- HYPE broke out of a descending triangle and is buying and selling close to $30, with quantity rising over 14% in 24 hours.

- Arthur Hayes predicted a possible transfer to $150 by July 2026, fueling bullish sentiment.

- Rising DEX quantity, rising income, and leveraged lengthy positions counsel strengthening upside momentum above $29 assist.

Because the broader crypto market begins to stabilize, Hyperliquid (HYPE) has flashed a robust reversal sign. The token pushed by resistance with what appears like a clear bullish breakout, and merchants seen nearly instantly. At press time, HYPE is buying and selling round $30.30, up roughly 4.75% up to now 24 hours. Not a small transfer, particularly in a market that solely just lately seemed shaky.

Quantity tells a part of the story. Buying and selling exercise climbed 14.5% to about $207.95 million, suggesting this isn’t only a skinny bounce. There’s actual participation behind it. When worth and quantity rise collectively, that normally means curiosity is constructing, not fading.

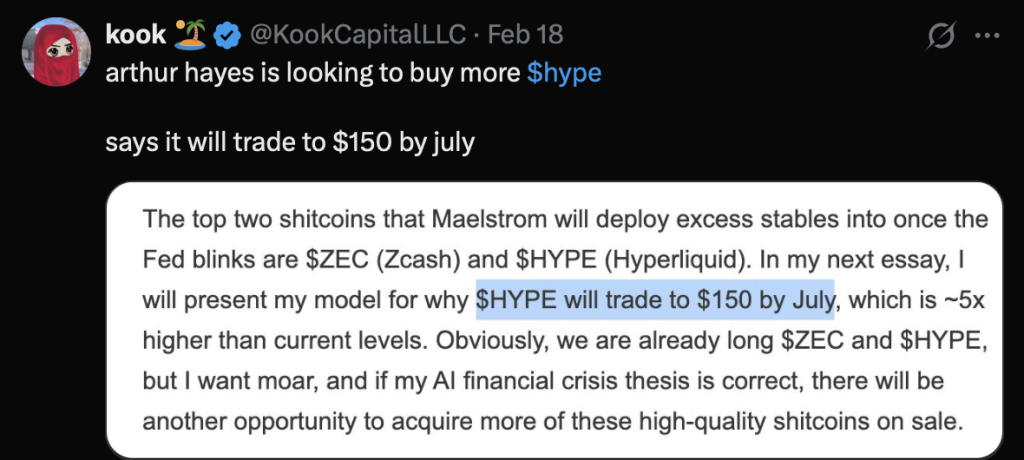

Arthur Hayes Drops a $150 Prediction

The rally gained much more traction after a publish on X highlighted a daring name from Arthur Hayes, former BitMEX CEO. Hayes reportedly plans to build up extra HYPE, with a long-term goal of $150 by July 2026. That sort of projection doesn’t keep quiet for lengthy, and it shortly unfold throughout crypto Twitter.

Whether or not you see it as visionary or aggressive, the quantity grabbed consideration. A transfer to $150 from present ranges would suggest large upside. It additionally reinforces the concept some heavyweight gamers view HYPE as greater than only a short-term commerce.

On the four-hour chart, HYPE seems to have damaged out of a descending triangle sample, a setup usually related to development reversals when breached to the upside. So long as worth holds above the $29 assist zone, analysts counsel a possible 20% transfer towards $36 within the close to time period. Nevertheless, if HYPE slips under $28 and closes a four-hour candle there, the bullish case weakens shortly. That will probably invite sharp promoting.

Indicators Present Momentum, However Not Overheating

The technical indicators are supportive, although not screaming euphoria. The Common Directional Index (ADX) at the moment sits at 12.26, effectively under the 25 threshold sometimes related to sturdy developments. That implies the breakout continues to be growing and hasn’t absolutely matured into a robust directional transfer.

In the meantime, the Relative Energy Index (RSI) is round 57.97. That locations it comfortably under overbought territory, leaving room for additional upside if shopping for stress continues. In different phrases, momentum is constructing, nevertheless it’s not stretched. Not but.

Leverage and On-Chain Exercise Add Gasoline

Derivatives information from CoinGlass reveals merchants leaning bullish. Over-leveraged positions cluster round $28.32 on the draw back and $30.92 on the upside. At these ranges, roughly $14.49 million in lengthy positions outweigh about $4.70 million in shorts. That imbalance signifies bulls are at the moment in management, at the least within the brief time period.

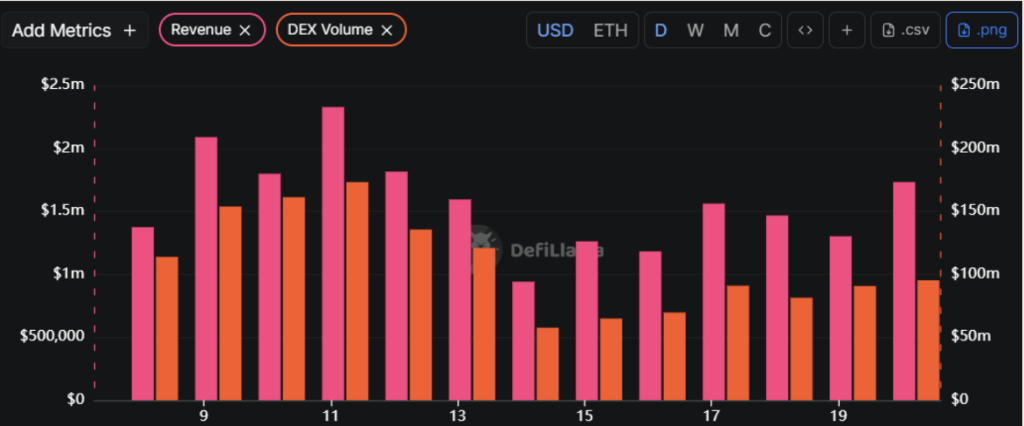

On-chain metrics strengthen the narrative. In keeping with DeFiLlama, Hyperliquid’s income has climbed from $941.78K to $1.73 million since February 14, 2026. DEX quantity jumped from $57.59 million to $95.31 million in the identical interval. That’s not marginal development. It displays rising engagement and deeper liquidity flowing by the protocol.

Taken collectively, HYPE’s breakout, leveraged positioning, and increasing on-chain exercise paint a constructive image. The development continues to be younger. The conviction isn’t excessive. However the construction is tilting bullish, and if momentum holds above key assist, the subsequent leg greater may arrive quicker than many anticipate.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.