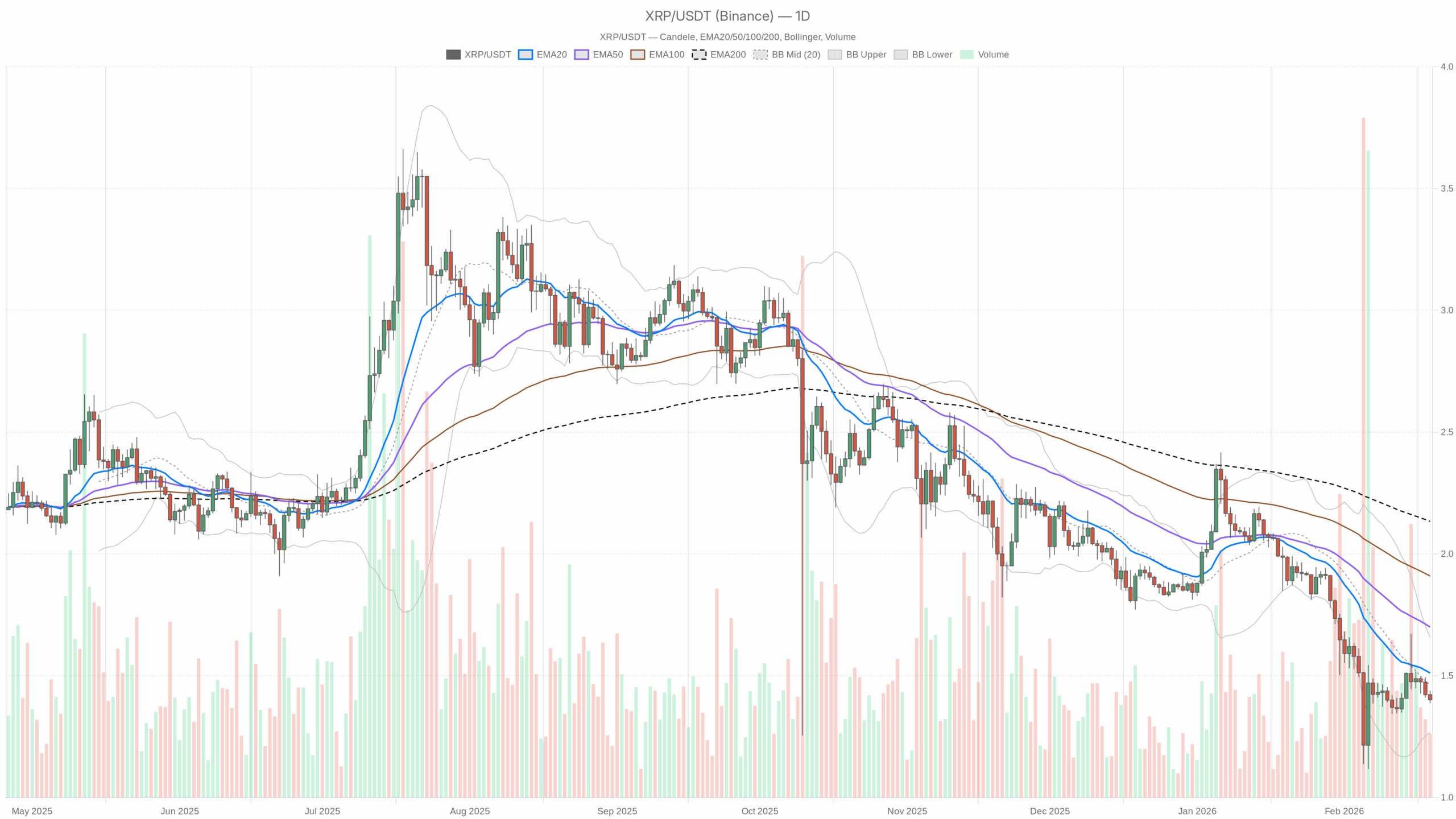

XRPUSDT is buying and selling round $1.40, sitting under all the important thing day by day shifting averages and below the Bollinger mid-band. The upper timeframe construction is clearly bearish, however this isn’t a crash; it’s a grind decrease in a broader risk-off crypto atmosphere.

Complete crypto market cap is down about 1.8% over 24 hours, BTC dominance is elevated at ~56%, and the Worry & Greed Index is caught in Excessive Worry (9). Capital is hiding in Bitcoin and stables, and altcoins like XRP are feeling the load. Nonetheless, the dominant pressure proper now could be defensive positioning, not speculative urge for food.

On XRP particularly, the day by day pattern is down, momentum is weak, but volatility is comparatively contained. That cocktail often favors managed stair-steps decrease fairly than explosive strikes in both path, till a catalyst or a transparent technical break seems.

Each day Timeframe (D1): Macro Bias = Bearish

On the day by day chart, XRP is in a textbook downtrend that has been growing over time fairly than erupting all of a sudden.

