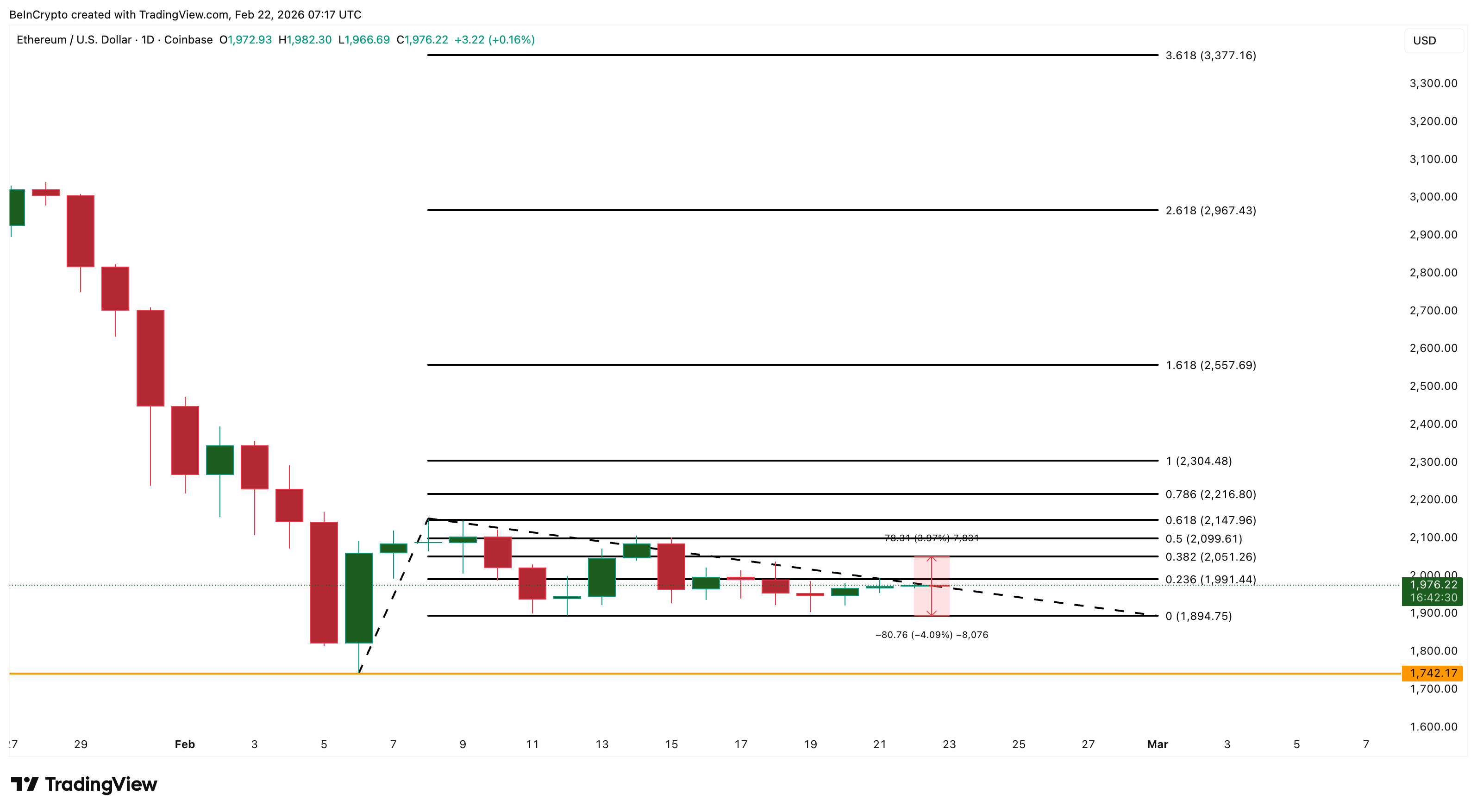

The Ethereum worth motion has not impressed a lot confidence lately. It has stayed largely flat over the previous 24 hours and stays down over 5% previously seven days. But a small restoration try is underway. Since February 19, Ethereum has rebounded about 4.5%, helped by a bullish divergence on the each day chart.

This sign normally means that promoting strain is weakening. However on the identical time, a pointy drop in staking demand is elevating a brand new query. Is returning liquidity quietly constructing strain towards this restoration?

Bullish Divergence Seems, But Falling Staking Demand Could Be Returning Provide

Ethereum’s latest rebound started after a bullish divergence fashioned between February 15 and February 19. A bullish divergence happens when the value makes a decrease low whereas the Relative Energy Index (RSI) makes the next low. RSI is a momentum indicator that exhibits whether or not promoting or shopping for strain is stronger.

