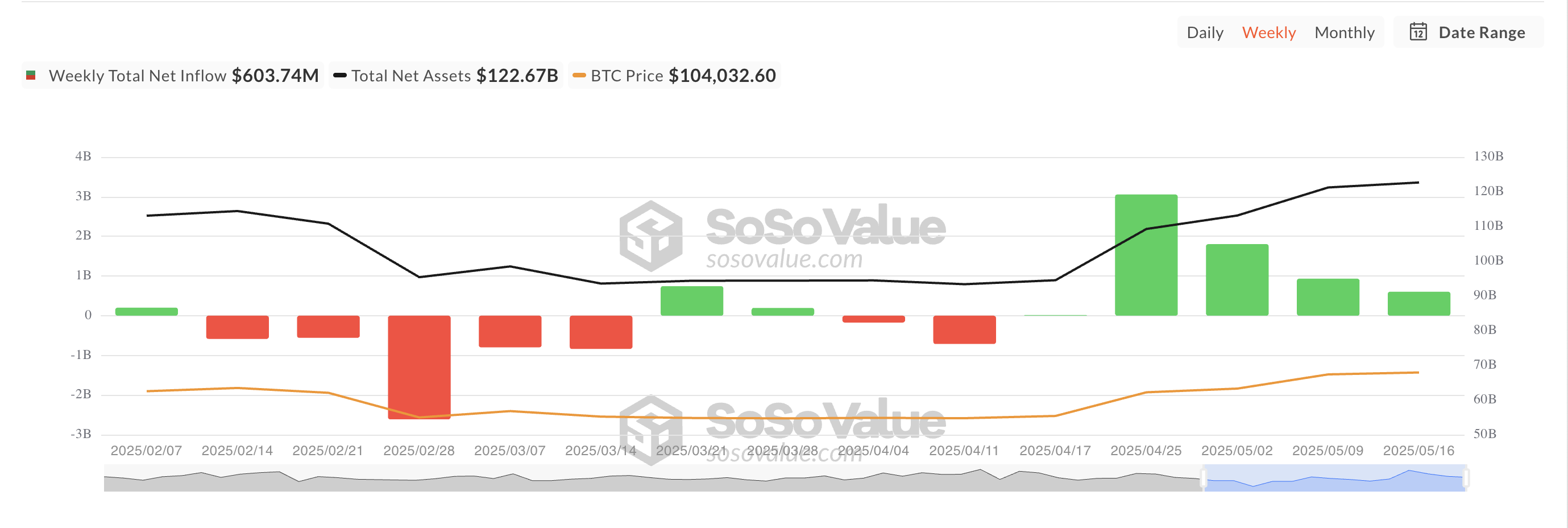

Final week, US-listed spot Bitcoin exchange-traded funds (ETFs) recorded web inflows exceeding $600 million.

Whereas this marked a continuation of optimistic capital motion into digital asset merchandise, it additionally had the bottom weekly influx determine previously month, signaling investor warning or profit-taking at greater ranges.

ETF Inflows Sluggish as Worth Consolidation Cools Investor Urge for food

Between Might 12 and Might 16, inflows into spot BTC ETFs totaled $603.74 million. Though this was a web optimistic by way of influx into these funds, final week’s determine was the bottom weekly influx previously month. This highlights a extra cautious however sustained capital motion into the market.

The slowdown in ETF inflows may be linked to BTC worth consolidation throughout the five-day interval underneath assessment. All through that interval, BTC traded sideways, dealing with resistance at round $104,971 whereas discovering constant help at $102,711.

This lack of clear motion doubtless led some traders to be extra cautious, leading to lowered capital inflows into BTC ETFs final week.

BTC Eyes Recent Highs

Nonetheless, bullish momentum persists within the BTC market. The king coin briefly surged to a three-month excessive of $107,108 throughout Monday’s early Asian buying and selling session. Whereas it has since corrected to commerce at $104,956, the bullish bias towards the coin stays important.

