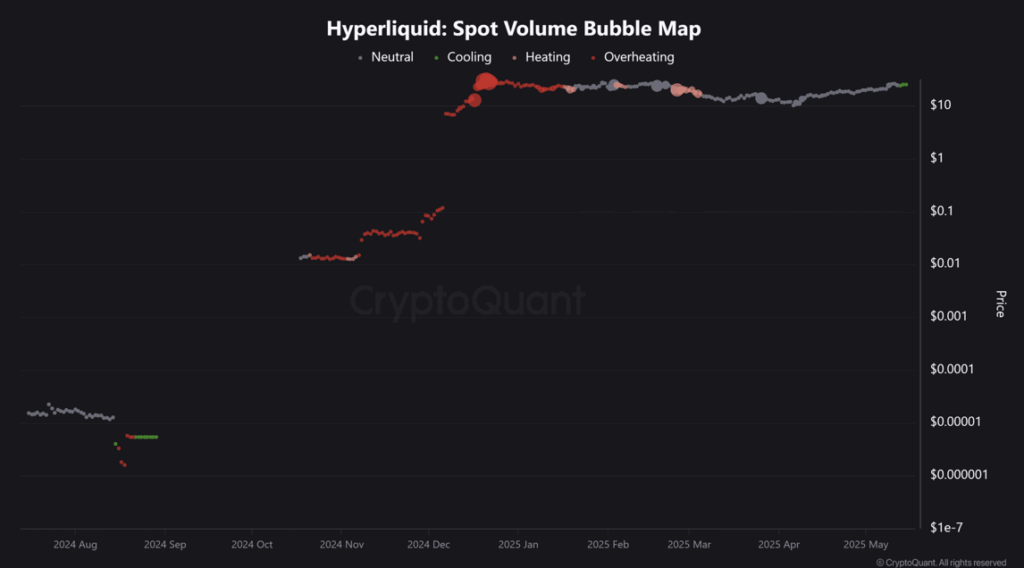

- HYPE Rallies However Spot Quantity Softens: Hyperliquid (HYPE) surged 9.5% prior to now 24 hours, however CryptoQuant knowledge exhibits spot volumes are dipping, suggesting retail demand could also be cooling regardless of the value spike.

- TVL Hits New Highs, Bullish Bias Holds: HYPE’s Whole Worth Locked (TVL) jumped over 4% to $1.073 billion, indicating sturdy capital inflows, whereas the lengthy/brief ratio stays skewed towards longs, signaling ongoing bullish sentiment.

- Bullish Channel Stays Intact: Regardless of spot quantity softening, HYPE continues to print greater lows and highs, sustaining a bullish channel that began in April, with potential for additional upside if momentum holds.

Hyperliquid (HYPE) simply popped – up 9.5% within the final 24 hours. However regardless of the surge, CryptoQuant knowledge exhibits that spot volumes are beginning to cool off. It’s a bizarre combine – the value is pushing greater, however the shopping for momentum? Not a lot.

Spot Quantity Dips, However Bullish Indicators Stay

Spot volumes often sign quick shopping for and promoting stress. Once they drop after a worth spike, it could possibly imply retail demand is petering out. And that’s what we’re seeing with HYPE proper now – volumes dipping at the same time as the value climbs.

However right here’s the catch – different metrics counsel the rally would possibly nonetheless have some juice left.

TVL Hits Recent Highs – Investor Confidence?

Over the past 24 hours, HYPE’s Whole Worth Locked (TVL) jumped over 4%, hitting $1.073 billion, in accordance with DefiLlama. That’s an honest bump and often alerts stronger capital inflows, whether or not via staking, lending, or DeFi protocols.

In the meantime, the Lengthy/Quick Ratio continues to be leaning closely towards longs. Most merchants are betting on extra upside, and once you pair that with a rising TVL, it may be a fairly sturdy signal that buyers aren’t achieved with HYPE simply but.

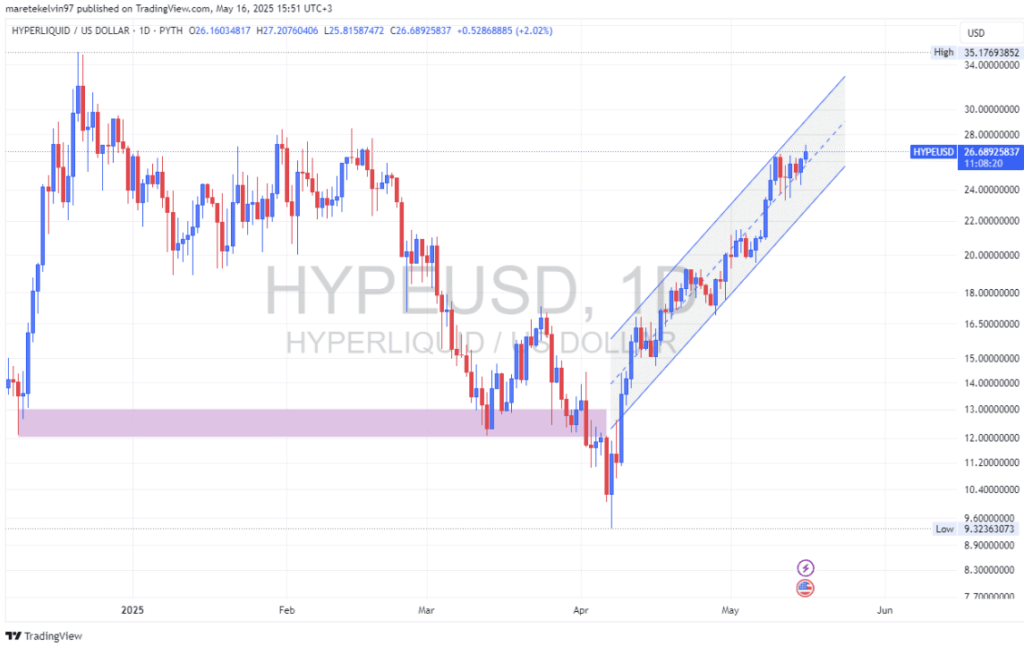

Technicals – Bullish Channel Intact

From a technical perspective, HYPE’s been driving a bullish channel since early April. It’s been printing greater lows and better highs – basic indicators of a wholesome uptrend. The latest surge suits proper into that sample, suggesting it’s a part of a broader momentum play fairly than only a one-off spike.

If HYPE retains up this tempo, the subsequent resistance ranges might come into play quickly. But when spot quantity retains softening, count on some uneven motion alongside the best way.

Backside Line – A Blended Bag

On the floor, issues look strong for HYPE – TVL’s climbing, the lengthy/brief ratio is long-heavy, and the bullish channel continues to be intact. However the decline in spot quantity hints that retail demand may be shedding steam. If that occurs, short-term volatility might kick in. But when the broader momentum holds, HYPE could possibly be gearing up for an even bigger run to greater targets.