When RSI improves whereas worth falls, it typically indicators that sellers are dropping energy, permitting a rebound to start. That is why Ethereum managed to get better from its February 6 low close to $1,740 and climb again towards $1,970, at press time.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Nonetheless, whereas the chart signaled restoration, Ethereum’s staking information, compiled completely by BeInCrypto analysts, started to indicate the alternative development.

Staking means locking ETH contained in the community to assist safe Ethereum and earn rewards. When ETH is staked, it reduces the liquid provide as a result of these cash can’t be simply offered.

However when demand falls, that offer can return to the market and enhance promoting threat.

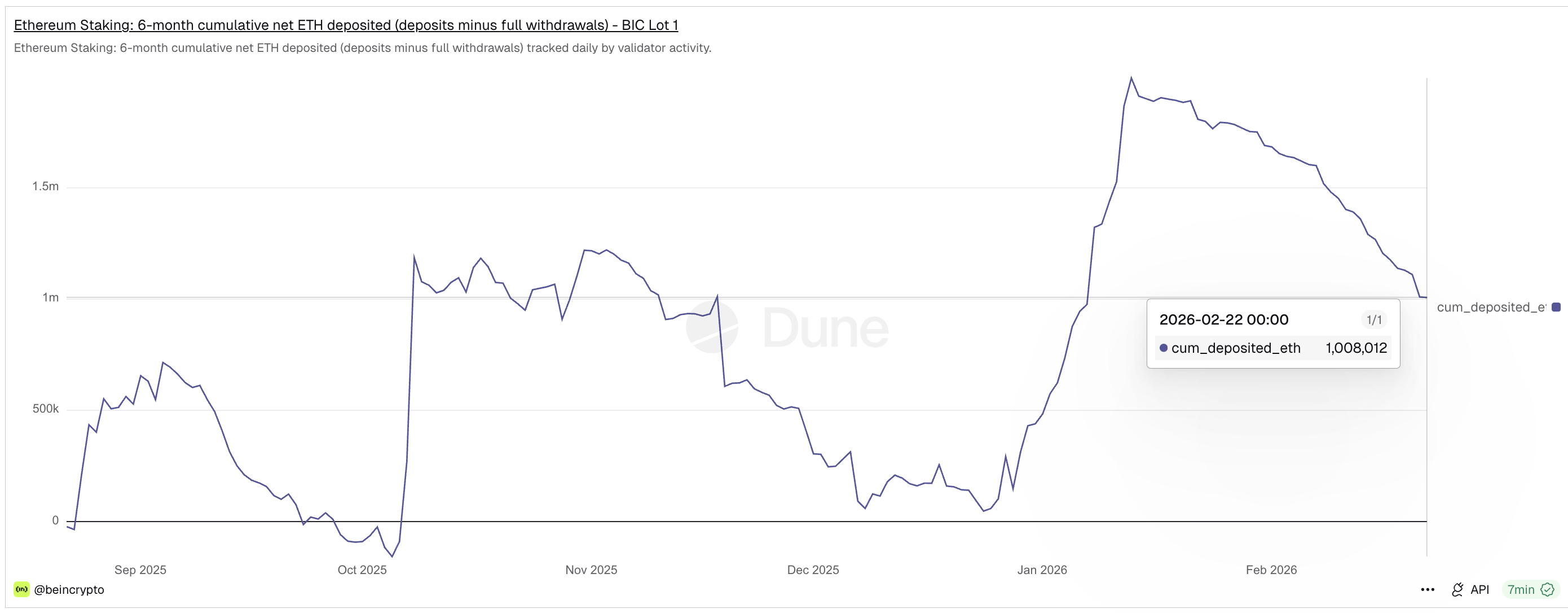

Ethereum’s 6-month cumulative internet staking deposits dropped from 1,994,282 ETH on January 13 to 1,008,012 ETH on February 22. It is a decline of about 986,000 ETH, or almost 50%.

This sharp drop means far much less ETH is being absorbed into staking. This enables extra ETH to stay liquid or out there available in the market. This creates a direct battle.

The bullish divergence suggests restoration, however falling staking demand suggests liquidity is returning. So the important thing query turns into clear.

The place is that this returning ETH going?

