The crypto business is present process important dialogue. An Ethereum advocate’s latest critique highlights issues about Bitcoin’s potential vulnerabilities like 51% assaults, questioning the sustainability of its proof-of-work mannequin. This isn’t mere debate—it displays a broader dialog about blockchain evolution, contrasting older techniques with newer scalable, safe networks.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

As Bitcoin’s reliability is being scrutinized alongside Ethereum’s developments, strategic buyers are reallocating towards initiatives emphasizing trendy infrastructure, DeFi innovation, and AI integration. Whereas Bitcoin stays dominant, this scrutiny underscores the necessity for adaptability in a altering market. On this surroundings, one of the best crypto to purchase now could also be these prioritizing innovation whereas addressing blockchain’s evolving challenges.

Ethereum Proponent Claims Bitcoin Is Susceptible to 51% Assaults

Ethereum bigwig Justin Drake simply dropped a bombshell—and Bitcoin maximalists aren’t thrilled. Whereas talking at a blockchain convention final week, Drake referred to Bitcoin’s safety mannequin as a “home of playing cards,” asserting {that a} 51% assault isn’t simply on the horizon—it’s seemingly.

These feedback are the echo of the publish written by Grant Hummer on X, which highlighted the shortfalls of Bitcoin.

1. Respectfully, BTC is totally screwed due to its safety funds. It might solely price $8B to 51% assault BTC at this time. When this will get all the way down to $2B (AKA, BTC’s safety market cap turns into 0.1% of its asset market cap), a 51% assault is nearly sure to occur. This can…

— gphummer.eth 🦇🔊 (@gphummer) Could 14, 2025

For the brand new consumer, a 51% assault is akin to a hostile takeover: if somebody has nearly all of the mining energy, they’ll reverse transactions, spend their cash twice, and basically use the blockchain as their playground. “Bitcoin’s enjoying with fireplace,” Drake claimed. “Its antiquated Proof-of-Work system is a bug, not a characteristic.”

Right here’s the meat: Bitcoin depends on miners fixing complicated math puzzles (PoW) to validate transactions, however Drake claims this makes it a sitting duck.

Why? Mining’s change into a rich-kid recreation—dominated by a couple of industrial-scale farms in locations like Texas and Kazakhstan. “Think about if a authorities or billionaire determined to gobble up mining rigs,” he mentioned. “Sport over.”

In the meantime, Ethereum ditched PoW in 2022’s “Merge” for Proof-of-Stake (PoS), the place validators lock up crypto as collateral. Translation: attacking Ethereum would price billions upfront, whereas attacking Bitcoin? Simply lease extra machines.

Bitcoin loyalists aren’t biting. “That is FUD,” fired again podcaster Nic Carter, pointing to Bitcoin’s 14-year hack-free streak. However Drake’s acquired a degree: 98% of Bitcoin mining swimming pools are managed by simply 4 firms.

Whether or not one buys the doomsday state of affairs or not, one factor’s clear—the crypto world’s safety debate simply acquired spicy. As Drake quipped: “Innovation doesn’t sleep. Neither ought to Bitcoin.”

Finest Crypto to Purchase Now

Because the crypto world absorbs the most recent blows traded between Ethereum and Bitcoin loyalists, a deeper undercurrent brews—belief, decentralization, and narrative management are now not monopolized by legacy leaders. Rising as one of the best crypto to purchase now, new gamers are seizing the cracks in previous hierarchies, positioning themselves as the subsequent symbols of resilience, utility, and cultural relevance in a market hungry for contemporary conviction.

XRP

In a world the place tribal wars between Bitcoin and Ethereum dominate headlines, XRP quietly escalates its mission—redefining world funds with precision and defiance. As previous titans conflict, XRP thrives within the shadows, constructing an unstoppable funds rail past the noise.

XRP, being the native cryptocurrency of Ripple, has established itself as a novel place in digital property by offering cross-border cost companies with excessive velocity, cost-efficiency, and scalability.

It started with RipplePay, a peer-to-peer community that Ryan Fugger developed in 2004 to facilitate direct transactions with no intermediary.

This modification has assisted in shifting the standard system, lengthy beset by delay and expense, to a system that facilitates remittances and international funds.

