Abraxas Capital is rising as one of many largest whales within the Ethereum (ETH) market, with a complete ETH holding worth of $561 million over the previous week.

The group’s actions replicate confidence in ETH’s potential and lift questions on its impression on the cryptocurrency market within the close to future.

Abraxas Capital Aggressively Accumulates ETH

Over the previous week, Abraxas Capital has grow to be a focus by constantly accumulating ETH on a big scale. In keeping with Lookonchain, on Could 14, 2025, the group bought 242,652 ETH inside 7 days. It’s equal to $561 million.

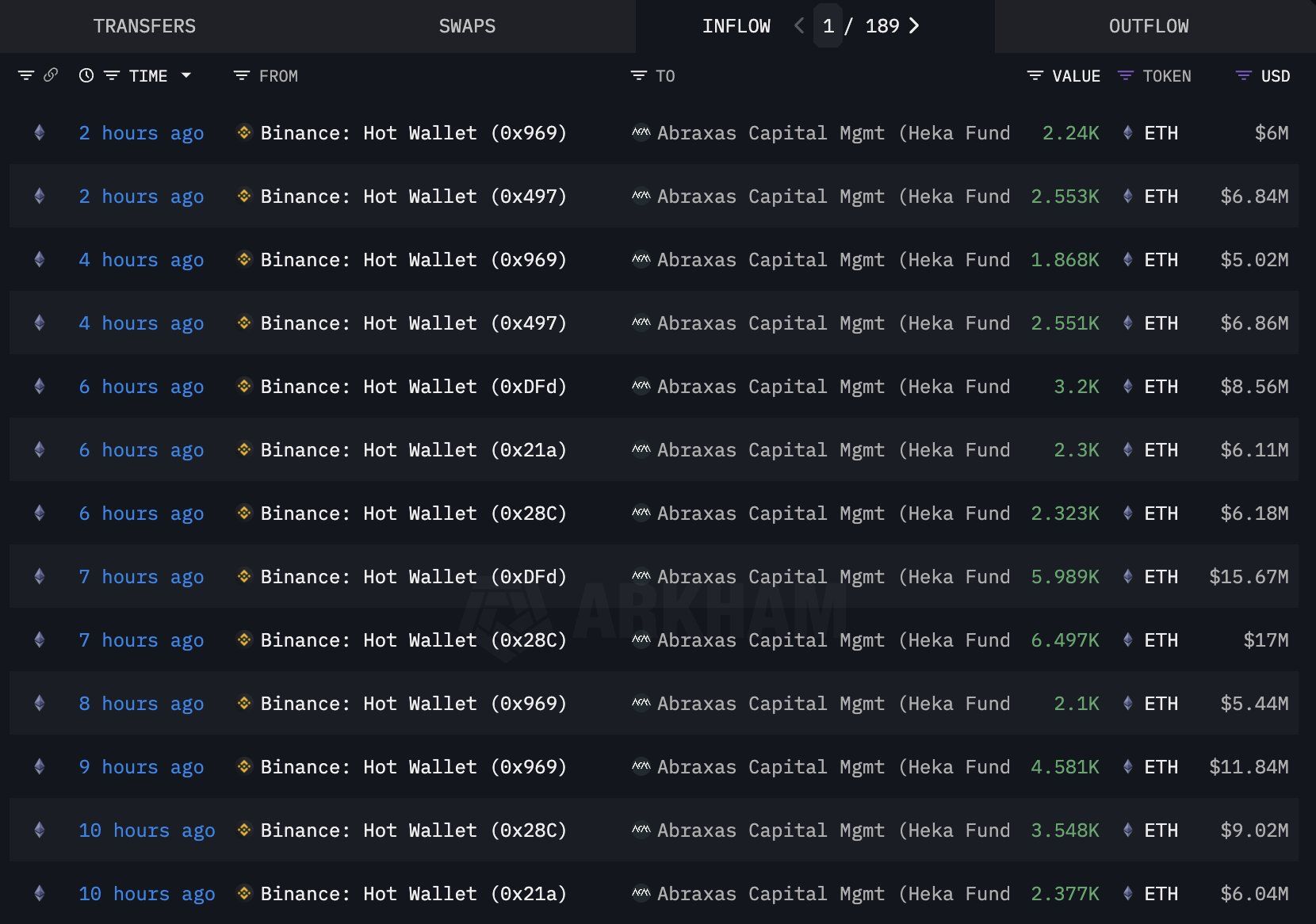

Knowledge from Arkham Intelligence exhibits that wallets belonging to Abraxas Capital Heka Funds withdrew ETH from a number of main exchanges, primarily Binance. Transactions ranged from 2,100 to six,497 ETH per occasion, comparable to values between $5.44 million and $17 million. 189 transactions in 10 hours spotlight the group’s aggressive accumulation technique.

Abraxas Capital is a serious whale with ETH holdings price $561 million. They may affect ETH value tendencies within the close to future.