Change Balances And Whale Promoting Present Liquidity Is Already Transferring

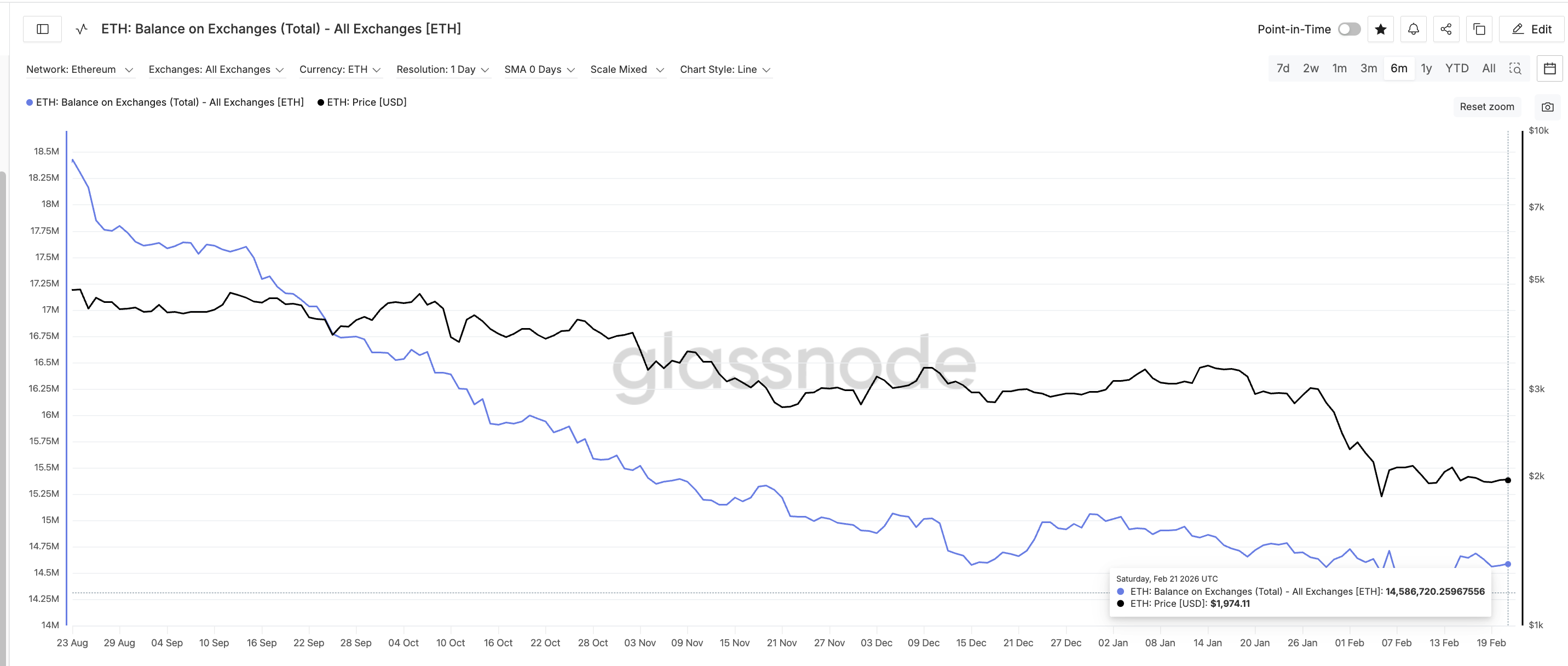

Change steadiness information supplies the primary clue. Ethereum balances on exchanges lately rose from 14,241,203 ETH to 14,586,720 ETH. This is a rise of about 345,500 ETH, or roughly 2.4%, in a short while.

Change balances measure how a lot ETH is on the market on buying and selling platforms. When this quantity rises, it normally means extra ETH is on the market to promote.

This degree is particularly necessary as a result of it matches ranges final seen on February 4.

At the moment, Ethereum’s worth fell sharply from $2,140 to $1,820 in simply at some point, a drop of almost 15%. This exhibits how rising trade provide can shortly translate into promoting strain.

The timing additionally aligns intently with the staking decline, confirming that falling staking demand is contributing to rising liquid provide.

ETH whale habits is reinforcing this development. Whales are giant holders whose shopping for and promoting can affect worth course. Since February 19, whale holdings have dropped from 113.65 million ETH to 113.42 million ETH.

This implies whales offered about 230,000 ETH in simply three days. This promoting occurred whereas Ethereum was making an attempt to get better.

This implies that as an alternative of supporting the rebound, giant holders are presumably utilizing the present or elevated liquidity to cut back their positions. This mix of rising trade balances and whale promoting exhibits that liquidity is not only returning. It’s already creating resistance.