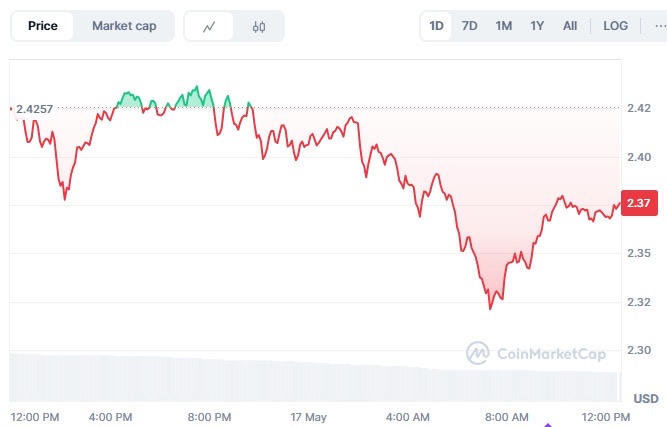

In technical phrases, it’s at present buying and selling at round $2.37, with a market cap of $139.36 billion, securing its place in 4th place. Nonetheless, over the previous 24 hours, it has been declining, creating a chance for potential consumers to profit from the dip.

There are rumors swirling throughout the crypto communities about Mark Zuckerberg’s tech big, Meta, buying Ripple Labs. If this occurs, it might take XRP to new heights.

BTC Bull

Whereas Bitcoin’s vulnerabilities spark heated debates, the bullish spirit behind its legacy is discovering new vessels. BTC Bull embodies that uncooked vitality, channeling the aggression of Bitcoin’s early days right into a hyper-charged, fearless narrative for the subsequent crypto era.

It’s excessive time to put money into BTC Bull, as Bitcoin has been on a roll, with JP Morgan analysts boldly saying that it might quickly change gold as the brand new hedge.

BTC Bull doesn’t simply comply with Bitcoin’s worth momentum; it amplifies the impact and rewards its customers handsomely by its twin mechanisms of token burn and airdrop.

On prime of that, staking rewards are at present over 300% APY, giving customers a number of methods to earn. Now, chasing a $6M presale goal, BTC Bull is undoubtedly outpacing its opponents.

Don’t mistake it for a joke meme coin, because it rewards customers with actual Bitcoin straight of their Finest Pockets, which provides unparalleled safety.

Finest Pockets Token

Amid narratives of protocol flaws and energy struggles, the longer term belongs to these providing simplicity, sovereignty, and accessibility. Finest Pockets Token isn’t simply watching the drama—it’s arming customers with a device that lets them work together with the crypto market seamlessly.

Because the crypto market stays in its early phases, there are quite a few shortcomings, such because the security-related one. Experiences of safety compromises, together with leaks of confidential buyer info or, within the worst attainable state of affairs, lack of funds, are sadly widespread.

This locations a lot emphasis on decentralization, pseudonymity, and anonymity that has led to decentralized crypto wallets as a shrewd funding prospect.

Finest Pockets Token is the native token of Finest Pockets, a non-custodial pockets that cuts out middlemen, permitting information to stay safe.

It’s a KYC-free software program pockets that options superior fraud safety, a cross-chain DEX, a crypto debit card, and far more.

Holding the $BEST token offers customers with benefits resembling free reductions, buying and selling perks, governance rights, greater staking yields, and entry to promotions on associate initiatives.

SUBBD

As fears of 51% assaults and fractured networks ripple by the house, SUBBD emerges as a cultural rebel—fusing memetics, DeFi, and emotional loyalty into a press release: belief isn’t coded, it’s earned by communities that refuse to kneel.

It’s a cryptocurrency that’s able to shake up all the creator financial system, power-packed with AI, enabling creators to generate extra inventive content material.

Whether or not it’s monetization, viewers engagement, content material era, or automation, SUBBD has the creators’ backs.

It operates on a Web3 platform, providing its group members the prospect to work together with spicy tales and giving them the chance to ask their favourite fashions about their fantasies.

One of many well-liked crypto YouTubers, ClayBro, has predicted parabolic returns from the SUBBD token.

Nonetheless, with a lot strain to ship new and fascinating content material each day, typically resulting in burnout, that’s the place SUBBD eases issues up by eliminating inventive blocks and automating half of the method.

Conclusion

Current critiques from Ethereum advocates about Bitcoin’s limitations have sparked renewed debate about blockchain priorities and speculative discussions. Whereas issues over vulnerabilities gasoline group debates, additionally they spotlight ongoing innovation because the business evolves. Savvy buyers acknowledge that market uncertainty typically precedes progress: scrutiny of Bitcoin’s limitations creates alternatives for different initiatives to realize traction.

From Bitcoin’s long-term holders to Ethereum’s advocates, and from rising tokens to DeFi innovators, this second might reshape market dynamics. The most effective crypto to purchase now isn’t about hype—it’s initiatives that tackle legitimate issues whereas demonstrating clear utility, adaptability, and sustainable use circumstances in a maturing ecosystem.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, straight or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.