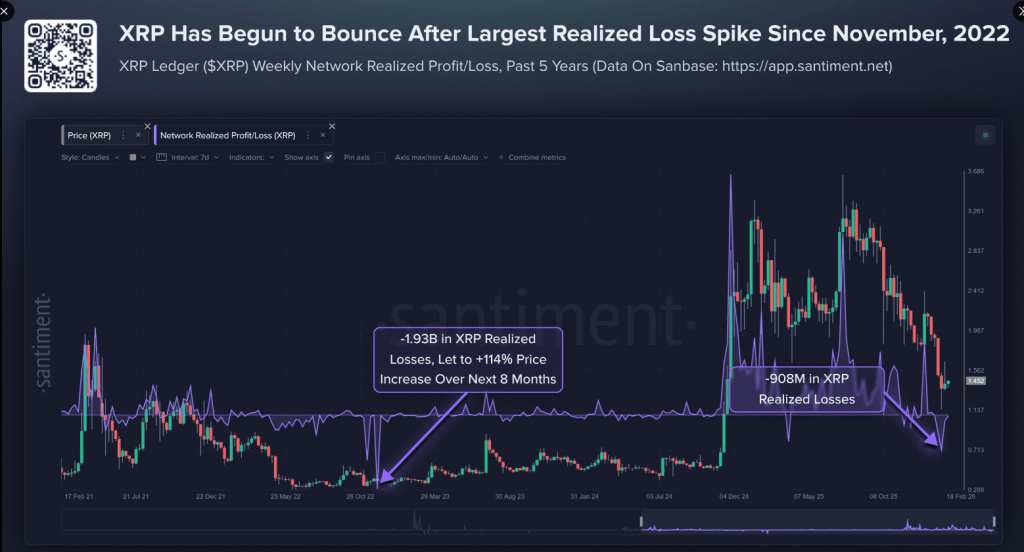

XRP on-chain ache has drawn recent consideration this week. Realized losses surged to almost $2 billion over a one-week span. That form of transfer grabs merchants’ eyes as a result of it usually marks a clearing out of weaker holders.

Associated Studying

Santiment Reveals Heavy Realized Losses

In line with Santiment, the spike is the most important since 2022. Realized losses occur when individuals promote for lower than what they paid. It’s a measure of capitulation. In previous cycles, related spikes occurred close to main lows and had been adopted by sturdy rallies.

📉 BREAKING: XRP has seen its largest on-chain realized loss spike since 2022. When the earlier weekly milestone of -1.93B in realized losses occurred 39 months in the past, $XRP proceeded to leap +114% over the subsequent 8 months.

💸 Vital realized losses occur when a big quantity… pic.twitter.com/gPUU8fYfiY

— Santiment (@santimentfeed) February 21, 2026

One historic episode that merchants level to noticed a giant loss week earlier than a 114% climb over roughly eight months. Nonetheless, that final result got here from a particular set of market circumstances that aren’t assured to reappear.

When Many Small Holders Go away

The latest spike in realized losses has drawn consideration from market contributors. When traders promote at a loss, the metric rises, reflecting the size of cash altering palms beneath their buy worth. Analysts usually monitor this information to evaluate shifts in provide and demand.

Realized revenue and loss figures are generally used to trace market conduct in periods of sharp worth motion. Whereas the information highlights the extent of losses being locked in, worth route sometimes is dependent upon broader buying and selling exercise, liquidity circumstances, and total market tendencies.

Value Strikes And Market Tone

XRP traded close to $1.45 on the time of those studies, up about 1.50% over 24 hours however down roughly 24% for the month. The token moved principally consistent with Bitcoin throughout a broader market bounce.

Quick-term power like that may be a begin. It will also be a quick reprieve inside an extended correction. Merchants watching the charts need to see extra quantity and clear ranges taken earlier than calling a pattern change.

My #XRP worth targets for the subsequent three months:

March $13

April $27

Could $70— CryptoBull (@CryptoBull2020) February 21, 2026

Why Some Forecasts Stretch Actuality

Analyst targets working into double and triple digits have circulated on-line. CryptoBull’s requires $13, $27, and $70 in a matter of months are excessive and would require dramatic new capital flows.

Market cap math exhibits these strikes want far bigger demand than informal optimism supplies. Different analysts used prior cycle lows to estimate a attainable macro ground between $0.75 and $0.85 by making use of a roughly 2.8x a number of.

Associated Studying

A Good Sign

Taken collectively, the information has revived dialogue round a uncommon on-chain sign that previously got here earlier than a 114% advance.

Santiment’s newest figures present realized losses reaching ranges not seen since 2022, inserting the metric again in focus for merchants monitoring cycle conduct.

Whether or not historical past repeats will depend upon incoming demand, broader crypto sentiment, and sustained shopping for strain within the weeks forward. For now, the sign has flashed once more, and the market is watching to see what follows.

Featured picture from Pexels, chart from TradingView