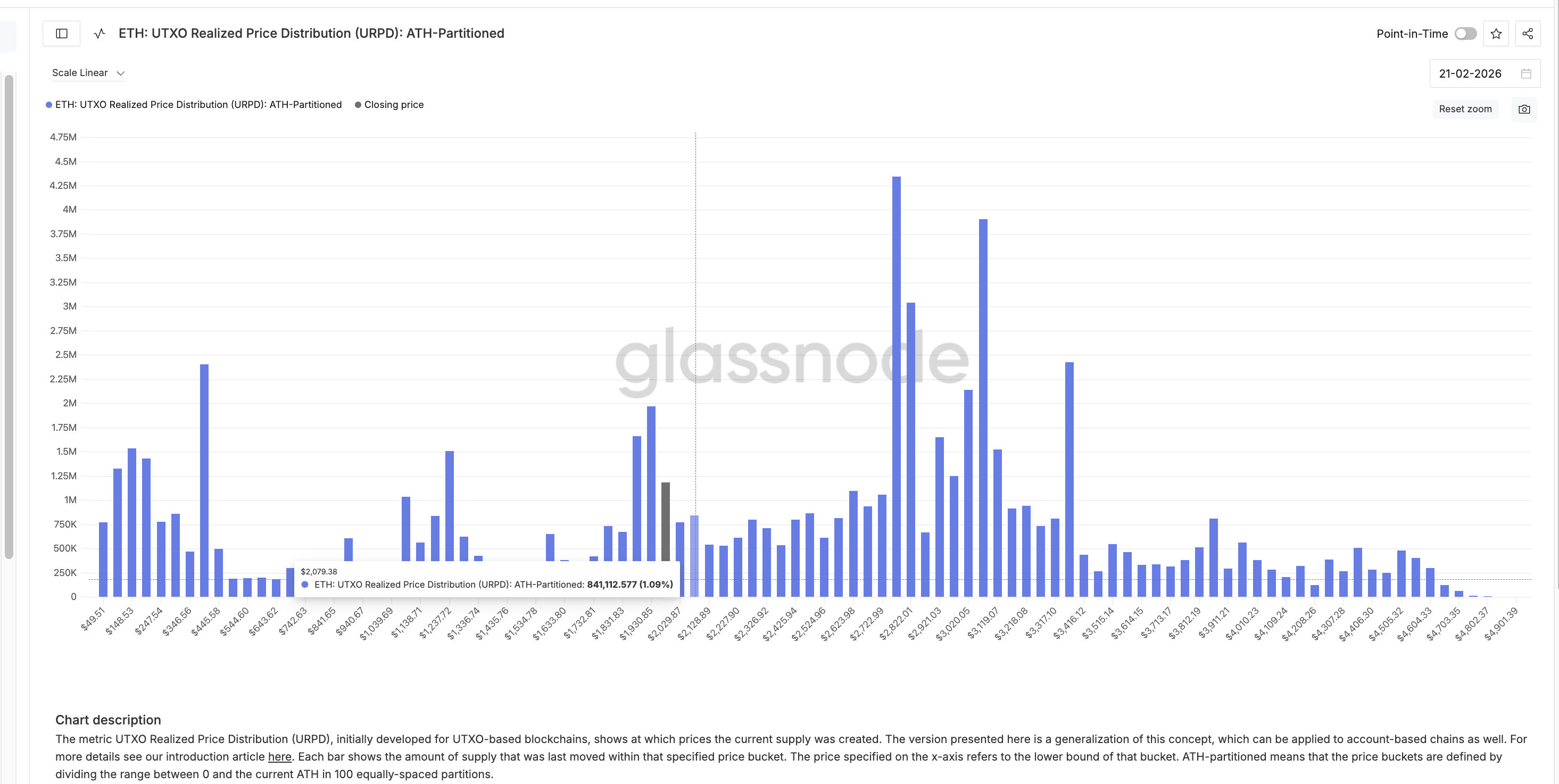

On-chain value foundation information now explains the place this resistance might seem. Price foundation represents the value ranges at which buyers beforehand purchased their ETH. When costs return to those ranges, many holders attempt to promote at breakeven, creating resistance except a cause to carry emerges.

This information comes from the UTXO Realized Worth Distribution, or URPD. Though Ethereum makes use of an account-based system, this metric has been tailored to estimate Ethereum’s provide distribution.

It exhibits that greater than 2% of Ethereum’s provide is concentrated between $2,020 and $2,070. These ranges additionally align intently with resistance ranges on Ethereum’s worth chart.

This creates a essential take a look at. If Ethereum’s restoration continues, it should break above $2,050 first after which problem the $2,140 degree. A stronger transfer may prolong towards $2,300.

However as a result of provide is concentrated close to $2,020 and $2,070, many holders might promote as ETH approaches these ranges. This makes $2,050 probably the most essential zone within the quick time period.

With staking demand falling and whales already promoting, absorbing this provide (if it unlocks when the value hits a key degree) turns into troublesome with out sturdy new demand.

On the draw back, the important thing assist degree sits at $1,890. This degree sits about 4% under the present worth. If this assist fails, Ethereum may fall again towards its February low close to $1,740.

This locations Ethereum in a dangerous place. The bullish divergence has opened the door for restoration. However falling staking demand, rising trade balances, whale promoting, and powerful cost-basis resistance recommend that returning liquidity might decide what occurs subsequent.