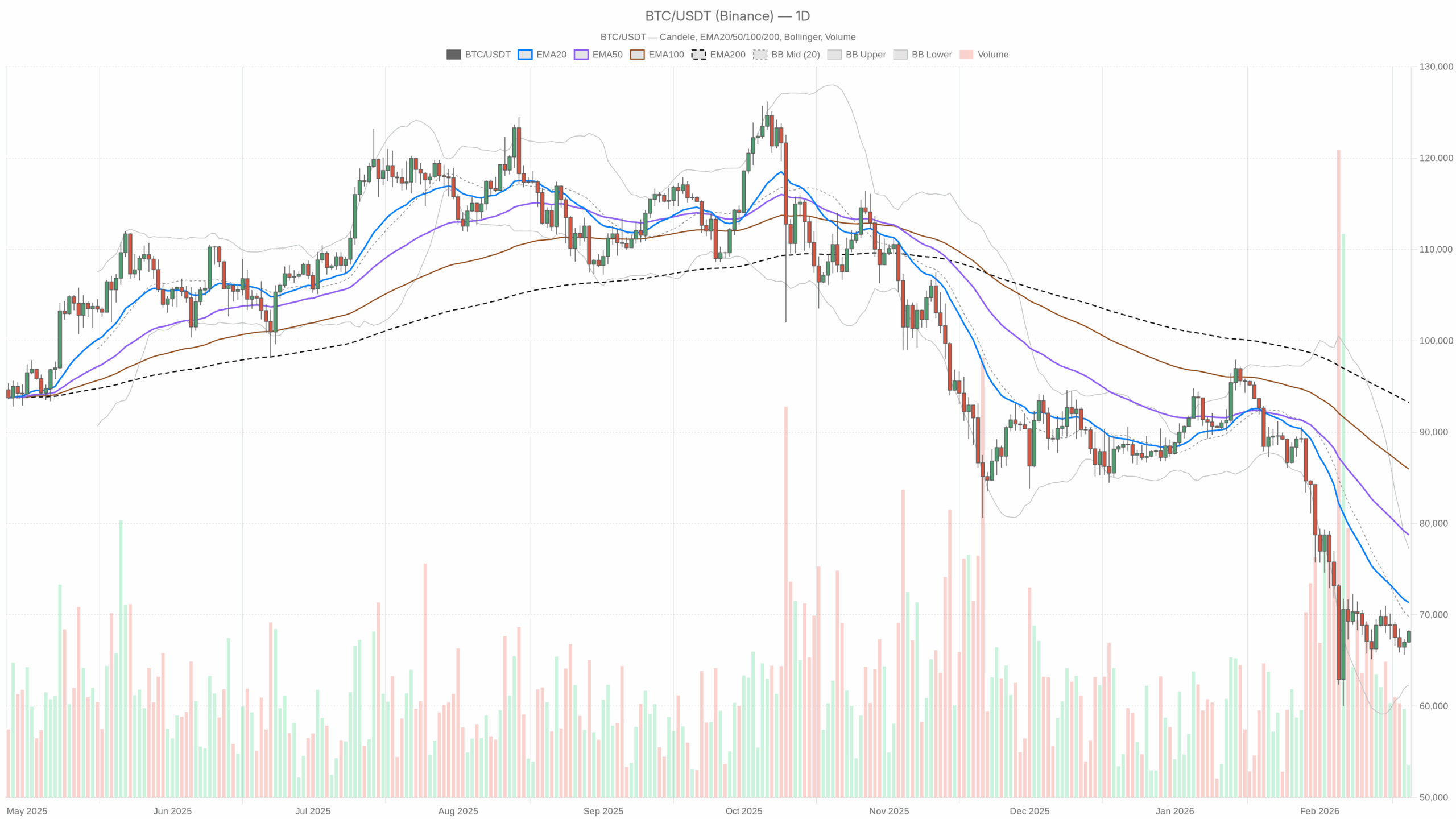

Merchants are navigating a tactically bullish tape towards a structurally weak backdrop, as Bitcoin value at the moment makes an attempt a restoration inside a still-damaged broader development.

