After a quiet weekend of low volatility, Bitcoin is making ready for a decisive transfer. Value motion has consolidated into a decent vary between $100,000 and $105,000—traditionally a setup that precedes huge breakouts or sharp corrections. Bulls stay in management for now, however the momentum is fragile and will rapidly shift if BTC breaks beneath key assist ranges across the $100K mark.

The broader market is rising impatient, with many traders anticipating a breakout to all-time highs. Nevertheless, warning stays. Crypto analyst Daan shared insights suggesting that Bitcoin has just lately proven indicators of relative weak spot in comparison with conventional equities. In keeping with Daan, this underperformance adopted the announcement of a US-China commerce deal, decreasing macroeconomic uncertainty and reigniting energy in shares.

Whereas Bitcoin surged strongly within the face of prior uncertainty, it has since stalled just under its all-time excessive, failing to outperform as equities proceed climbing. This divergence highlights that BTC is more and more being considered as a hedge during times of instability, reasonably than a risk-on asset. With rigidity easing, capital could also be rotating elsewhere, not less than within the quick time period. All eyes are actually on whether or not Bitcoin can break away from this vary and reclaim management.

Bitcoin Faces Resistance However Eyes Liquidity Above $105K

Bitcoin continues to consolidate above the $103,000 stage, forming a decent vary that sometimes precedes main strikes. Bulls are pushing to reclaim momentum, however resistance on the $105,000 mark stays sturdy. Liquidity clusters simply above this stage and into the all-time excessive zone round $109,000, making it a vital area for a possible breakout. Nevertheless, rising quick positions have saved stress on BTC, slowing upward momentum regardless of favorable broader circumstances.

Daan’s technical evaluation provides depth to this image. His assessment of the BTC/SPX 1D chart exhibits that Bitcoin has just lately didn’t outperform shares, a notable change from earlier weeks. The relative weak spot adopted information that the US reached a “Deal” with China, decreasing market uncertainty and fueling a risk-on rally in equities. Bitcoin, however, stalled just under its highs.

This divergence means that Bitcoin is evolving into an asset that traders lean into during times of outflows or international instability. Whereas it could be underperforming within the quick time period in comparison with equities, BTC’s sturdy run-up previous to the commerce deal stays intact. Daan notes that continued monitoring of this ratio is important because the macro atmosphere shifts, particularly if new volatility emerges.

Weekly Chart Evaluation: Breakout Affirmation Nonetheless Pending

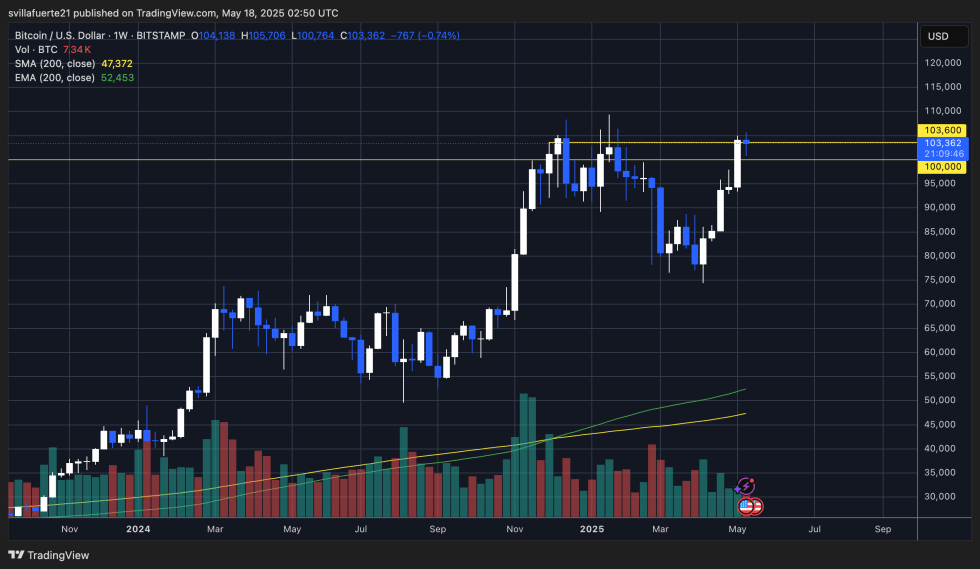

The weekly chart for Bitcoin exhibits a robust restoration from the April lows, with BTC now consolidating just under the important thing $105,000 resistance zone. After reclaiming the $100,000 psychological stage with a strong bullish candle, the worth is stabilizing round $103,000–$104,000, suggesting rising stress for a breakout into new all-time highs.

Quantity has remained comparatively steady, with no excessive spikes, indicating regular curiosity reasonably than aggressive hypothesis. The construction nonetheless favors the bulls, as the present weekly candle holds above final week’s excessive and the worth continues to commerce nicely above each the 200-week easy transferring common (SMA) at $47,372 and the exponential transferring common (EMA) at $52,453.

The chart means that if Bitcoin can shut the week above $105,000, we may see an explosive transfer into worth discovery. Nevertheless, repeated rejections at this stage would enhance the chance of a short-term correction. The $100,000 mark stays the important thing assist for sustaining a bullish construction.

Momentum stays with the bulls, however warning is warranted as that is traditionally a high-risk, high-reward zone. Merchants are watching intently to see if Bitcoin can break cleanly above resistance and start a brand new leg greater.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.