Shift from BTC to ETH

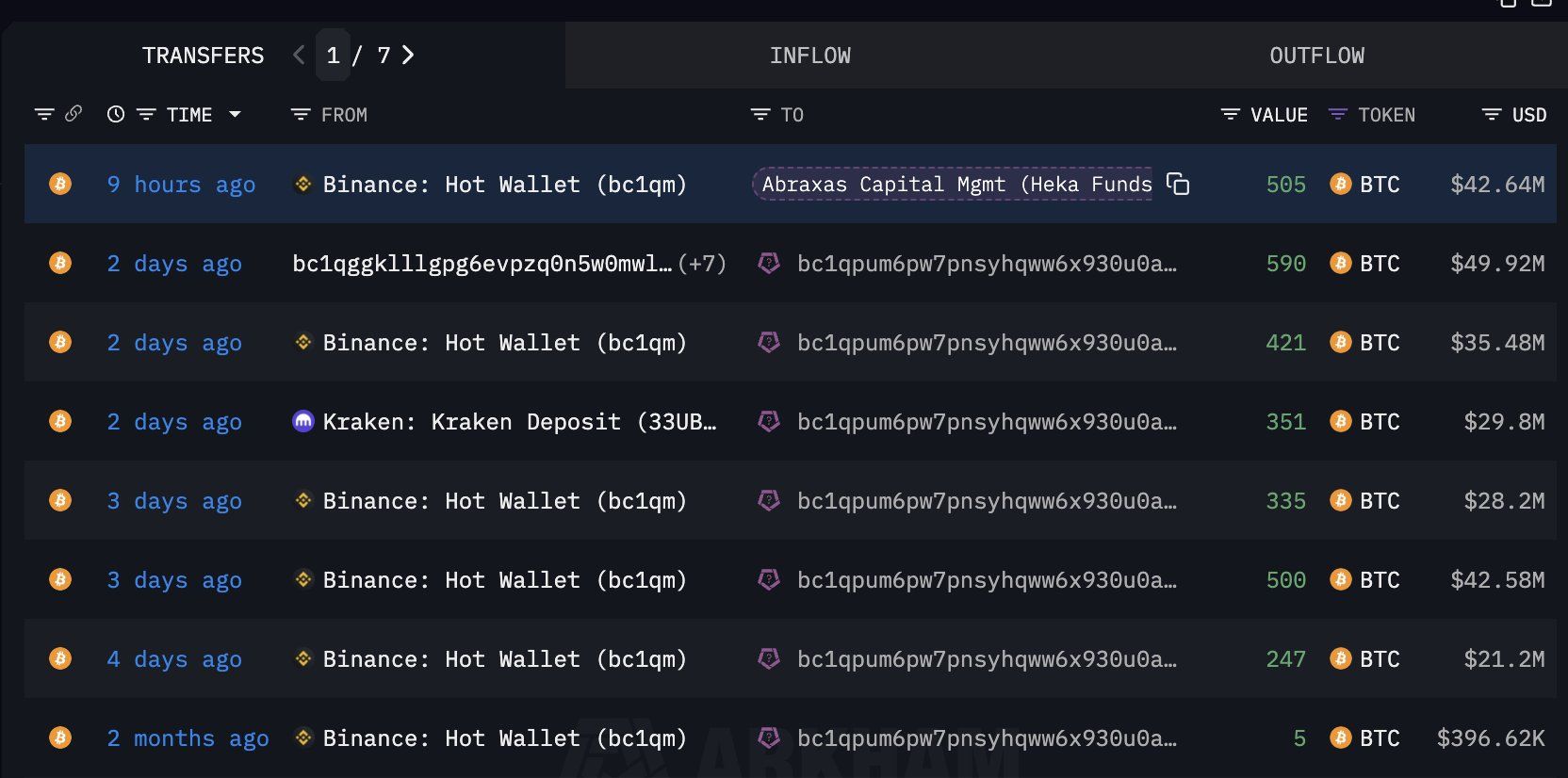

One other notable level is Abraxas’s shift from Bitcoin (BTC) to ETH. Lookonchain reported {that a} pockets linked to the group withdrew 2,949 BTC, equal to $250 million, from a number of exchanges.

Nonetheless, by Could 8, 2025, OnchainDataNerd reported that the group deposited 1,000 BTC to Kraken. They maintain solely 983 BTC, equal to $98 million at present costs. This means that Abraxas considerably decreased its BTC place to deal with ETH, with ETH holdings surging to $561 million in the identical interval.

This shift could replicate Abraxas’s confidence in ETH’s long-term potential, notably because the Ethereum ecosystem thrives with DeFi and NFT purposes. The discount in BTC holdings and elevated funding in ETH counsel they might be getting ready for a brand new progress cycle for Ethereum, particularly after ETH lately surpassed the $2,500 mark.

“ETH is a wager on fundamentals. Ethereum dominates on builders, stablecoins, RWAs and NFTs.” A person on X commented

With its potential, analysts consider that Ethereum might quickly surpass Bitcoin. By 2026, Ethereum’s strategic reserve is anticipated to extend to 10 million ETH.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.