- Solana is buying and selling close to $83 however stays in a broader downtrend under its 50-day and 100-day shifting averages.

- Destructive funding charges recommend heavy brief positioning, elevating the potential for a brief squeeze if SOL breaks above $90.

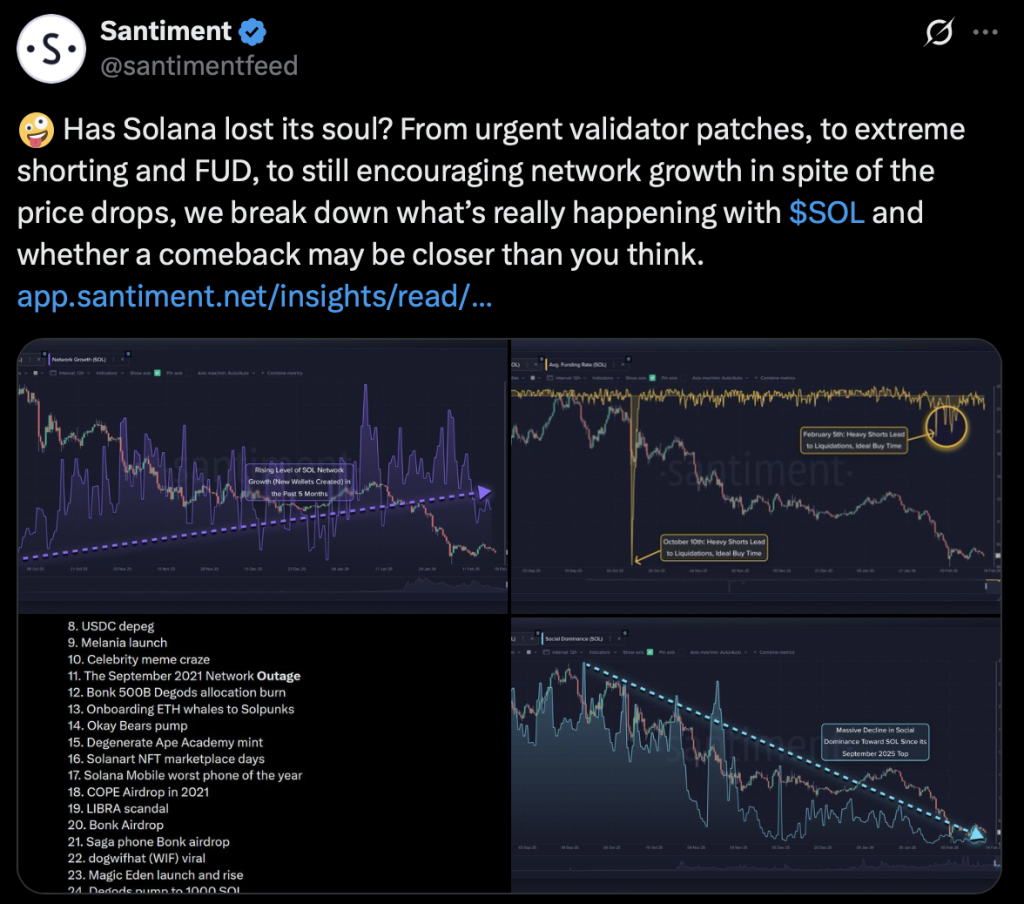

- On-chain pockets progress is rising regardless of falling worth, hinting at doable accumulation inside the $75–$90 vary.

Solana is hovering round $83.69, clawing its manner again after dipping to $79.82 earlier within the session. On the floor, a 1.5% achieve over 24 hours appears to be like first rate sufficient, particularly with $3.25 billion in buying and selling quantity flowing by means of the market. Its market cap sits close to $47.57 billion, which retains it firmly in heavyweight territory. However zoom out a bit, and the larger image feels heavier.

SOL continues to be buying and selling nicely under its 50-day shifting common at $106.66 and even additional beneath the 100-day at $124.18. Each averages are sloping downward, not flat, not curling up, simply pointing south. That’s often an indication that sellers nonetheless have management, even when short-term bounces pop up right here and there. Momentum, structurally talking, hasn’t flipped.

Key Ranges: $90 Above, $75 Under

Proper now, the $90 to $100 zone stands out as rapid resistance. Any push into that area is prone to meet provide, merchants who’ve been ready to promote into power. A clear break above the 50-day shifting common could be the primary actual technical trace that development path may be shifting. Till then, rallies could merely be aid strikes.

On the draw back, $78 is the near-term line within the sand. Lose that, and $75 comes into view shortly, which isn’t simply technical help however psychological as nicely. Spherical numbers matter, particularly in crypto the place sentiment can activate a dime. For now, SOL seems to be constructing a base, or attempting to a minimum of, although affirmation hasn’t proven up but. It’s extra pause than reversal.

Funding Charges Flash a Contrarian Sign

Curiously, the derivatives market is telling a barely totally different story. Funding charges have slipped sharply into adverse territory, which means a majority of merchants are positioned brief. When positioning leans too closely a method, it could create gas for the other transfer.

If SOL abruptly pushes greater, these shorts could also be pressured to shut. That pressured shopping for can cascade shortly, triggering what merchants name a brief squeeze. In previous cycles, deeply adverse funding charges have usually lined up with native bottoms for Solana. A breakout above $90, backed by robust quantity and rising open curiosity, would considerably improve the percentages of that squeeze state of affairs unfolding towards $100. However quantity has to substantiate it. In any other case, it’s simply concept.

Adoption Climbs Whereas Sentiment Cools

On-chain knowledge provides one other layer. New pockets creation on Solana has been steadily rising, whilst worth drifts decrease. That divergence, rising community exercise alongside falling worth, has traditionally appeared throughout accumulation phases. It doesn’t assure upside, but it surely does recommend the ecosystem isn’t shrinking.

In the meantime, social dominance has cooled since its September highs. Fewer individuals are speaking about Solana relative to different crypto property. Oddly sufficient, that may be constructive. Decreased hype usually means short-term speculators have exited, abandoning quieter accumulation. The True Power Index stays under zero, with readings round -33 and -35, exhibiting bearish momentum nonetheless in play. Nonetheless, the strains are flattening. Promoting strain could also be easing, slowly.

Analyst curb.sol is watching the $75 to $90 vary as a consolidation zone. If SOL breaks above $90 convincingly, $120 turns into a sensible upside goal. For now although, Solana sits at $83.69, balanced between strain and chance, ready for its subsequent decisive transfer.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.