- Value Drop: BONK fell 14%, buying and selling at $0.00001875, with resistance at $0.00002039 and assist at $0.00001572.

- Information Insights: On-chain quantity drops; $251K in lengthy liquidations counsel merchants keep bullish.

- Partnership Enhance: New take care of Nasdaq-listed DeFi Growth Corp may raise market sentiment.

Bonk (BONK), a Solana-based meme coin with a market cap exceeding $1.436 billion, confronted a tough patch final week as its worth dipped by 14%. Regardless of broader market traits favoring smaller cryptos and Solana-based memes, BONK lagged behind, whereas blue-chip DeFi tokens like Dogwifhat (WIF) led in positive factors.

Combined Technical Alerts for BONK

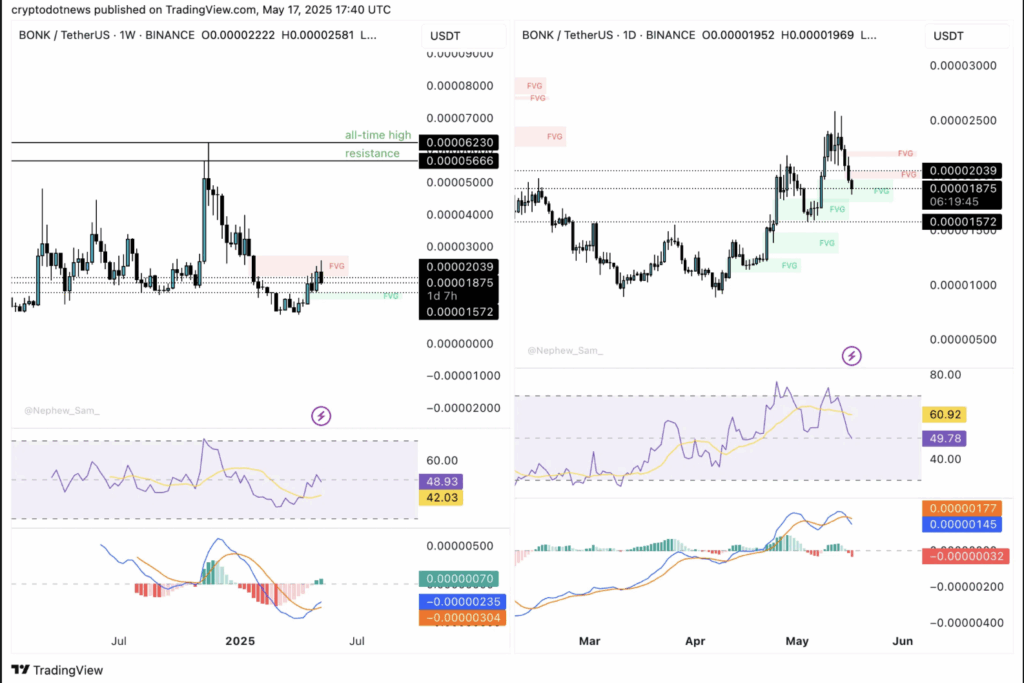

The each day and weekly charts paint a combined image for BONK. On the weekly timeframe, technical indicators like MACD trace at underlying bullish momentum, flashing inexperienced bars that counsel potential upside. The RSI reads 48, hovering close to impartial territory.

At the moment buying and selling at $0.00001875, BONK faces its nearest resistance at $0.00002039, marking the decrease boundary of a Truthful Worth Hole (FVG) on the weekly chart. On the draw back, the closest assist stage lies at $0.00001572 — the decrease boundary of a bullish imbalance zone.

On the each day chart, the outlook seems extra bearish. The MACD has flipped unfavorable, displaying purple histogram bars, and the RSI sits at 49, additionally close to impartial. Whereas BONK is in an upward pattern, it has slipped into the imbalance zone, a sign that additional correction might be on the horizon. Nonetheless, ought to BONK collect liquidity and rebound, targets at $0.00002039 and $0.00002581 come into focus, each marked by decrease FVG boundaries on the each day timeframe.

On-Chain Information Displays Market Fatigue

On-chain knowledge from Santiment reveals a decline in transaction quantity and social dominance for BONK over the previous week. Decrease transaction quantity suggests diminished buying and selling exercise, whereas decreased social dominance signifies waning curiosity from retail merchants and influencers.

Curiously, regardless of the dip, Santiment knowledge doesn’t point out a major uptick in promoting stress. This might imply that whereas curiosity in BONK has light considerably, there hasn’t been a notable enhance in bearish sentiment.

Derivatives Information: Lengthy Liquidations Pile Up

Information from Coinglass reveals a surge in lengthy liquidations over the past 24 hours, with over $251,000 in longs liquidated in comparison with simply $2,670 in shorts. The lengthy/quick ratio on OKX reads 1.81, suggesting that regardless of the worth dip, derivatives merchants stay bullish on a possible BONK restoration.

New Partnership Might Be a Sport Changer

Past worth motion, BONK introduced a noteworthy partnership with DeFi Growth Corp, a Nasdaq-listed agency, for the launch of its meme coin validator. The event is pivotal because it marks the primary collaboration between a Solana-based meme token and a publicly listed firm.

In keeping with the BONK staff, the partnership will increase validator protection, bolster BONKSOL, the community-run Liquid Staking Token, and additional decentralize Solana’s community infrastructure. As BONK pilots this initiative, it may set a precedent for future collaborations between meme tokens and established companies, doubtlessly influencing market sentiment and worth motion within the weeks forward.