- Cardano’s ADA fell 58.6% in This fall 2025, with market cap dropping to $12.2 billion and community exercise declining sharply.

- Regardless of fewer energetic addresses, remaining customers grew to become extra engaged, and governance reforms strengthened structural stability.

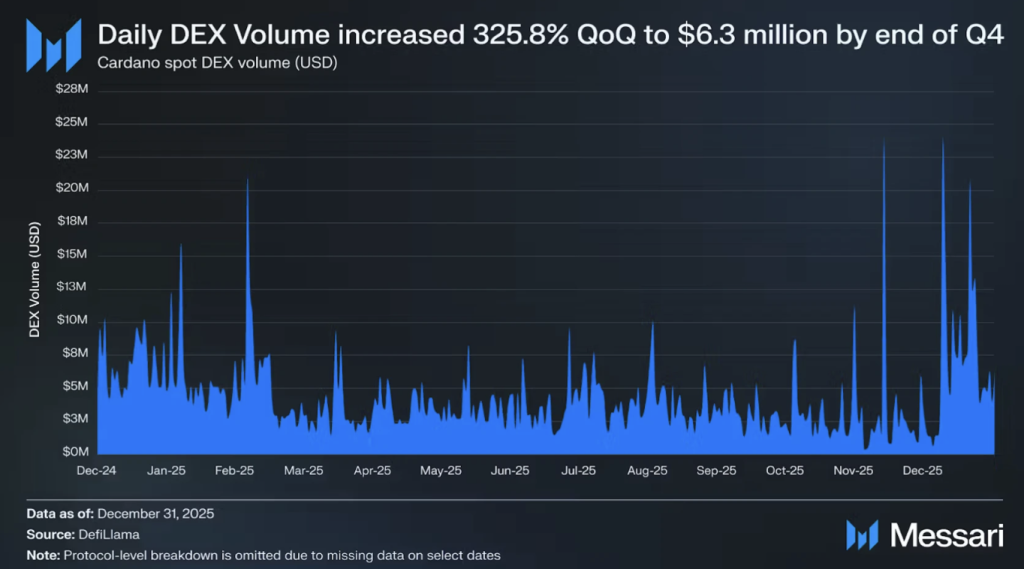

- DEX quantity and NFT buying and selling confirmed resilience, whilst DeFi TVL and staking worth declined alongside worth.

Cardano had a tough fourth quarter. There’s no elegant option to put it. In line with Messari’s February 20 report, ADA dropped 58.6% quarter-on-quarter, sliding to $0.33 and dragging its circulating market cap down from $29.5 billion to $12.2 billion. That decline pushed ADA to eleventh place globally — a noticeable shift for a community that after hovered comfortably within the high tier.

However worth alone doesn’t inform the total story. It hardly ever does.

