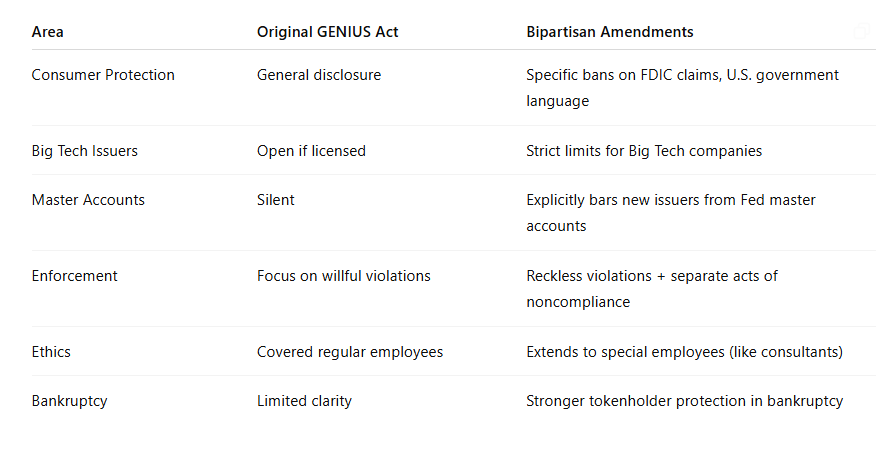

After the GENIUS Act failed within the Senate final week, legislators added a number of bipartisan amendments. These signify vital concessions to the anti-crypto faction, with a number of necessary restrictions.

Specifically, they ban Massive Tech companies from issuing and probably even holding stablecoins. These amendments would improve stablecoin transparency and allow enforcement actions on noncompliant companies.

Might the GENIUS Act Move with New Amendments?

Stablecoin laws are a precedence challenge for US crypto regulation, and the GENIUS Act is presently the trade’s finest hope for passing them.

Though its success appeared possible final week, it failed within the Senate after stiff Democratic opposition and Republican defections. Nevertheless, rumors declare that the GENIUS Act has new bipartisan amendments which may see it by way of.

Usually, the GENIUS Act amendments fall alongside the identical axis: addressing the considerations that precipitated it to fail final week. These embody limiting the potential for fraud in a number of methods, like making it clear that these merchandise haven’t any shopper safety underneath the FDIC or federal affiliation.

Nevertheless, one stands proud specifically, with enormous implications:

“Prohibits non-financial publicly traded corporations from issuing a stablecoin until they’ll meet strict standards concerning monetary threat, shopper knowledge privateness, and honest enterprise practices. This helps stop corporations like Meta, Amazon, Google, and Microsoft from issuing a stablecoin and maintains the separation between banking and commerce,” one model reads.

Studies declare these GENIUS Act amendments come from two Senate sources. Nevertheless, a distinct model has additionally been circulating, and it means that Massive Tech could also be prohibited from holding stablecoins in any method.

The invoice’s language has not been finalized, so both model could possibly be correct.

Particular Amendments and Their Objectives

Skeptical lawmakers have good motive to make this a high regulatory precedence, as stablecoins have attracted a variety of information. Placing apart the big use case for stablecoins in mundane legal actions, these GENIUS Act amendments appear tailor-made to latest particular incidents.

Take, for instance, the requirement that stablecoins can’t immediately bear US-themed branding. Trump’s USD1 has generated large controversy, and it has no direct affiliation with the federal government.

The GENIUS Act amendments goal to ban Massive Tech from launching stablecoins, and Meta proposed utilizing them lower than per week in the past.

Most of all, the GENIUS Act amendments are explicitly supposed to “keep the separation between banking and commerce.” Tether has been investing unbelievably huge sources in new US stablecoin alternatives, spending $65 billion on US Treasury bonds in solely three months.

Massive Tech has ample money to throw round, so it wants tight guardrails. The opposite GENIUS Act amendments element a number of such guardrails. For instance, they loosen the necessities for enforcement actions in opposition to stablecoin issuers.

In addition they place these actions underneath the Treasury’s purview, as different regulators just like the SEC and CFTC have been gutted.

Moreover, one particularly names Elon Musk as a federal worker with sturdy conflicts of curiosity on this matter, nevertheless it names others.

Once more, these amendments haven’t been finalized, so it’s not clear if the GENIUS Act will even move. Nevertheless, in any occasion, these proposals signify an enormous win for the crypto-skeptical faction in Congress.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.