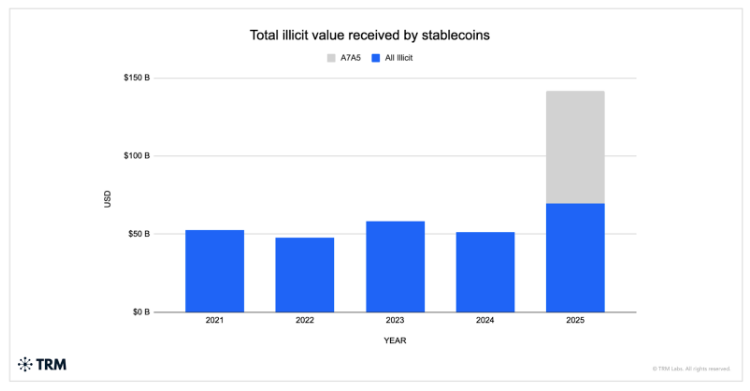

In 2025, about $141 billion in stablecoins reportedly ended up within the fingers of illicit actors. A lot of this exercise was funneled via just a few networks that favored stablecoins for his or her predictable worth and fast transfers.

A lot of that motion is tied to a small variety of networks that use stablecoins for his or her pace and worth stability. That doesn’t imply widespread legal use throughout all stablecoins. It factors to concentrated channels the place these tokens meet a particular want: shifting worth reliably outdoors common banking rails.

Sanctions Linked Networks Drive The Bulk Of Flows

In accordance To TRM Labs, sanctions-related flows made up roughly 86% of detected illicit crypto transfers final yr. Round $72 billion of the stablecoin complete traced again to a ruble-pegged token linked to Russian networks.

These networks aren’t remoted. Studies observe overlaps with entities tied to China, Iran, North Korea, and Venezuela, which reveals how stablecoins can act as bridges between totally different sanctioned programs.

The mechanics are easy: worth stability issues if you want predictable settlement and low volatility threat. Stablecoins supply that.

Assure Marketplaces And Human Trafficking Rely On Stablecoins

Quantity on sure marketplaces surged, principally in stablecoins. Some escrow and assure websites — which act like middlemen for high-value transfers — noticed tens of billions of {dollars} stream via their programs.

Studies observe these venues are virtually completely stablecoin-denominated, which raises purple flags about their position in shifting funds tied to illicit commerce. Chainalysis and others have additionally pointed to sharp will increase in flows to networks linked to human trafficking and escort companies, and people operations leaned closely on stablecoins for funds.

In these circumstances, cost certainty and liquidity matter extra to the consumers and sellers than the prospect of good points.

Totally different Varieties Of Crime Use Totally different Paths

Scams, ransomware, and thefts usually begin in Bitcoin or Ether after which shift into stablecoins later within the laundering chain. That sample is widespread as a result of attackers need an asset that holds worth whereas they transfer it via fewer fingers.

Market Cap

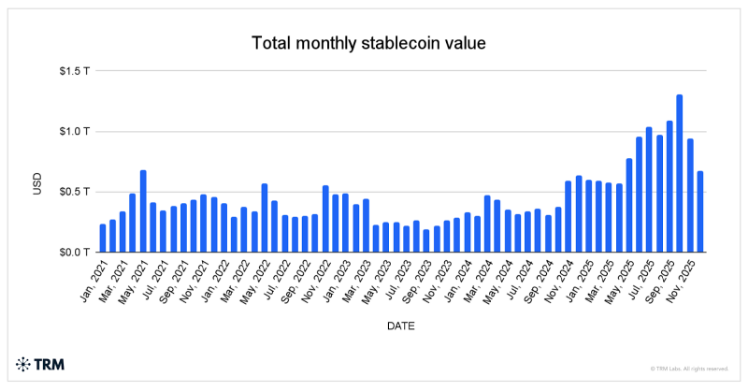

In the meantime, the worldwide stablecoin market has grown right into a multi‑hundred‑billion‑greenback sector, with complete market capitalization topping roughly $270 billion in early 2026.

In line with knowledge monitoring web site Stablecoin.com, the mixed worth of all main stablecoins constantly sits above the mid‑tons of of billions mark, with fiat‑backed cash accounting for many of that complete.

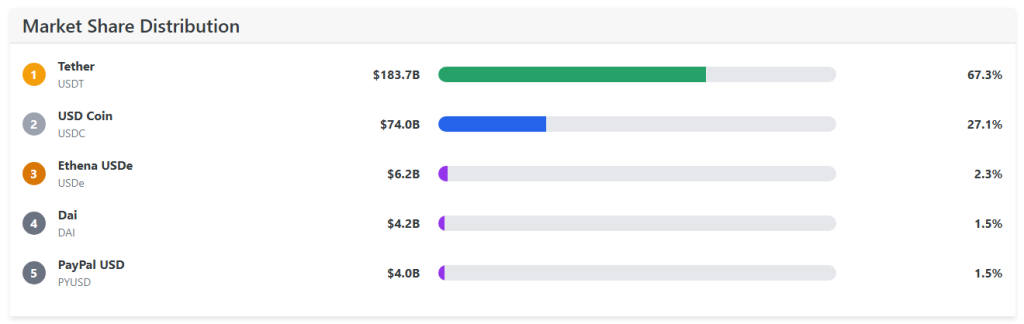

Two issuers dominate the sector. Tether’s USDT leads by a large margin, with a market cap usually reported at round $180 billion or extra, and representing greater than two‑thirds of the entire stablecoin market.

Supply: Stablecoin.com

Circle’s USD Coin (USDC) sits in second place with a market cap usually above $70 billion, collectively holding over 90% of stablecoin capitalization when mixed with USDT.

Smaller stablecoins like Ethena USDe, DAI, and PayPal USD make up a a lot smaller portion of the market however sign ongoing diversification amongst suppliers, the info tracker mentioned.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.