Fewer Customers, However Extra Lively Ones

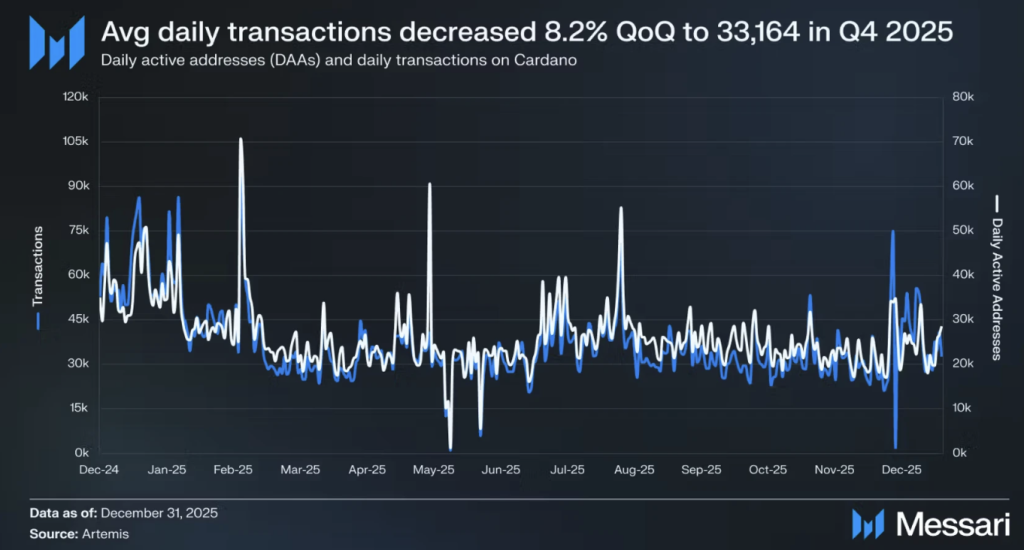

Community exercise cooled alongside the worth. Common each day transactions fell 27.4% to 25,970, whereas energetic addresses dropped almost 30% to 18,641. On the floor, that implies shrinking participation.

But there’s a twist.

Common transactions per energetic tackle truly climbed 27% to 1.70. So whereas fewer customers have been interacting with the community, those who remained have been extra engaged. It’s a refined however vital element — the ecosystem could also be contracting, nevertheless it’s not essentially hollowing out.

Staking additionally softened. Whole ADA staked declined 2% quarter-over-quarter to 21.4 billion ADA, bringing the staking price right down to 57.80%. In greenback phrases, the worth of staked ADA fell considerably because of worth depreciation, touchdown close to $7.1 billion. Community charges adopted the identical sample, dropping 38% in USD phrases to $524,202 and almost 29% in ADA to 742,242 ADA. Cheaper price, decrease exercise, thinner charge technology. It tracks.

Governance Reforms Add Structural Stability

Amid the worth turbulence, Cardano quietly restructured elements of its governance framework.

After the Cardano Atlantic Council resigned from the Constitutional Committee, a swift election restored the committee to its full seven-member composition. Cardano Curia secured the seat by delegated ADA voting, whereas Christina Gianelloni, who positioned second, was added as an alternate to strengthen continuity and cut back governance friction transferring ahead.

The neighborhood additionally prolonged the Internet Change Restrict (NCL) for treasury withdrawals by eight epochs, pushing the deadline to February 8, 2026. The 350 million ADA cap stays intact, stopping what some referred to as a possible “spending cliff.” This transfer permits growth funding to proceed with out abrupt treasury drains.

Apparently, Cardano’s treasury steadiness grew 4.46% quarter-over-quarter to 1.67 billion ADA. Nevertheless, as a result of ADA’s worth fell sharply, the treasury’s USD worth dropped 53.7% to roughly $585.9 million. Identical tokens. Totally different valuation. Markets will be unforgiving like that.

Combined Indicators Throughout the Ecosystem

Regardless of the broader contraction, elements of the Cardano ecosystem confirmed resilience. Common each day DEX buying and selling quantity truly elevated 17.3% to $4.44 million. That’s not explosive, nevertheless it’s significant in 1 / 4 outlined by retracement.

Minswap maintained dominance, capturing 72.4% of whole swap quantity. Its KuCoin itemizing and buyback-and-burn technique seemingly contributed to that edge. In the meantime, WingRiders and Danogo posted beneficial properties in buying and selling exercise, whereas older DEX platforms like MuesliSwap and Splash noticed declines.

On the DeFi facet, whole worth locked fell 48.1% to $177.3 million — a sharper drop than the broader market’s 25.2% decline. Nonetheless, Minswap held a 27% share of TVL, reinforcing its place because the community’s DeFi anchor.

NFTs supplied a uncommon vibrant spot. Common each day NFT gross sales rose 3.6% to 276, whereas buying and selling quantity surged 133.4% to $612,454. The standout second was the $44.8 million sale of the “GoodSamaritan” NFT sequence — a headline-grabbing transaction that briefly shifted sentiment. Stablecoins remained regular, with USDM at $14.7 million and USDA at $11.7 million, suggesting at the least some capital stability throughout the ecosystem.

In brief, Cardano’s This fall was undeniably painful from a worth perspective. However beneath the floor, engagement pockets stay energetic, governance has tightened, and particular verticals like DEX buying and selling and NFTs are nonetheless discovering traction.

Markets cool. Networks evolve. The true query is whether or not these structural changes will matter when sentiment turns once more.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.