Core Bias by Timeframe

Every day (D1) – Principal State of affairs: Bearish

The day by day development is clearly down. Worth is buying and selling beneath all key EMAs, MACD is adverse, and RSI sits within the low 40s. That retains the principle situation bearish till confirmed in any other case.

1H – Countertrend Restoration

On the hourly chart, Bitcoin has pushed again above short-term EMAs with a powerful, overbought RSI. That may be a basic recipe for a countertrend rally inside a bigger down transfer – robust sufficient to harm late shorts, however not but robust sufficient to flip the macro development.

15m – Native Upswing, Momentum Fading

The 15-minute construction is bullish however already dropping momentum. That is extra execution context than a sign: the short-term push is maturing proper at resistance bands.

Every day Chart (D1): Construction Nonetheless Factors Down

Development & EMAs (Every day)

Information:

Worth: $68,180.76

EMA 20: $71,329.06

EMA 50: $78,730.88

EMA 200: $93,253.97

Regime flag: bearish

Studying: Worth is beneath the 20, 50, and 200-day EMAs, and the shorter EMAs (20/50) are effectively below the 200. That may be a textbook bearish alignment and alerts a dominant downtrend on the day by day. The space to the 200-day additionally tells you the way far we have now already slid from the prior cycle highs. This isn’t only a shallow pullback anymore; it’s a correct development deterioration.

In sensible phrases, rallies towards the 20-day EMA round $71k are, for now, extra prone to be offered than chased until we see a clear reclaim and maintain above it.

RSI (Every day)

RSI 14 (D1): 37.76

That is weak however not but oversold. The market is leaning bearish, nevertheless it has not washed out. There may be nonetheless room for an additional leg decrease earlier than the form of panic-driven capitulation that always marks sturdy bottoms. For swing merchants, this implies the draw back just isn’t exhausted but, even when short-term bounces can happen.

MACD (Every day)

MACD line: -4,261.67

Sign line: -4,782.75

Histogram: +521.08

MACD is effectively beneath zero, confirming a bearish momentum backdrop. Nonetheless, the road is barely above the sign (constructive histogram), which alerts that the draw back momentum is beginning to cool off. In plain language: the downtrend continues to be the principle story, however the aggressive part of promoting has eased. That’s precisely the form of backdrop the place bear market rallies could be sharp and misleading.

Bollinger Bands (Every day)

Center band (20-day foundation): $69,781.88

Higher band: $77,228.43

Decrease band: $62,335.34

Shut: $68,180.76

Worth is hovering just under the center band and effectively above the decrease band. Now we have bounced off the lower-volatility edge and are actually making an attempt to stabilize within the decrease half of the vary. It’s a consolidation inside a downtrend moderately than a clear development reversal. A decisive shut again above the center band (~$69.8k) could be an early signal that the market is making an attempt to mean-revert larger towards the higher band within the coming periods.

ATR (Every day)

ATR 14 (D1): 2,858.27

Every day volatility is elevated however not excessive by Bitcoin requirements. A typical day by day swing is roughly $2.8k, which implies assessments of close by ranges could be hit or missed in a short time. Place sizing and leverage must respect the truth that a 4–5% day is regular right here, not an outlier.

Every day Pivot Ranges

Pivot Level (PP): $67,816.19

Resistance 1 (R1): $68,682.96

Help 1 (S1): $67,313.98

Shut: $68,180.76

BTC is buying and selling above the day by day pivot and nearer to R1 than S1. Intraday consumers have the higher hand versus at the moment’s reference ranges, however the upside is bumping into the primary resistance band. The pivot construction matches the story: a bounce inside a still-bearish larger timeframe.

Hourly Chart (H1): Countertrend Push, Quick Squeeze Potential

Development & EMAs (H1)

Worth: $68,175

EMA 20: $67,439.14

EMA 50: $67,287.52

EMA 200: $67,937.79

Regime flag: impartial

On the hourly, value has reclaimed all the important thing EMAs. The 20 and 50 are actually stacked below value and are near crossing above the 200 once more. That’s what you normally see in a short-term restoration part after an aggressive drop. It doesn’t overturn the day by day downtrend, nevertheless it does let you know that intraday sellers are dropping management.

