A modest declare. A daring quantity. Each are on the desk for Bitcoin this week as a debate over find out how to learn short-term streaks in worth beneficial properties grows louder.

Associated Studying

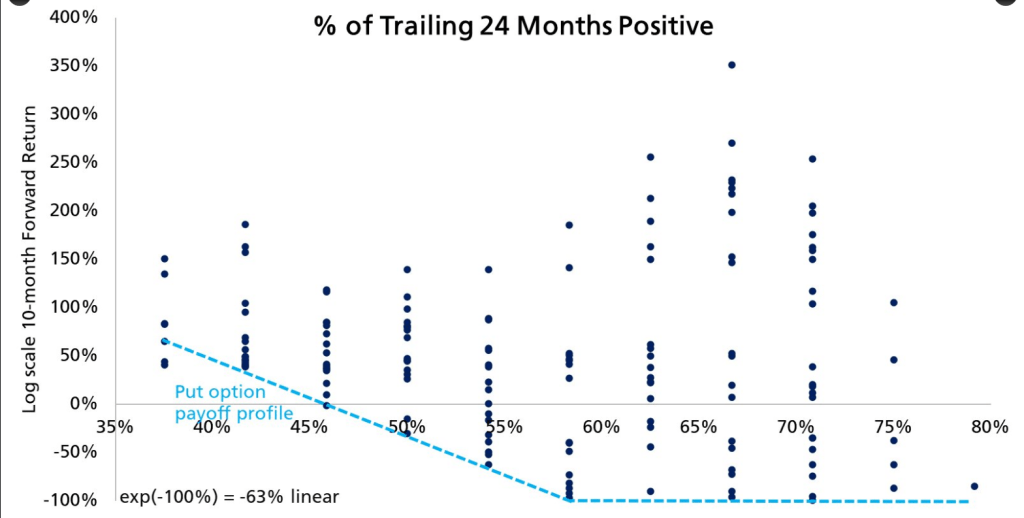

Crypto analyst Timothy Peterson has identified that half of the final 24 months confirmed optimistic returns. Based mostly on stories, he then gave an almost 90% probability that Bitcoin could be increased in 10 months.

That leap from a easy depend to a agency chance is the headline grabber. It ought to be met with cautious questions on how the chances have been calculated and what assumptions have been constructed into the mannequin.

Counting Optimistic Months

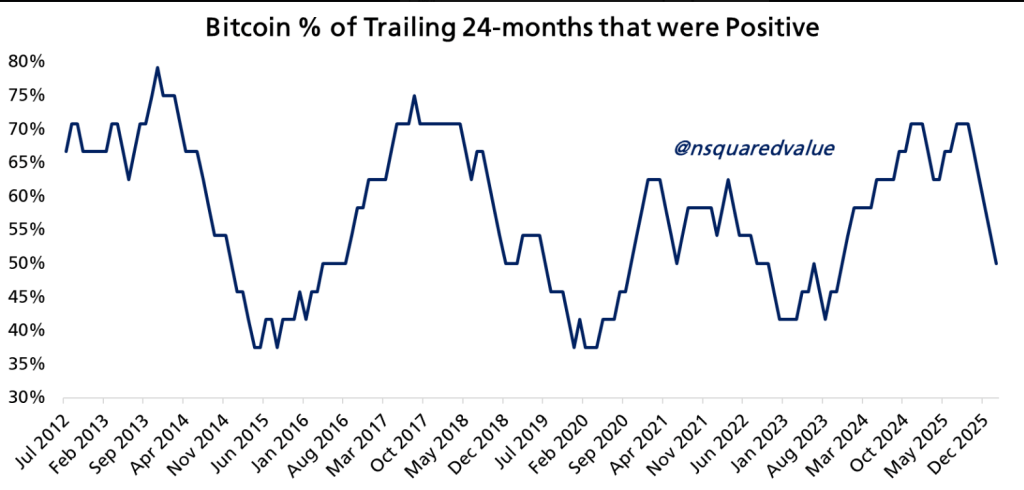

Peterson primarily based his view on a evaluate of month-to-month efficiency information. Figures compiled by CoinGlass present that Bitcoin closed six months of 2025 in optimistic territory, whereas the remaining six completed decrease.

In accordance with the info, 50% of the previous 24 months ended with beneficial properties. Peterson stated he tracks this rolling two-year window to identify potential turning factors in worth traits.

50% of the previous 24 months have been optimistic.

This suggests a 88% probability that Bitcoin will probably be increased 10 months from now.

The typical return is exp(60%)-1 = 82% => $122,000.

Knowledge goes again to 2011. https://t.co/k4IjTisuTH pic.twitter.com/ZxfTyequjt— Timothy Peterson (@nsquaredvalue) February 21, 2026

Market Odds And Betting

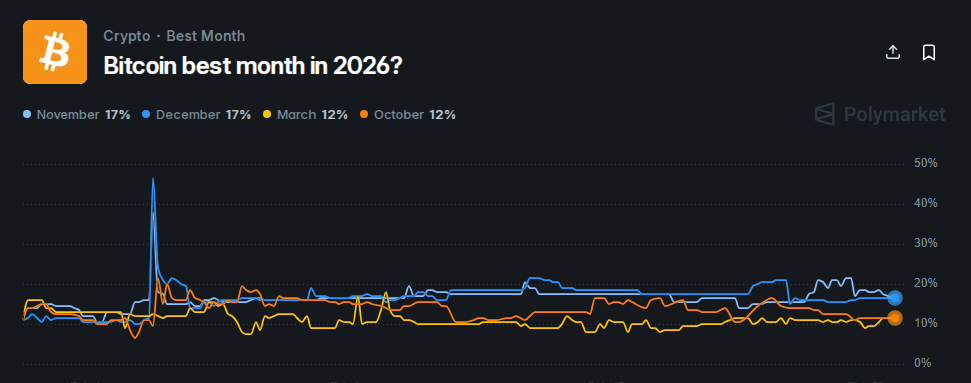

An alternate of bets reveals a really completely different view. Polymarket presently costs December as solely a 17% shot at being the perfect month of 2026, with November a hair increased.

These numbers reply a special query from Peterson’s: they mirror market bets on which month will outperform others, not whether or not the value will merely be increased at a future date.

Betting markets may be blunt instruments, however they do pack the collective view of many merchants right into a single quantity.

Bitcoin Value Motion

Value has not been calm. Bitcoin traded in a roughly $67,000–$68,000 band this week as geopolitical rigidity within the Center East tightened.

Protected-haven property like gold and oil jumped on information flows, and Bitcoin felt the squeeze as some consumers stepped again. On the similar time, dwell tickers confirmed the token about 20% beneath its stage at the beginning of the yr, a reminder that headline percentages cover extensive intraday swings.

Analysts Are Break up

Voices from the buying and selling desk are divided. Michael van de Poppe prompt near-term inexperienced candles could possibly be coming, urging merchants to observe for a carry. Alternatively, Peter Brandt has argued a deeper low might not arrive till late 2026.

Each views relaxation on completely different units of alerts — one on momentum and chart construction, the opposite on longer cycle patterns and threat of macro shocks.

Sentiment Nonetheless Down

In the meantime, stream information from spot ETF purchases, derivatives positioning, and on-chain liquidity figures would add weight to any forecast.

Associated Studying

Peterson’s forecast comes as crypto market sentiment continues to say no, with stories noting that dialogue and exercise round Bitcoin predictions have slowed. Merchants seem cautious, weighing previous traits in opposition to present uncertainty out there.

Featured picture from Vecteezy, chart from TradingView