- U.S. spot Bitcoin and Ethereum ETFs noticed heavy outflows, with BlackRock’s IBIT and ETHA main single-day withdrawals.

- Offshore whale focus in IBIT provides structural threat and will increase short-term volatility.

- Oversold technicals trace at a doable bounce, however with out a new bullish catalyst, institutional demand stays weak.

Institutional temper turned sharply unfavorable this week, and the crypto market didn’t take it flippantly. Capital rotated out of main digital asset merchandise at pace, dragging sentiment down with it. Bitcoin and Ethereum spot ETFs, as soon as seen as regular pillars of demand, at the moment are reporting sizable outflows — and BlackRock’s flagship funds are proper on the middle of the storm.

Bitcoin ETFs Face Heavy Withdrawals

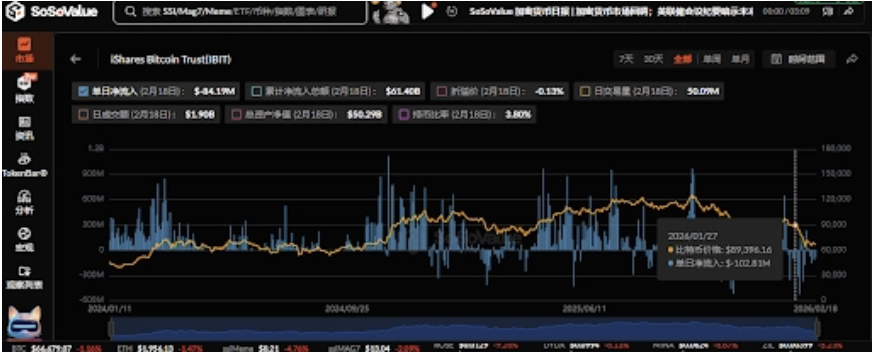

U.S. spot Bitcoin ETFs recorded a mixed web outflow of $133 million, a quantity that landed tougher than many anticipated. BlackRock’s IBIT alone noticed $84.19 million stroll out the door in a single session, marking the biggest each day withdrawal amongst friends. That sort of transfer doesn’t occur quietly, it shifts tone throughout your entire market.

Buying and selling quantity has additionally cooled. On Tuesday alone, U.S. spot Bitcoin ETFs noticed $104.9 million in web outflows, whereas complete exercise slipped to only above $3 billion — noticeably softer than latest averages. Analysts level on the market’s no recent bullish catalyst in sight, and with out a new narrative to seize onto, institutional capital seems content material to sit down on the sidelines… or just exit.

Offshore Whales Add a New Layer of Threat

Current 13F filings added an sudden twist. Laurore Ltd, a comparatively low-profile Hong Kong-based entity, emerged as a significant holder of BlackRock’s IBIT, changing into a big participant throughout the fund’s inner liquidity construction. That sort of possession focus can introduce fragility, particularly when giant holders shift positions rapidly.

Whereas BlackRock stays the dominant issuer, it’s these concentrated non-public gamers who can affect short-term value motion extra aggressively. Offshore whales don’t sometimes function with retail conviction; they handle entries and exits strategically, usually specializing in liquidity home windows slightly than long-term narratives. The result’s a market that feels extra unstable, the place value swings aren’t simply emotional — they’re structural.

BlackRock Caught Between Redemptions and Dip Consumers

BlackRock now finds itself in a fragile balancing act. On one aspect, large-scale redemptions stress the ETF construction. On the opposite, on-chain knowledge exhibits whales accumulating Bitcoin at decrease ranges, shopping for into weak spot with quiet confidence.

This push and pull creates an odd sort of value discovery surroundings. IBIT’s technicals replicate the pressure — the fund dropped 2.21% in its newest session, and its Relative Power Index has fallen to 32.03, deep in oversold territory. Usually, which may trace at a bounce. However when outflows stay heavy, oversold situations can stretch longer than merchants anticipate, which makes issues… tough.

Ethereum ETFs Battle With out Yield Incentives

Ethereum isn’t escaping the stress both. Spot Ethereum ETFs recorded $41.83 million in web outflows, with BlackRock’s ETHA seeing $29.93 million withdrawn in a single day. That’s a notable drain, particularly for merchandise nonetheless making an attempt to solidify institutional loyalty.

One underlying situation is structural: these ETFs don’t provide staking rewards. In a market the place yield issues, yield-free publicity appears to be like much less engaging in comparison with decentralized alternate options that generate returns. Capital has began drifting towards extra productive DeFi avenues, leaving ETH value motion comparatively flat and technically susceptible.

Day by day indicators now present a bearish crossover for Ethereum, reinforcing the cautious tone. Promote-side stress from ETF redemptions spills into perpetual markets, triggering liquidations and including to draw back momentum. It turns into a suggestions loop — outflows stress value, falling value triggers extra warning, and the cycle continues.

For now, each Bitcoin and Ethereum sit in a part that feels much less like panic and extra like institutional recalibration. Whether or not that is only a pause earlier than the subsequent leg increased, or the beginning of a deeper cooling interval, relies on one factor the market at the moment lacks: a compelling new purpose to purchase.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.