Bittensor (TAO) has been up 6.5% over the previous seven days, and its market cap is now hovering slightly below $4 billion regardless of correcting 6.6% within the final three days. The latest pullback has weakened key technical indicators, with each momentum and development power displaying indicators of degradation.

Whereas TAO has managed to carry key help ranges and stays above $440, bearish indicators are beginning to emerge throughout a number of charts. Whether or not bulls can reclaim management or TAO slips under $400 will seemingly outline its subsequent main transfer.

Bittensor Pattern Weakens as Bearish Momentum Overtakes Bulls

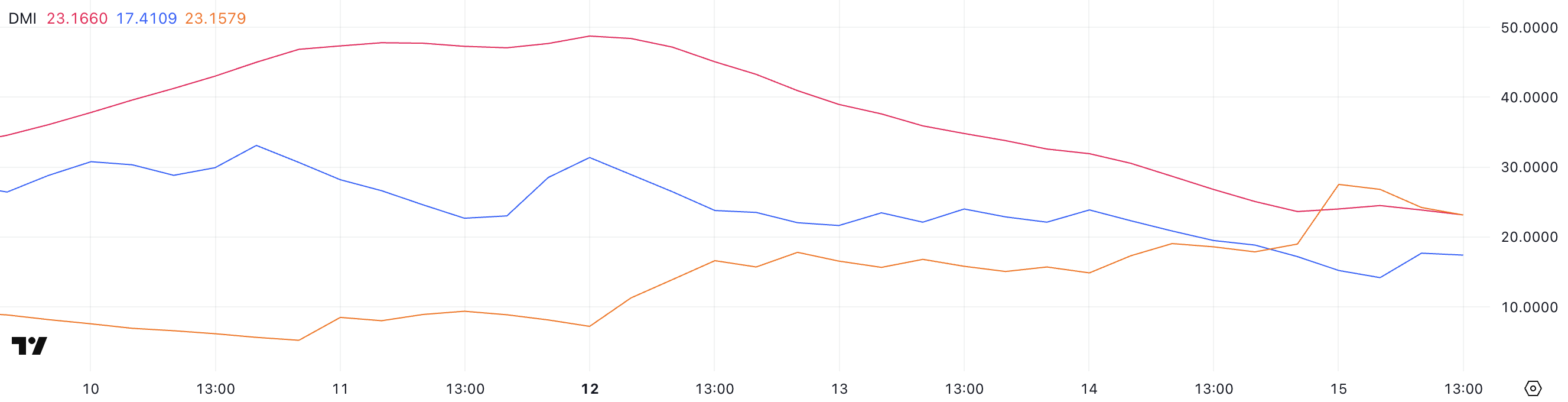

TAO’s DMI (Directional Motion Index) chart exhibits a weakening development, with its ADX (Common Directional Index) falling sharply from 47 to 23.16 over the previous three days.

The ADX measures the power of a development—no matter path—on a scale from 0 to 100. Values above 25 sometimes point out a robust development, whereas readings under 20 counsel a weak or ranging market.

TAO’s present ADX is simply above 23, suggesting the latest development is shedding power and could also be nearing a transition section. Regardless of that, based on CoinGecko information, Bittensor is the most important synthetic intelligence coin out there, surpassing gamers like NEAR, ICP, and RENDER.

In the meantime, the +DI (Optimistic Directional Indicator) has dropped from 23.87 to 17.41, signaling a decline in bullish strain. On the similar time, the -DI (Unfavourable Directional Indicator) has risen from 17.86 to 23.15, displaying that bearish momentum is gaining management.

This crossover—the place -DI strikes above +DI—signifies that sellers have overtaken consumers, and with ADX nonetheless above 20, the downtrend could proceed to develop.

If this divergence persists, TAO’s worth might face additional draw back strain within the brief time period until bulls re-enter to shift the momentum.

