Bitcoin is buying and selling in a slender vary between $100,000 and $105,000, sparking rising impatience amongst traders longing for the subsequent main transfer. After weeks of bullish momentum and a pointy climb from April lows, the market has entered a section of quiet consolidation. Whereas this sort of sideways value motion could appear uneventful, it typically precedes volatility, and merchants are watching carefully.

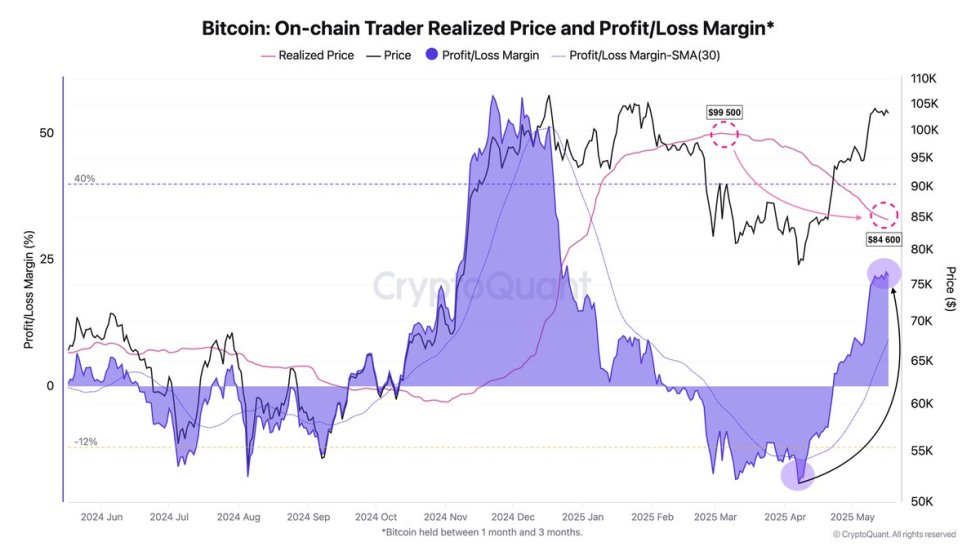

In line with contemporary information from CryptoQuant, merchants—these holding Bitcoin for 1 to three months—are actually firmly again in revenue territory. Their common revenue/loss margin has swung from a -19% deficit to +21% in only one month, highlighting how a lot the latest rally has shifted sentiment. The 30-day shifting common of their revenue now sits at round +9%, a wholesome however not but overheated degree.

This restoration in unrealized beneficial properties means that market members who purchased the dip have been rewarded and will now be positioning for one more leg up or getting ready to take income. Because the buying and selling vary tightens, the market seems coiled for a decisive transfer. Whether or not Bitcoin breaks new all-time highs or faces a deeper pullback stays to be seen. For now, the wait continues.

Merchants Again In Revenue As Bitcoin Eyes Value Discovery

Bitcoin is exhibiting indicators of energy because it hovers just under its all-time excessive close to $109,000. Regardless of latest upward momentum, the $105,000 resistance degree has confirmed tough to interrupt, preserving BTC locked in a decent vary between $100,000 and $105,000. This consolidation has created a way of market indecision, with bulls making an attempt to take care of management whereas bears take a look at their resolve. Nonetheless, the broader development stays bullish, and lots of traders consider a breakout into value discovery is imminent if present assist holds.

High analyst Darkfost shared insights into on-chain exercise, highlighting that merchants—outlined as wallets holding Bitcoin for 1 to three months—have returned to revenue. Their revenue/loss margin has shifted dramatically from -19% to +21% over the previous month, an indication of renewed market confidence. The 30-day shifting common for this cohort’s profitability now sits at +9%, indicating a wholesome however not extreme acquire.

Apparently, because the final correction, the realized value for these merchants has dropped to $84,600 and seems to be stabilizing. This implies elevated shopping for exercise in the course of the dip, reinforcing the bullish construction. Whereas present ranges are removed from the overheated zone of +40%, rising unrealized income might quickly tempt some traders to take partial beneficial properties.

The approaching days are more likely to be decisive. A breakout above $105K might open the doorways to cost discovery, whereas failure to carry assist might set off short-term promoting. For now, Bitcoin stays at a pivotal level.

Technical Particulars: Calm Earlier than The Large Transfer

Bitcoin is at the moment buying and selling round $103,300 after failing to interrupt via the $103,600 resistance degree. This space has develop into a key short-term barrier for bulls as value consolidates tightly beneath it. The chart reveals a transparent construction of robust bullish momentum from early Could, pushing BTC from the $87,000 space into the $100K–$105K zone. Nevertheless, latest candles replicate indecision, with a number of wicks above $103,600 being rejected and the worth closing beneath.

Regardless of the rejection, bulls proceed to defend the $100,000 assist degree successfully. The 200-day EMA and SMA are far beneath present costs—sitting round $88,000 and $92,600—highlighting the energy of the latest uptrend. Quantity is reducing barely, suggesting that merchants are ready for a transparent breakout or breakdown earlier than committing to a brand new path.

If Bitcoin can reclaim and maintain above $103,600, a retest of the all-time excessive close to $109K turns into more and more seemingly. Alternatively, a lack of $100K might open the door to a deeper retrace towards the $96K–$94K vary.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.