Changpeng Zhao (CZ), founder and former CEO of the world’s largest crypto change, Binance, has revealed his function within the United Arab Emirates’ (UAE) Bitcoin adoption.

In a tweet highlighting info that the UAE has formally acknowledged bitcoin (BTC) as a retailer of worth just like gold, CZ disclosed that his advocacy contributed to the event.

CZ Influenced the UAE’s Bitcoin Adoption

“I might need executed a tiny little bit of advocacy for this,” the Binance founder mentioned.

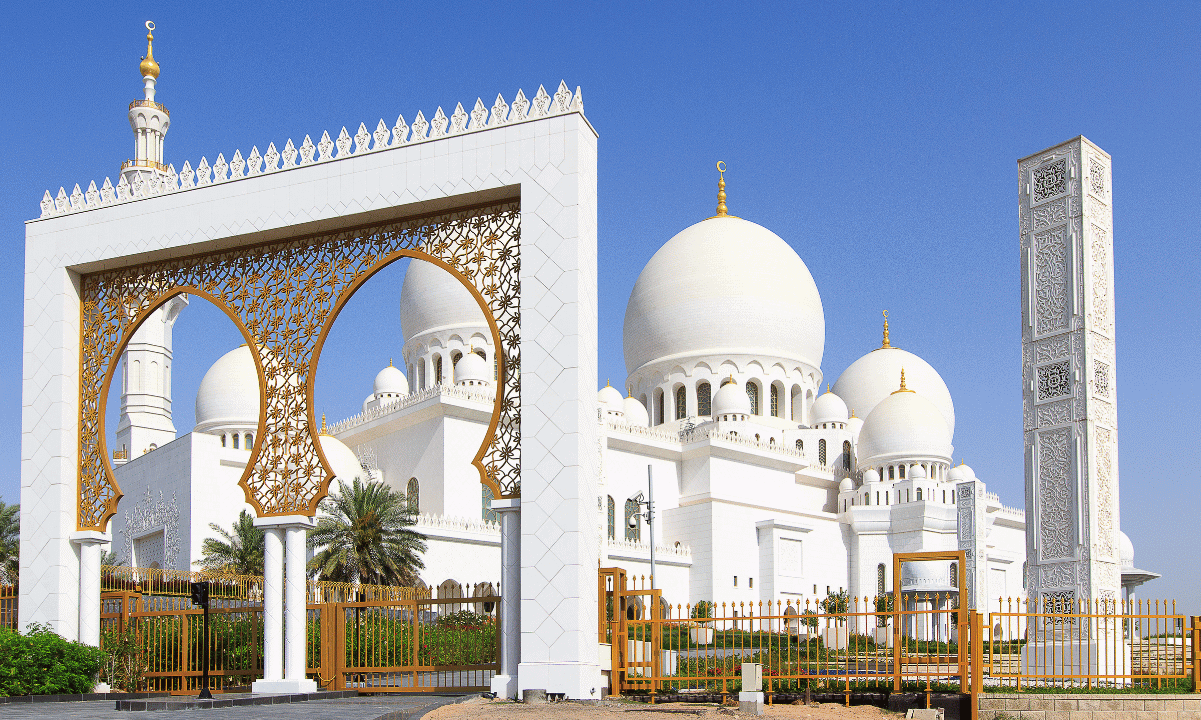

It’s no information that CZ established his major residence in Dubai in 2021, because of the metropolis’s pro-crypto and forward-thinking surroundings. His presence within the metropolis and affect on distinguished figures have actually affected their stance on Bitcoin and the crypto trade as an entire.

Through the years, the UAE has elevated its Bitcoin publicity via mining and the acquisition of exchange-traded funds (ETFs). By 2022, Abu Dhabi’s royal household had ventured into Bitcoin mining via its affiliated agency, Citadel Mining. The royal household, via Citadel, established large-scale mining operations on AI Reem Island and has since amassed over $450 million in bitcoin.

Earlier at present, the market intelligence platform, Arkham, revealed that the UAE has mined $453.6 BTC. On-chain information reveals the entity has been holding the vast majority of BTC produced, with its final outflow recorded 4 months in the past. The royal household is now $344 million in revenue on their BTC, minus vitality prices.

UAE’s Bitcoin Publicity Crosses $1B

Moreover the Bitcoin mining ventures, two main Abu Dhabi sovereign wealth entities, particularly Mubadala Funding Firm and Al Warda Investments, have bought thousands and thousands of shares in spot Bitcoin ETFs. By the tip of 2025, the businesses had amassed greater than $1 billion in mixed holdings of BlackRock’s iShares Bitcoin Belief (IBIT).

Separate 13F filings with the U.S. Securities and Alternate Fee (SEC) revealed that by the tip of final 12 months, Mubadala held over 12.7 million shares in IBIT. However, Al Warda owned at the very least 8.21 million shares of the identical product. The shares had been price $631 million and $408 million, respectively.

Though the worth of the ETF shares has plummeted alongside bitcoin’s value, the mixed Bitcoin publicity for the UAE stays nicely above $1 billion. With the federal government recognizing BTC as a retailer of worth, the cryptocurrency is more likely to be handled as a everlasting reserve asset going ahead.

The publish Binance’s CZ Says He Performed a ‘Tiny’ Half in UAE’s Embrace of Bitcoin as Retailer of Worth appeared first on CryptoPotato.