TAO Recovers however Lacks Clear Power

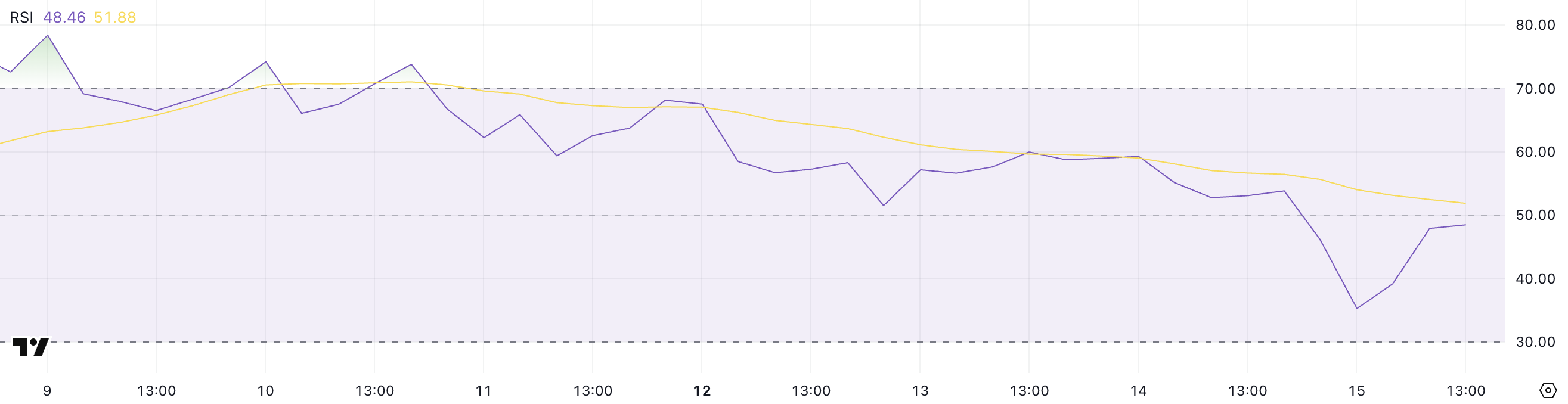

TAO’s Relative Power Index (RSI) is at the moment at 48.46, after experiencing a pointy intraday dip from 53.82 yesterday to as little as 35.25 only a few hours in the past.

The RSI is a momentum indicator that measures the pace and magnitude of latest worth actions on a scale from 0 to 100. Sometimes, values above 70 counsel overbought circumstances and potential for a pullback, whereas values under 30 point out oversold circumstances and a potential rebound.

Readings between 30 and 70 are thought of impartial, with the 50 mark typically appearing as a steadiness level between bullish and bearish momentum.

TAO’s present RSI of 48.46 locations it barely under that midpoint, signaling a light bearish bias after a quick interval of stronger promoting strain.

The restoration from the 35.25 low exhibits that consumers have stepped again in, however the failure to carry above 50 means that bullish momentum stays weak. This stage might replicate consolidation or indecision out there, the place TAO could commerce sideways until new catalysts emerge.

If RSI stabilizes or climbs above 50 once more, it might point out renewed power, whereas one other drop towards 30 would enhance the chance of additional draw back.

TAO Holds Help however Faces Key Take a look at for Momentum Restoration

TAO not too long ago examined key help round $417.6 and bounced again above $440, displaying resilience after a quick dip. Its EMA traces nonetheless replicate a bullish construction, with short-term transferring averages positioned above the long-term ones.

Nevertheless, the narrowing hole between them means that momentum is weakening. If promoting strain returns, the development might shift, threatening Bittensor’s management as the most important AI coin.

If Bittensor regains power, it might purpose for a retest of the $492.79 resistance space, which might totally recuperate latest losses.

On the draw back, failure to carry the $434 and $417.6 help ranges would put TAO liable to getting into a sharper downtrend.

A break under these zones might drag the value down towards $380, pushing TAO under $400 for the primary time in roughly one week.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.