Supreme Court docket voids Trump tariffs as Bitcoin jumps above $67,000, with crypto markets reacting to shifting commerce and coverage dangers.

The U.S. Supreme Court docket has dominated that President Trump’s international tariffs are illegal, and the choice is creating new debate throughout monetary and crypto markets.

The ruling removes a commerce coverage that formed many commerce discussions, and merchants now watch how markets reply.

Court docket Rejects Use of Emergency Powers

The Supreme Court docket dominated 6 to three that the president lacked authority to impose the worldwide tariffs beneath the Worldwide Emergency Financial Powers Act.

The justices stated the legislation doesn’t give the president the ability to levy broad tariffs throughout peacetime. The choice ends a significant White Home commerce measure that had remained energetic throughout lengthy court docket challenges.

The tariffs coated imports from Canada, China, Mexico, and most different international locations.

The White Home projected that the tariffs would elevate as a lot as $1.5 trillion over ten years.

They had been introduced after nationwide emergency declarations tied to fentanyl and commerce deficits, and the coverage stayed in impact whereas the case moved by means of decrease courts.

SUPREME COURT STRIKES DOWN TRUMP’S GLOBAL TARIFFS

The Supreme Court docket dominated Friday that President Trump’s international tariffs are unlawful, rejecting his use of emergency powers to impose commerce duties.

• The tariffs, protecting imports from Canada, China, Mexico, and almost all… pic.twitter.com/Qu7EVbBCch

— *Walter Bloomberg (@DeItaone) February 20, 2026

A number of lawsuits argued that the tariffs acted as unauthorized taxes on American patrons.

Decrease courts agreed with lots of these claims, and the Supreme Court docket ruling brings the authorized course of to an finish.

The court docket choice now leaves federal companies to handle the following steps round commerce enforcement and tariff procedures.

Market Focus Turns to Crypto and Foreign money Circumstances

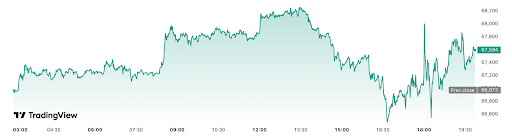

Bitcoin moved greater quickly after the ruling and traded above the $67,000 degree throughout the afternoon session.

Merchants seen the transfer as a response to the top of a significant commerce coverage that formed financial uncertainty. Market information confirmed robust exercise on main exchanges because the information unfold.

Bitcoin had traded close to $66,800 earlier within the day after new inflation numbers had been launched.

The PCE report got here in at 2.9% yr over yr, and the quantity created early market stress.

The ruling shifted the tone, and Bitcoin moved again above a key psychological degree throughout the session.

Different main cryptocurrencies additionally moved greater as merchants reacted to the ruling. Market platforms reported added quantity, and several other property rose throughout the identical interval.

The broader crypto market confirmed a gentle response as merchants monitored new statements across the court docket choice.

Associated Studying: Trump’s Crypto Advisor Warns: Cross Invoice Now

Coverage Questions Proceed After the Court docket Ruling

The Supreme Court docket didn’t rule on tariff refunds, and questions stay about whether or not the U.S. could must return as much as $150 billion.

A number of merchants and analysts now watch for brand spanking new steering from federal companies because the refund problem stays open.

Selections about refunds could form future debates round commerce and foreign money actions.

VanEck’s Matthew Sigel stated on X that the ruling could cut back tariff income and will result in extra money printing.

He added that Bitcoin and gold could draw extra curiosity as merchants search for hedges. His remark drew large consideration as a result of it got here throughout a interval of stronger crypto motion.

Bitcoin rallies as Trump tariffs struck down by US Supreme Court docket

Within the absence of tariff revenues, cash printing and debasement will speed up.

— matthew sigel, recovering CFA (@matthew_sigel) February 20, 2026

The tip of the tariffs brings new consideration to U.S. commerce coverage, and merchants proceed to trace market exercise throughout crypto and conventional property.

Market platforms anticipate extra reactions as federal our bodies launch additional updates within the coming days.