Pattern Construction: EMAs

EMA20: 1.51 | EMA50: 1.70 | EMA200: 2.13 | Worth (shut): 1.40

Worth is buying and selling under all three EMAs, and they’re stacked bearishly (20 < 50 < 200). That may be a mature downtrend, not only a pullback. Being under the 20-day specifically means short-term sellers nonetheless management the tape; there is no such thing as a signal of an actual reclaim but.

Momentum: RSI (14)

RSI14: 37.82

RSI is under 40, so momentum is bearish, however it isn’t deeply oversold. Sellers are in cost, however they aren’t maxed out. That leaves room for additional draw back with out requiring a right away aid rally. But it additionally hints that pressured promoting isn’t excessive at this stage.

Momentum Affirmation: MACD

MACD line: -0.10 | Sign: -0.12 | Histogram: 0.02

MACD is unfavourable, aligning with the downtrend, however the line is barely above the sign, therefore the small optimistic histogram. That may be a gentle momentum stabilisation: the draw back push is slowing fairly than accelerating. Bears are nonetheless in management, however the stress is easing a bit as an alternative of snowballing.

Volatility and Vary: Bollinger Bands & ATR

Bollinger Bands (20): Mid 1.46 | Higher 1.66 | Decrease 1.27

ATR(14): 0.11

Worth sits under the center band however not pinned to the decrease band. That may be a managed downtrend fairly than a waterfall. There’s nonetheless room to the draw back (towards ~1.27) if promoting picks up, however present positioning exhibits extra of a sluggish drift than outright panic. ATR at 0.11 means day by day swings of roughly 8% are regular proper now, elevated sufficient to harm overleveraged positions, however not excessive for XRP.

Brief-Time period Ranges: Each day Pivot

Pivot Level (PP): 1.41 | R1: 1.43 | S1: 1.38

Worth is sitting proper below the day by day pivot at 1.41. That retains intraday bias barely unfavourable. So long as XRP holds under 1.41–1.43, rallies usually tend to be offered into than prolonged. First close by assist is round 1.38; shedding that opens up a deeper check decrease within the day by day Bollinger vary.

Each day takeaway: The primary situation is bearish. Pattern, construction, and momentum lean down. The one nuance is that the selloff is managed, not capitulatory, which shapes expectations for follow-through.

Hourly Timeframe (H1): Weak Bounces in a Bearish Channel

On the 1H chart, XRP is grinding sideways to decrease, echoing the day by day bias however with even much less power displaying up within the candles.

Pattern: EMAs (H1)

EMA20: 1.42 | EMA50: 1.44 | EMA200: 1.45 | Worth: 1.40

Worth is below all key intraday EMAs, and people averages are clustered simply above: 1.42–1.45 is a dense resistance zone. Every time value tries to bounce, it runs into this overhead provide. Intraday consumers are shedding the battle on the averages, which reinforces the short-term bearish tone.

Momentum: RSI & MACD (H1)

RSI14: 36.41

MACD line: -0.01 | Sign: -0.01 | Histogram: 0.00

RSI on the hourly is weak however not washed out, once more across the excessive 30s. This mirrors the day by day: persistent promoting, no actual signal of exhaustion. MACD is flat and unfavourable, displaying an absence of robust intraday impulse in both path. Sellers are pushing value decrease by way of grind, not aggression or panic.

Vary & Intraday Pivot (H1)

Bollinger Bands (H1): Mid 1.42 | Higher 1.44 | Decrease 1.40

ATR(14): 0.01

Pivot (H1 PP): 1.40 | R1: 1.41 | S1: 1.39

Worth hugs the decrease hourly band and sits proper on the intraday pivot at 1.40. That indicators a good, low-volatility drift decrease. With ATR at simply 0.01, the hourly strikes are small and managed. Scalpers are buying and selling a compressed vary round 1.39–1.41. A decisive break under 1.39 would possible increase that vary to the draw back.

Hourly takeaway: H1 confirms the bearish day by day bias, however in a sluggish bleed fairly than a dump. Any bounce into 1.42–1.45 stays suspect until value can shut and maintain above that band on a number of hourly candles.

15-Minute (M15): Execution Context, Not a Pattern Reversal

On M15, XRP is simply chopping close to the lows of the broader vary, providing extra noise than sign for bigger-picture path.

Brief-Time period Construction: EMAs (M15)

EMA20: 1.41 | EMA50: 1.42 | EMA200: 1.44 | Worth: 1.40

The identical sample repeats: value is under all short-term EMAs, that are stepping down. The micro-structure is aligned with the upper timeframes. There isn’t any hidden bullish divergence in pattern right here that will justify a powerful reversal name.

Brief-Time period Momentum & Volatility (M15)

RSI14: 42.78

MACD: Line -0.01 | Sign -0.01 | Histogram 0.00

Bollinger Bands (M15): Mid 1.41 | Higher 1.42 | Decrease 1.39

Pivot (M15 PP): 1.40 | R1 1.41 | S1 1.39

ATR(14): 0.01

RSI on M15 is barely greater than on H1, within the low 40s, hinting at gentle intraday dip-buying or at the least some stabilization. However MACD is flat, and value sits close to the decrease band and close to S1 at 1.39–1.40. For execution, this timeframe exhibits quick, tradable bounces from 1.39–1.40 into 1.41–1.42, however nothing that challenges the broader bearish construction.

