Technique CEO Phong Le is asking for a rethink of how banks are required to capital-charge bitcoin publicity underneath Basel-style guidelines, arguing that present risk-weighting remedy materially shapes whether or not regulated establishments can have interaction with digital property in any respect.

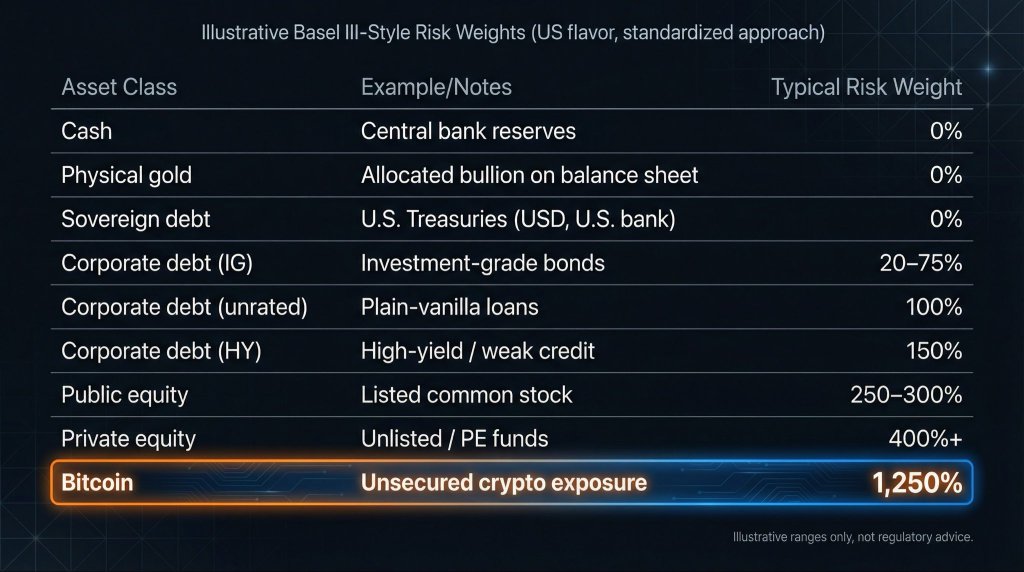

The catalyst was a chart shared on X that labels bitcoin “unsecured crypto publicity” with a “typical danger weight” of 1,250% underneath an “Illustrative Basel III-Model” standardized strategy, alongside 0% weights for money, bodily gold, and US Treasuries.

A Capital Penalty For Financial institution Bitcoin Publicity

Le framed the problem as structural reasonably than political, pointing to the best way international capital guidelines stream into nationwide financial institution regulation. “The Basel Accords set international financial institution capital requirements and risk-weighting guidelines for property. These frameworks materially form how banks have interaction with digital property, together with bitcoin,” he wrote. “They’re developed by the Basel Committee of central banks and regulators throughout 28 jurisdictions — the US is only one.”

He tied that on to Washington’s acknowledged ambitions for crypto management. “If the US desires to be the Crypto Capital of the World, our implementation of Basel capital remedy deserves cautious evaluation,” Le mentioned.

Jeff Walton, who posted the picture Le quoted, summarized the distinction in blunt numbers: “Basel III Danger weights for property: Gold: 0% Public fairness: 300% Bitcoin: 1,250%,” including that if the US desires to be a “crypto capitol,” “the banking laws want to vary,” as a result of “Danger is mispriced.”

The chart itself presents a ladder of “typical” danger weights throughout asset lessons. Money and central financial institution reserves sit at 0%, bodily gold at 0%, and sovereign debt comparable to US Treasuries (USD, U.S. financial institution) additionally at 0%. Funding-grade company debt is proven in a 20–75% vary, unrated company debt at 100%, high-yield at 150%, public fairness at 250–300%, and personal fairness at 400%+. Bitcoin is ready aside at 1,250%.

Conner Brown, Head of Technique on the Bitcoin Coverage Institute, argued that the sensible impact is to make financial institution intermediation of bitcoin prohibitively costly. “It’s onerous to overstate how dangerous of a coverage error that is,” he wrote. “Banks are required to put aside capital primarily based on how dangerous regulators suppose an asset is. The upper the ‘danger weight,’ the dearer it’s for a financial institution to carry.”

Brown described the 1,250% determine as translating right into a one-for-one capital requirement relative to publicity. In his phrases, bitcoin’s remedy “means banks should maintain $1 in capital for each $1 of Bitcoin publicity,” whereas gold is handled “the identical as money” with “primarily no capital price.”

He additionally pushed again on the premise that bitcoin must be penalized relative to legacy property, pointing to operational traits he sees as favorable for danger administration and market functioning, together with steady buying and selling, quick auditability of holdings, mounted provide, speedy international settlement, and clear pricing. The consequence, he argued, is that regulators have successfully discouraged banks from providing custody and associated companies that corporates and people would possibly want contained in the regulated perimeter.

Brown mentioned the knock-on results lengthen past financial institution steadiness sheets to competitiveness. He argued the framework diverts exercise towards “non-bank entities and offshore jurisdictions,” which he characterised as carrying increased dangers, and warned that failing to regulate the strategy might depart US establishments at an obstacle globally.

At press time, Bitcoin traded at $67,857.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.