- Technical Construction and Resistance: Dogecoin (DOGE) has damaged out of a descending channel and retested it as help, confirming a bullish construction. It’s at the moment buying and selling round $0.2238, with the $0.25 stage appearing as quick resistance. A decisive break above this stage may set the stage for a rally towards $0.35, however failure to reclaim it might result in a pullback.

- Bullish Momentum Pushed by Quick Liquidations: On Could 18th, quick liquidations amounted to $387K, whereas lengthy liquidations have been simply $65K, indicating a market-wide quick squeeze that might push costs larger.

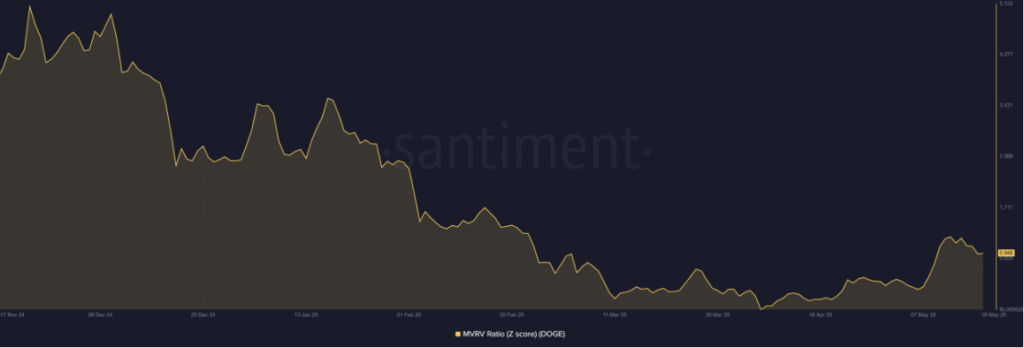

- MVRV Z-Rating and Volatility Issues: The MVRV Z-score sits at 0.94, suggesting room for additional positive aspects as most holders aren’t sitting on substantial unrealized income. Nonetheless, a pointy spike in DOGE’s Inventory-to-Stream Ratio to 99.53 raises potential volatility issues, as related spikes have traditionally led to each rallies and corrections.

Dogecoin (DOGE) has managed to reclaim some key technical floor after breaking out of a descending channel and retesting it as help — an indication of bullish construction holding regular. For the time being, the worth hovers round $0.2238, marking a 3.37% achieve previously 24 hours. The $0.25 zone looms as quick resistance, a stage that after served as help however has since flipped to a provide zone.

Potential Rally or Retracement?

A convincing break above $0.25 may set the stage for a rally towards $0.35. But when DOGE fails to decisively reclaim this stage, a short-term pullback may be on the playing cards.

Quick Liquidations Gasoline Bullish Momentum

On-chain liquidation information reveals a notable shift in favor of bulls. On Could 18th, quick liquidations amounted to $387K, whereas lengthy liquidations have been a mere $65K. This disparity factors to a market-wide quick squeeze, with bears exiting underwater positions. Such imbalances usually speed up worth motion, creating upward strain on the asset.

MVRV Z-Rating Factors to Extra Upside

The MVRV Z-score for Dogecoin stands at 0.94 — properly beneath the two.5 threshold generally linked to overvaluation. This metric compares market cap to realized cap, offering a snapshot of common holder profitability. A low rating signifies that almost all holders aren’t sitting on vital unrealized income, minimizing the motivation to promote.

Thus, the present studying suggests room for additional worth positive aspects.

Volatility Issues Come up

DOGE’s Inventory-to-Stream Ratio has surged to an unprecedented 99.53, signaling a big slowdown or perhaps a halt in circulating provide progress. Whereas perceived shortage is rising, such spikes within the Inventory-to-Stream Ratio have traditionally preceded each main rallies and corrections. Merchants ought to regulate potential volatility.

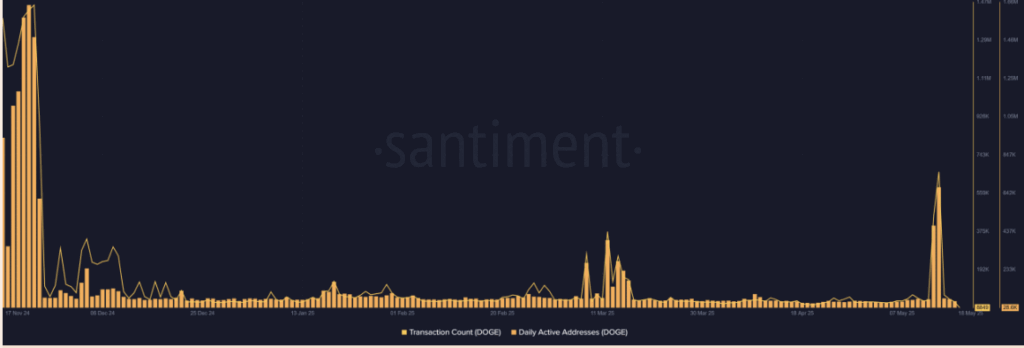

Community Exercise Spikes, Then Drops

Earlier in Could, day by day lively addresses surged to over 500K however have since plummeted to simply 28.6K. Equally, transaction counts dropped from their month-to-month highs to a mere 8.8K. This abrupt decline raises issues that the sooner rally was pushed extra by speculative curiosity than by sustained community utility.

Blended Alerts in Derivatives Knowledge

DOGE derivatives information presents a combined outlook. Whole quantity dropped 22.05% to $3.46B, hinting at waning speculative curiosity. But, Open Curiosity (OI) rose 2.7% to $2.64B, suggesting that merchants are holding their positions. Choices OI additionally jumped 10.61% to $378.98K, indicating rising demand for volatility publicity or hedging, whereas Choices Quantity sank 85.89%, pointing to diminished intraday hypothesis.

Can DOGE Maintain Above $0.25?

Dogecoin has a shot at reclaiming $0.25 and sustaining the breakout, bolstered by vital quick liquidation strain, a low MVRV ratio, and regular OI. Nonetheless, inconsistent on-chain exercise and the sudden spike in Inventory-to-Stream Ratio pose dangers of elevated volatility. Affirmation of a transfer above $0.25 with stable quantity could be essential for validating the subsequent leg up towards $0.35.