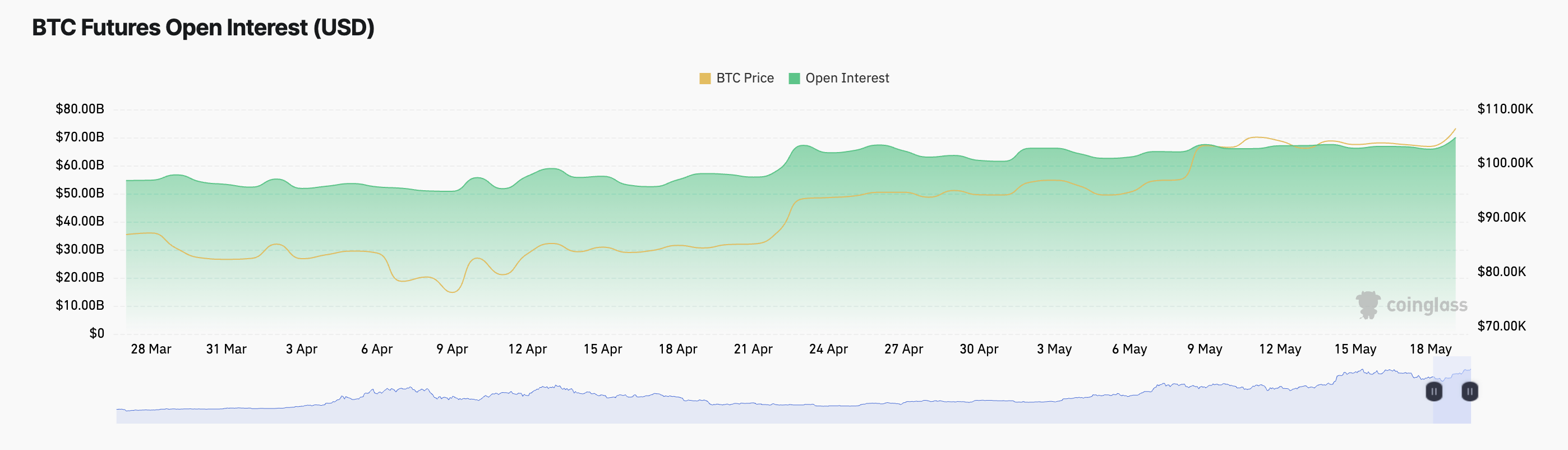

BTC’s worth uptick comes alongside an increase in its futures open curiosity. This stands at $70.03 billion at press time, climbing 7% over the previous day.

Open curiosity refers back to the complete variety of excellent spinoff contracts, equivalent to futures or choices, that haven’t been settled. When open curiosity rises alongside worth, it usually indicators that new cash is getting into the market. This helps the energy of BTC’s ongoing pattern and will set off a sustained worth uptick within the close to time period.

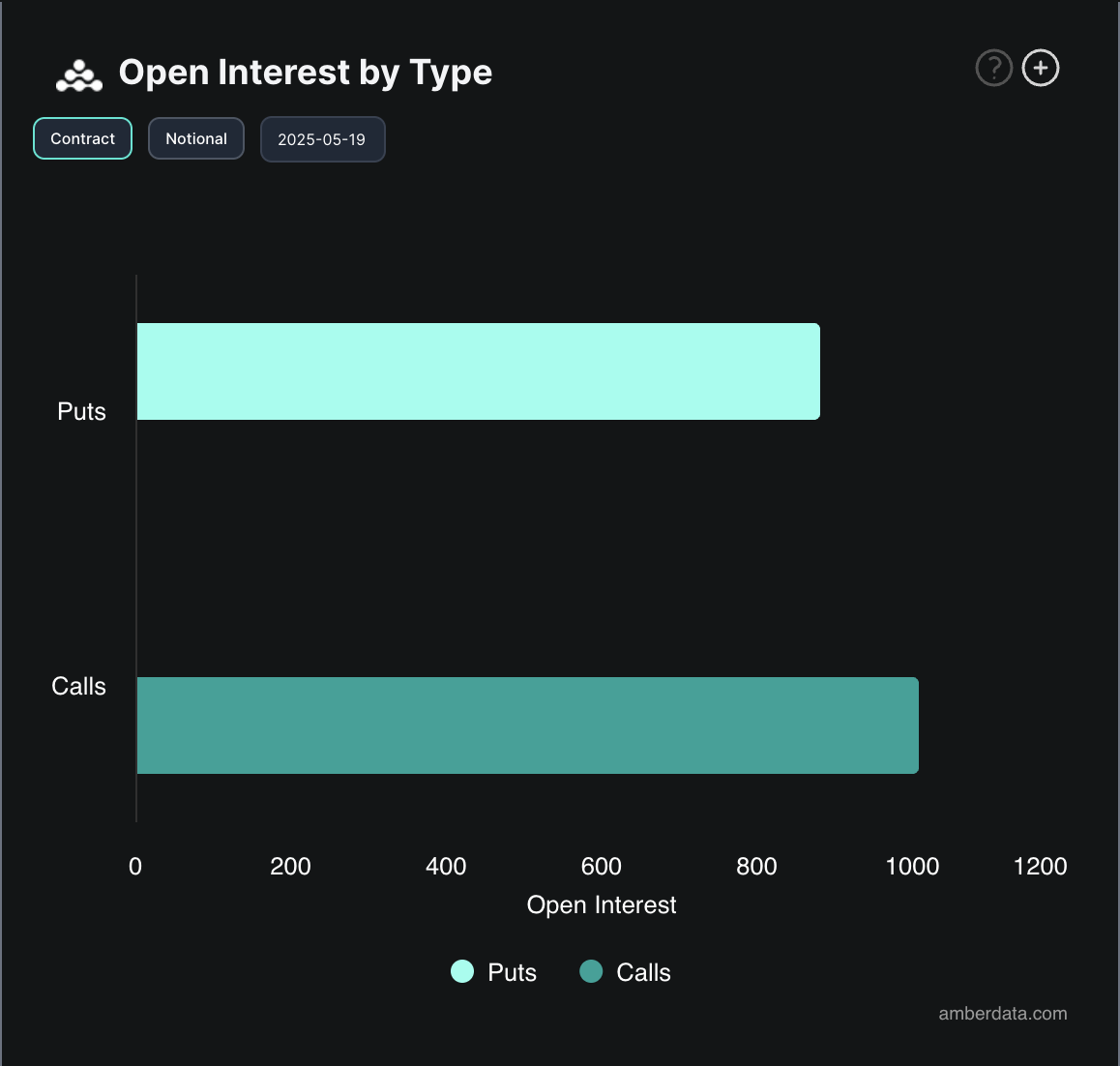

Furthermore, choices market information additional helps this optimistic outlook. In the present day, the demand for name choices has outpaced places, pointing to a rising demand for bullish positioning.

Nonetheless, with derivatives exercise surging and BTC reclaiming greater worth ranges, the coin may attain new highs within the brief time period.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.