Ripple has elevated the variety of its dollar-pegged stablecoin RLUSD tokens in circulation by 20 million, as reported by Ripple Stablecoin Tracker, a transfer that barely strengthens on-chain liquidity as competitors within the regulated stablecoin market will get extra intense.

In accordance with the Etherscan, 20,000,000 RLUSD had been minted on the RLUSD Treasury and transferred through a confirmed Ethereum transaction on Feb. 19, 2026. The switch was made by a pockets labeled “Ripple: Deployer” and was finalized in seconds.

Ripple Exec Studies Breakthrough in DC Crypto Assembly

Crypto Market Evaluate: XRP Faces 85% Quantity Reset, Shiba inu (SHIB) Bull Run Probabilities Are Slim, Analyzing Dogecoin’s Risk to Return to $0.10

How newest $20 million mint impacts RLUSD’s market place

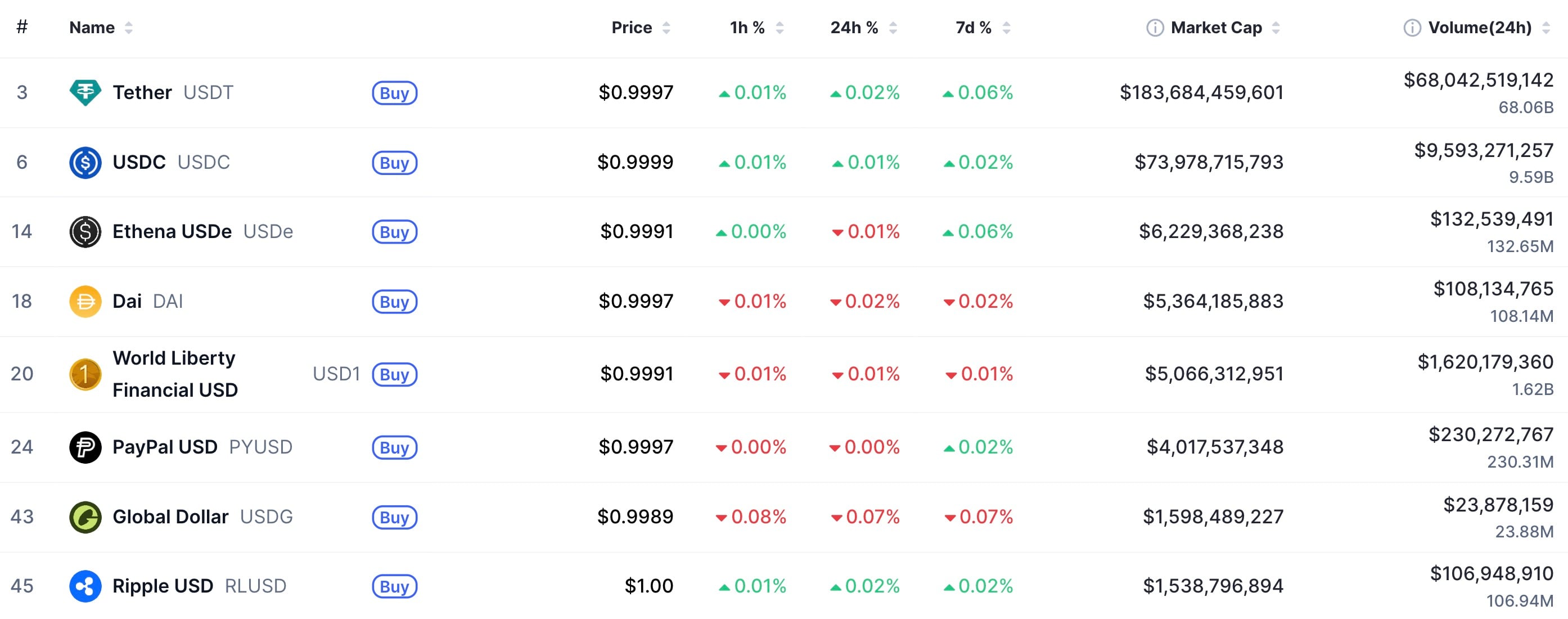

After the discharge, RLUSD’s provide is 1.53 billion tokens, placing it in the midst of the pack for greenback stablecoins by way of market capitalization, in response to CoinMarketCap. For comparability, Tether’s USDT remains to be above $183 billion in market cap, whereas USDC is over $74 billion, exhibiting the massive distinction RLUSD remains to be making an attempt to shut.

RLUSD has been slowly turning into part of Ripple’s larger plan for the ecosystem, which incorporates issues like custody infrastructure, RWA tokenization for establishments and use instances for cross-border settlement. Will increase in provide normally point out new demand from establishments, rebalancing of the treasury or liquidity provisions for exchanges and DeFi platforms.

Market information reveals RLUSD buying and selling near its $1 peg, with each day quantity above $100 million, suggesting lively circulation slightly than dormant treasury inventory. Stablecoin issuance on this vary just isn’t sufficiently big to trigger main disruptions to the market, however it’s important for RLUSD’s personal liquidity profile.

For starters, a $20 million enlargement will increase the obtainable depth for funds flows, change pairs and potential DeFi integrations on Ethereum. Whether or not or not this results in long-term use relies upon much less on the full quantity of RLUSD created and extra on whether or not counterparties use it to settle, collateralize and handle their treasury operations within the coming months.