RSI (H1)

RSI 14 (H1): 69.94

Hourly RSI is flirting with overbought. The transfer up has been robust and quick, which inserts the concept of a short-covering rally. Close to-term, this makes chasing longs much less enticing until you see continued power. It additionally means any pullback from right here might be sharp as quick longs and late shorts rebalance.

MACD (H1)

MACD line: 316.64

Sign line: 195.69

Histogram: 120.95

MACD is above zero and widening away from the sign line. Momentum on this timeframe is clearly bullish. Consumers have taken intraday management and are nonetheless urgent, which helps the concept that dips on very quick timeframes could be purchased tactically, so long as the hourly construction holds above the EMAs.

Bollinger Bands (H1)

Center band: $67,262.26

Higher band: $68,356.08

Decrease band: $66,168.44

Shut: $68,175

Worth is using the higher band on the hourly. That’s what you see in a powerful short-term impulse. So long as BTC hugs or stays close to the higher band, intraday bulls are in management. Nonetheless, if value begins to slide again towards the center band, it might sign that this thrust is cooling off and the market is transferring again into consolidation mode.

ATR (H1)

ATR 14 (H1): 306.9

Common hourly swings are about $300. That’s sufficient noise to run by means of tight stops repeatedly. For brief-term methods, entries too near apparent intraday ranges can simply be depraved out.

Hourly Pivot Ranges

Pivot Level (PP): $68,198.81

R1: $68,294.58

S1: $68,079.23

Shut: $68,175

Worth is pinned nearly precisely on the hourly pivot zone and just under R1. That reveals a tug-of-war proper at a key intraday choice space. A clear break and maintain above R1 would open the door towards larger intraday resistance. Repeated failures or wicks above R1 that shut again below PP would trace that the countertrend transfer is stalling.

15-Minute Chart (M15): Execution Context, Not a New Development

Development & EMAs (M15)

Worth: $68,175

EMA 20: $67,887.16

EMA 50: $67,549.27

EMA 200: $67,228.78

Regime flag: bullish

The 15-minute chart is in a clear native uptrend. Worth sits above all short-term EMAs, with a correct bullish stack (20 > 50 > 200). For execution, this implies intraday pullbacks towards the 20/50 EMAs are the primary zones the place short-term merchants are prone to probe longs, in keeping with the hourly push.

RSI (M15)

RSI 14 (M15): 66.68

RSI on this timeframe is elevated however not excessive. The instant momentum continues to be up, however the straightforward a part of the transfer is probably going behind us. Quick-term, this favors scaling into power with warning moderately than initiating contemporary, aggressive longs at market.

MACD (M15)

MACD line: 205.62

Sign line: 190.08

Histogram: 15.54

MACD is constructive however the histogram has shrunk. The development is up, however the momentum burst is fading. On this timeframe, that always precedes both a sideways consolidation or a shallow pullback earlier than the market decides on the subsequent leg.

Bollinger Bands (M15)

Center band: $67,901.91

Higher band: $68,280.81

Decrease band: $67,523.01

Shut: $68,175

Worth is pressed towards the higher band once more. The short-term push is prolonged, so chasing up right here carries the next threat of shopping for into an area high. For scalpers, it’s a spot to tighten threat, not chill out it.

ATR (M15)

ATR 14 (M15): 145.52

Common 15-minute ranges are about $145. Micro-level stops inside that noise band can be examined regularly. It is a uneven surroundings for very tight threat parameters.

15-Minute Pivot Ranges

(Similar intraday pivot set because the hourly, given the supplied information.)

PP: $68,198.81

R1: $68,294.58

S1: $68,079.23

On the 15-minute, value is oscillating proper across the pivot. This reinforces the concept that the instant battle is going on right here; it’s the intraday line between continuation larger and a fade again into the prior vary.

Macro Context: Concern Is Excessive, Bitcoin Nonetheless Dominates

Bitcoin is buying and selling round $68,175 towards USDT, caught within the decrease half of its latest vary however exhibiting a pointy intraday rebound. The larger image continues to be a downtrend on the day by day chart, whereas intraday timeframes are attempting to squeeze larger. In different phrases, the market is tactically bid, however structurally broken.

