Bitcoin is buying and selling above the important thing psychological degree of $100,000, however the bullish momentum that drove costs greater in current weeks has cooled as BTC fails to reclaim resistance close to $105,000. After a pointy rally that noticed Bitcoin surge greater than 40% from its April ninth low, worth motion is now consolidating and testing demand. Whereas bulls stay in management above the $100K mark, rising indicators of uncertainty have led some analysts to warn of a possible breakdown if $100K fails to carry.

Regardless of these short-term issues, long-term fundamentals stay robust. Knowledge from CryptoQuant reveals that since April 4, Lengthy-Time period Holders (LTH) have added 339,000 BTC to their holdings. The constant accumulation by long-term traders provides weight to the bullish thesis, exhibiting continued conviction in Bitcoin’s long-term worth, whilst short-term merchants specific hesitation.

The approaching days can be vital, as Bitcoin should both verify $100K as stable assist or threat a deeper pullback. All eyes are on whether or not demand will maintain, and whether or not LTH accumulation can offset rising market worry.

Lengthy-Time period Holders Add Gas To Bitcoin Bullish Outlook

Bitcoin is at the moment in a pivotal section that would outline the trajectory of the marketplace for the approaching months. After rallying over 40% from its April ninth low, BTC has spent the previous couple of days consolidating under the $105K resistance. This consolidation has sparked a mixture of expectations—some merchants anticipate a breakout into a brand new all-time excessive, whereas others consider the market could possibly be organising for an prolonged vary.

Regardless of short-term volatility, the broader pattern stays clearly bullish. Bitcoin has maintained a gentle uptrend for over 5 weeks, climbing by a number of resistance ranges and attracting renewed investor consideration.

One of the important alerts of confidence comes from the conduct of long-term holders. In accordance with information shared by prime analyst Axel Adler, since April 4, long-term holders (LTH) have added a complete of 339,000 BTC to their wallets. This brings the full LTH provide to 14,370,338 BTC—a report determine that underscores deep conviction in Bitcoin’s future worth.

This wave of accumulation is a strong bullish sign. Traditionally, intervals of heavy LTH shopping for have preceded main rallies. If BTC can maintain present demand zones and reclaim resistance, the market might enter a brand new section of growth. Nonetheless, if resistance holds and momentum weakens, the market might stay trapped in a broader consolidation. For now, the stress is on bulls to verify energy, and LTH accumulation reveals they’re not backing down.

BTC Holds Above Help, However Breakout Stays Elusive

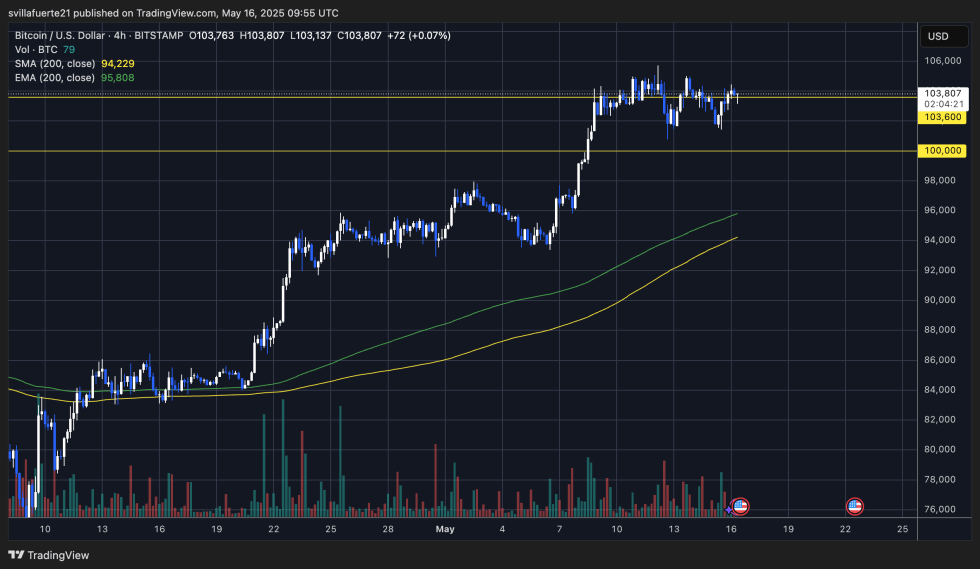

The 4-hour chart reveals Bitcoin persevering with to consolidate simply above the $103,600 assist degree after failing to interrupt cleanly above the $105,000 zone. Value motion stays tightly ranged between $103,600 and $104,800, with a number of failed makes an attempt at pushing greater, suggesting the presence of heavy sell-side liquidity in that area.

Regardless of this, Bitcoin’s construction stays bullish. The 200-period EMA and SMA on this timeframe are each trending upward and considerably under the present worth, offering a powerful basis for continued assist. Quantity has barely decreased throughout consolidation, which is typical in a pause section earlier than a possible breakout or breakdown.

If BTC holds above the $103,600 assist, bulls might quickly try one other breakout, particularly if quantity picks up and macro circumstances stay favorable. A confirmed transfer above $105,000 would seemingly set off a surge towards the subsequent key psychological goal close to $110,000. On the draw back, a lack of $103,600 opens the door for a deeper pullback towards $100,000—an space of robust psychological and structural demand.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.