- Solana Surges Previous $180: Solana reclaimed $180 for the primary time since February, pushed by sturdy DeFi metrics and a 6% achieve in 24 hours, with open curiosity up 11.08%, signaling elevated dealer confidence.

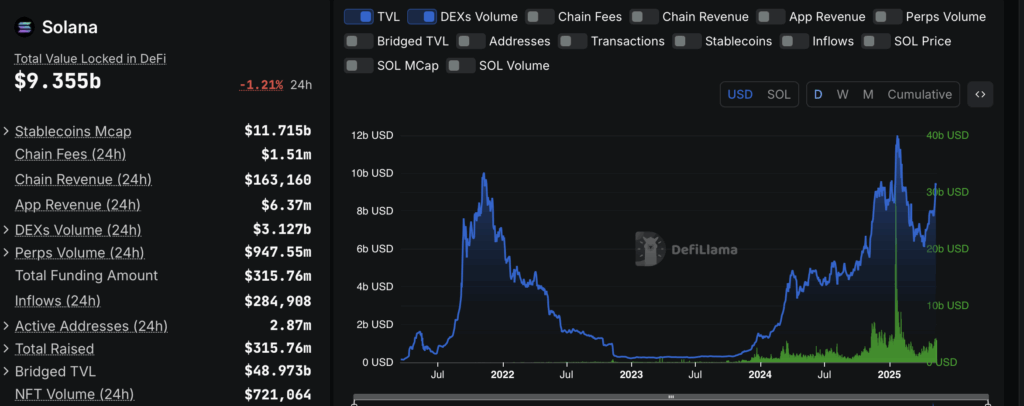

- DeFi and Community Exercise Enhance: Complete worth locked in Solana’s DeFi ecosystem rose from $7.5 billion to $9.6 billion, with platforms like Marinade, Jito, and Raydium main the cost. In the meantime, weekly DEX volumes jumped from $18 billion to $22 billion, and 65% of SOL stays staked.

- Technical Indicators Sign Combined Messages: Whereas main EMAs and SMAs present purchase alerts, the RSI is at 71, suggesting overbought situations. A breakout above $185 might goal $200, however failure to clear resistance could result in a pullback towards $157 or $130.

Solana’s again within the highlight, pushing previous $180 for the primary time since mid-February. A strong technical setup and rising DeFi metrics are behind the 6% achieve over the previous day and a 22% climb over the previous week. In accordance with Coinglass, open curiosity on Solana has jumped 11.08%, suggesting merchants are piling in with recent contracts – an indication of renewed confidence.

DeFi Ecosystem Positive factors Floor

Information from DeFiLlama exhibits Solana’s whole worth locked (TVL) leaped from $7.5 billion in the beginning of Might to $9.6 billion now. Platforms like Marinade surged 56%, Jito climbed 41%, and Raydium shot up 78%. In the meantime, weekly DEX volumes jumped from $18 billion to $22 billion, underscoring rising demand.

On-chain exercise is buzzing too. Revenues and transaction charges have been trending increased for 4 weeks straight, closing in on three-month highs. With 65% of SOL staked, the combo of DeFi demand and restricted provide might preserve costs propped up.

Not All Metrics Shine

Nonetheless, it’s not all excellent news. Solana’s stablecoin market cap slipped by 8% during the last seven days, now sitting at $11.7 billion. And with a funding price of 8%, merchants are paying a premium to carry longs – a bullish sign that always precedes a pullback.

Technical Setup – Inexperienced Lights and Crimson Flags

From a technical perspective, SOL is buying and selling comfortably above all main EMAs and SMAs – 10, 20, 50, 100, and 200-day averages – all flashing purchase alerts. That’s bullish. However the RSI is up at 71, suggesting overbought situations that may invite some profit-taking.

The Bollinger Bands are spreading out, indicating increased volatility. SOL’s hovering close to the higher band at $185, a key resistance stage. If it breaks by, the following goal is $200. But when it stalls right here, help sits round $157 (20-day EMA) and $130, the place the decrease Bollinger band and prior consolidation zone align.

Wanting Forward – Path to $200?

If SOL can punch by $185 with strong quantity, the door to $200 swings open. But when the breakout fails, anticipate a pullback to help zones. Regardless of being 39% under its all-time excessive of $295, momentum is constructing, and with institutional curiosity rising, upcoming upgrades like Firedancer might gas the following leg up – so long as market situations cooperate.