This second issues as a result of positioning is extraordinarily cautious. The crypto worry & greed index is printing 7 – Excessive Concern whereas BTC dominance sits close to 56.6%. Capital is hiding in Bitcoin and stables, and but value is urgent again towards short-term resistance. That mixture of fearful sentiment, heavy BTC dominance, and a short-term push larger is fertile floor for violent short-covering rallies inside a broader bearish regime.

The broader crypto market cap is about $2.41T, up roughly 1.45% over 24 hours, whereas BTC dominance stands close to 56.65%. That tells us two issues:

First, capital is flowing into crypto cautiously, not in a euphoric rush. Second, the stream is concentrated in Bitcoin and stables, not in high-beta altcoins. That is basic defensive risk-on: members need publicity to the house, however they aren’t able to go far out the chance curve.

The Excessive Concern sentiment studying (7/100) traces up effectively with the technicals: a broken larger timeframe development, however with sufficient pessimism baked in that sharp squeezes are completely on the desk. Fearful markets don’t transfer in straight traces; they spike each methods as positioning will get cleaned up.

State of affairs Map: Bullish vs. Bearish Paths for Bitcoin

Bullish State of affairs (Countertrend Rally Grows Legs)

For the bullish aspect to take management past a easy quick squeeze, we would want:

1. Every day reclaim of the 20-day EMA (~$71,300) with an in depth above it.

2. Hourly construction holding above the 200 EMA (~$67,900), turning pullbacks into larger lows as a substitute of decrease highs.

3. RSI on the day by day pushing again towards the mid-40s/50s with out instant rejection, confirming that sellers are dropping dominance.

If these circumstances play out, value may rotate towards the day by day center Bollinger band and higher band, that’s roughly the $70k–$77k zone over the subsequent leg. That will nonetheless be a transfer inside a broader corrective construction, however it might be significant sufficient to punish late shorts and stabilize sentiment out of Excessive Concern.

What invalidates the bullish situation?

A decisive rejection beneath the day by day pivot and lack of the hourly 200 EMA, for instance a clear break again below $67k that sticks, would present the bounce was only a one-off squeeze. If that occurs whereas day by day RSI stays sub-40, the trail of least resistance opens once more towards the decrease Bollinger band close to $62k.

Bearish State of affairs (Downtrend Resumes)

The principle day by day bias continues to be bearish, so this stays the default till flipped. Within the bearish continuation case:

1. Worth fails to shut above the $69.5k–$71k band (day by day mid-band and 20 EMA).

2. Intraday momentum on H1 and M15 rolls over from overbought ranges, with hourly RSI dropping again by means of 50 and MACD crossing down.

3. BTC loses the $67k space and begins closing day by day candles again towards the decrease band.

In that surroundings, the market could be concentrating on a retest of the $62k–$63k area (day by day decrease Bollinger band) as the subsequent logical demand zone. With day by day ATR round $2.8k, that transfer may occur in solely a few robust periods as soon as acceleration resumes.

What invalidates the bearish situation?

A sustained day by day shut and follow-through above the 20-day EMA (~$71.3k), accompanied by a transparent MACD upturn towards the zero line, would undermine the bear case. At that time, the downtrend could be transitioning into at the least a medium-term vary or early uptrend, and utilizing rallies as quick entries would change into far more harmful.

The right way to Suppose About Positioning Proper Now

From a buying and selling perspective, the important thing stress is easy:

– Every day: Downtrend, bearish regime, sentiment in excessive worry.

– Intraday (H1/M15): Robust countertrend bounce, overbought short-term, momentum nonetheless pointing up.

That blend normally favors tactical, short-term methods over large directional bets. Swing merchants in search of larger conviction will seemingly wish to see both:

– A clear rejection of this bounce from the $69k–$71k area (for trend-following shorts), or

– A agency reclaim and maintain above the 20-day EMA (for the primary medium-term lengthy bias shortly).

Volatility, as measured by ATR throughout timeframes, is excessive sufficient that intraday mis-timing could be costly, particularly with leverage. The present tape rewards persistence and clear ranges moderately than fixed response to each tick. Till the day by day chart proves in any other case, Bitcoin value at the moment is finest seen as a countertrend restoration inside a bigger corrective part, not but a contemporary bull leg.