15m takeaway: Micro bounces are doable, however the lower-timeframe motion is simply noise inside a bigger downtrend and needs to be handled as such by greater timeframe merchants.

Market Regime and Cross-Timeframe View

Throughout D1, H1, and M15, the regime flags are all explicitly bearish. There isn’t any timeframe displaying a transparent bullish shift but or a sturdy change in construction.

- Pattern: All key EMAs above value on each timeframe → bears management construction.

- Momentum: RSI under 50 throughout the board, with day by day and hourly sitting within the 30s → persistent promoting, not oversold panic.

- Volatility: ATR is average on D1 and compressed on intraday → managed drift, not capitulation.

- Macro context: BTC dominance excessive, excessive concern within the broader market → altcoins are within the penalty field and wrestle to draw new inflows.

The one gentle rigidity is between the slowing draw back momentum (MACD histogram on D1 barely optimistic) and the still-bearish value construction. In plain phrases, the downtrend is growing older, however it has not truly reversed and even correctly challenged the dominant sellers but.

Key Ranges for XRP Worth

Key technical zones proceed to outline the battleground the place bulls and bears are more likely to react.

- Speedy resistance: 1.41–1.43 (day by day PP and R1, plus intraday resistance)

- Brief-term resistance band: 1.42–1.45 (cluster of H1/M15 EMAs and hourly Bollinger mid)

- Stronger resistance: 1.51 (day by day EMA20) and 1.66 (day by day higher Bollinger)

- Speedy assist: 1.38 (day by day S1) and 1.39 (intraday S1)

- Deeper assist zone: 1.30–1.27 (day by day decrease Bollinger band area)

Situation Map for XRP Worth

Bullish Situation

For a significant bullish case, XRP wants greater than a scalp bounce; it wants to begin reclaiming construction step-by-step on a number of timeframes.

What a constructive bullish path appears like:

- Maintain above 1.38–1.39 on closing foundation (H1/D1). This confirms consumers are defending present assist.

- Break and maintain above 1.41–1.43, turning the day by day pivot band from resistance into assist.

- Reclaim the 1.42–1.45 EMA cluster on H1 with RSI shifting again above 50. That might present that intraday management is shifting from sellers to consumers.

- Each day shut again above the EMA20 (~1.51). That’s the key line the place the day by day downtrend begins to be questioned. Above there, rallies towards 1.60–1.66 (higher Bollinger) turn out to be practical.

If this performs out, XRP might transition from a managed downtrend right into a mean-reversion rally, with shorts masking and new longs focusing on the mid-1.60s area fairly than new lows.

What invalidates the bullish situation?

A decisive break under 1.38 on day by day closing foundation, with RSI staying under 40 and MACD turning extra unfavourable once more, would put the bullish path on ice. That might present that the obvious stabilisation was only a pause earlier than one other leg down.

Bearish Situation

The present setup already leans bearish, so continuation is the trail of least resistance until one thing shifts in construction or momentum.

What a continuation decrease appears like:

- XRP fails to reclaim 1.41–1.43 and retains closing under the day by day pivot zone.

- Intraday, H1 and M15 EMAs proceed to cap rallies within the 1.42–1.45 band, with RSI caught sub-50.

- Worth breaks under 1.38–1.39, increasing intraday volatility and dragging day by day RSI nearer to the low 30s.

- Promoting extends towards the 1.30–1.27 space (day by day decrease Bollinger band and psychological zone), the place a extra significant oversold situation might lastly kind.

On this path, XRP grinds decrease in legs, not in a straight line. Count on quick, sharp bounces as shorts take revenue, however with the broader path nonetheless down till key resistance ranges are convincingly reclaimed.

What invalidates the bearish situation?

A sustained transfer again above 1.45, adopted by a day by day shut over 1.51 (EMA20), would begin to break the bearish narrative. If that transfer is backed by RSI reclaiming 50+ on each H1 and D1, the downtrend can be unsure, and bears must reassess their positioning.

Positioning, Threat, and Uncertainty

The XRP value is in a longtime downtrend, in a market that’s clearly risk-off, and in an atmosphere of maximum concern. That mixture often rewards persistence and disciplined level-by-level buying and selling, not aggressive bets in both path.

For directional merchants, the vital factor is timeframe alignment and respecting the place construction truly modifications:

- In case you are buying and selling the day by day pattern, the bias is down till value begins closing above 1.51 on a constant foundation.

- In case you are buying and selling intraday, your battlefield is roughly 1.38–1.45, with tight ranges and low ATR on the decrease timeframes.

Volatility is average however can increase shortly if 1.38 breaks or if the broader market strikes out of maximum concern. Uncertainty stays excessive: sentiment is fragile, and any macro or regulatory headline can flip the tape in both path.

In abstract, XRP is in a managed bearish regime. The market isn’t pricing in a collapse, however it’s also not keen to pay up for danger. Till the important thing ranges outlined above are reclaimed or cleanly damaged, treating this as a trend-following atmosphere with respect for volatility and liquidity makes extra sense than making an attempt to name heroic tops or bottoms.