- Tron expanded its treasury by buying 177,587 TRX, reinforcing long-term confidence amid broader market uncertainty.

- TRX is holding close to the $0.27 assist zone, a stage that beforehand triggered a 15% rally towards $0.30.

- Rising TVL above $4 billion and regular liquidity might set the stage for a breakout if $0.30 resistance is cleared.

As crypto turns into extra mainstream, bear-market tremors don’t keep contained anymore. They ripple outward — into company treasuries, public portfolios, even conventional investor sentiment. When digital belongings are woven into stability sheets, a modest pullback isn’t only a chart occasion. It’s a belief occasion.

That’s why provide management and treasury technique abruptly matter much more than they used to.

Tron Buys the Dip Whereas Liquidity Climbs

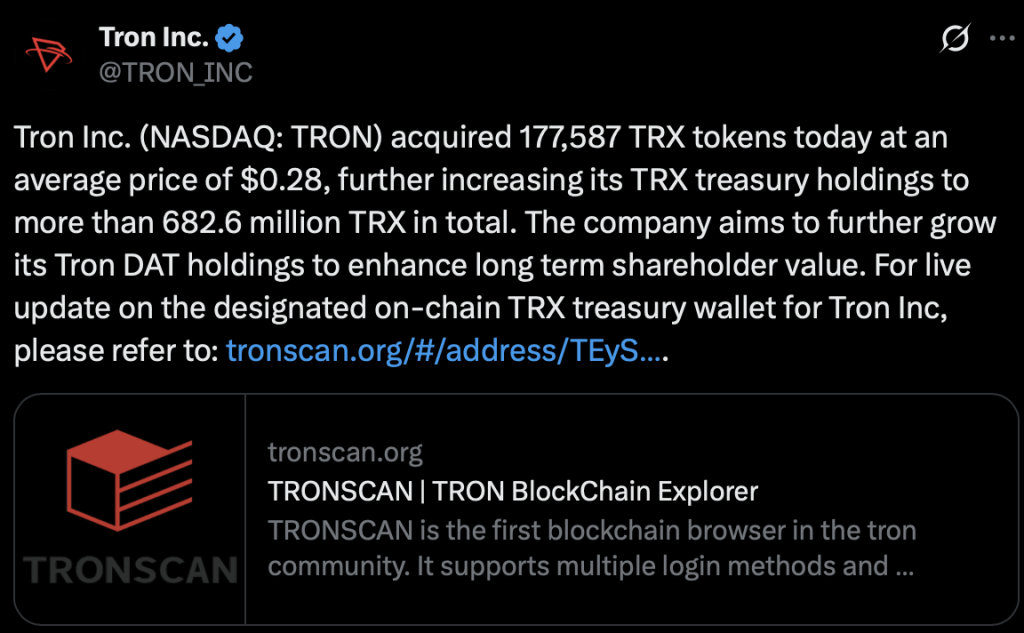

In that context, Tron made a deliberate transfer. The community acquired 177,587 TRX, pushing its treasury holdings above 682.6 million TRX. The said objective? Enhancing long-term shareholder worth. However strategically, it seems to be like one thing extra acquainted: purchase into weak point, stabilize notion, reinforce confidence.

It’s a basic playbook.

On the similar time, Tron’s on-chain liquidity is flashing constructive alerts. Whole Worth Locked has risen almost 2% prior to now 24 hours, crossing the $4 billion mark. In a risk-off market, that type of DeFi resilience isn’t trivial. It suggests capital isn’t fleeing as aggressively as headlines would possibly suggest.

Robust liquidity plus treasury accumulation sends a message — we’re not retreating. We’re reinforcing.

TRX Assessments a Traditionally Essential Ground

Technically, the timing isn’t random.

TRX is hovering close to a important assist zone that, again in mid-December 2025, sparked a roughly 15% rally towards $0.30. That rally ultimately bought erased in the course of the broader market crash, however the stage itself hasn’t misplaced its reminiscence. Markets bear in mind flooring. Merchants do too.

Now, with TRX circling that very same area once more, Tron’s acquisitions appear to be a defensive maneuver designed to guard it. Mixed with wholesome TVL, the construction begins to resemble a “purchase the concern” setup — the type that quietly builds a base earlier than a risk-on shift reignites momentum.

None of this ensures upside. Nevertheless it creates the circumstances for it.

The $0.27–$0.30 Resolution Zone

Proper now, $0.27 seems to be performing as a psychological and technical ground. Treasury enlargement reinforces that notion. So does on-chain engagement. When provide tightens and liquidity holds regular, it turns into more durable for panic to spiral unchecked.

The true inflection level, although, sits larger.

A decisive break above $0.30 would sign that consumers are not simply defending — they’re advancing. That’s when the narrative shifts from stabilization to enlargement. In that state of affairs, the groundwork Tron is laying now might look much less like injury management and extra like positioning.

In unstable markets, confidence is foreign money. Tron appears intent on defending each its token and its story. Whether or not that interprets right into a sustained breakout relies on broader threat urge for food. However structurally? The items are being put into place.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.