If merchants had a crystal ball, their largest want can be understanding the right way to purchase XRP on the backside. Very true in crypto, the place the mantra stays: “Wen moon?” Translation: “Are we lastly on the backside?”

First, a heads up: among the technical evaluation instruments and strategies mentioned right here would possibly differ from typical knowledge. Why? As a result of, similar to some other subject, buying and selling theories and finest practices evolve. It could take years for these up to date practices to trickle down from the professionals to retail merchants. Typically, even the professionals lag behind in adopting these modifications!

For this piece, we’ll dissect the anatomy of a market backside utilizing XRP, one of the extensively adopted cryptocurrencies.

First Issues First

Information is anecdotal.

That’s a well mannered approach to say, “information doesn’t matter.” In case you ever chase skilled certifications just like the CMT (Chartered Market Technician) or CFTe (Licensed Monetary Technician), you’ll dive into works like “Behavioral Investing” by James Montier, which tackles the impact of stories on markets.

The TL;DR? Information solely issues if the value strikes. If value doesn’t react meaningfully, the information is irrelevant. Folks merely look to the information as an evidence or a motive for one thing that occurred.

If we need to purchase XRP on the backside, there’s a number of instruments that may assist determine and time it accurately. The 2 instruments I’m going to deal with is the RSI and Stocktwits’ social sentiment information.

RSI: It’s About Context, Not Blind Ranges

If you wish to purchase XRP on the backside, the RSI may also help. Heads up: you’ve most likely been utilizing RSI incorrectly – or, at the very least, not as effectively as you may. Don’t really feel unhealthy, although. The way in which professionals interpret RSI shifted practically 20 years in the past… however once more, even professionals typically take ages to adapt.

The RSI (Relative Power Index) is among the many most acquainted and utilized indicators amongst merchants.

In 1978, J. Welles Wilder launched the RSI. Again then, it was revolutionary. Why? As a result of RSI thrives in ranging markets, precisely what buyers skilled throughout Wilder’s time:

Up to date RSI Use

In 2008, Connie Brown – arguably one of many world’s best residing analysts and merchants – remodeled how RSI is known in her ebook, Technical Evaluation for the Buying and selling Skilled (obligatory studying for certifications like CMT and CFTe).

With out going into the nitty gritty, the RSI ought to now be considered as one thing that’s both in a bull market or a bear market. And whereas every instrument and timeframe is barely totally different, the everyday OB (overbought) and OS (oversold) ranges are:

Bull Market:

- OB 1 – 80

- OB 2 – 90

- OS 1 – 50

- OS 2 – 40

Bear Market:

- OB 1 – 65

- OB 2 – 55

- OS 1 – 30

- OS 2 – 20

Living proof: XRP’s day by day chart from Might 2019 to June 2020

The RSI stage 65, particularly throughout this timeframe, acted as a comparatively constant supply of resistance, whereas 30 and 20 acted as assist.

However how are you going to inform if RSI is bullish or bearish? Easy – overlay these ranges, and whichever aligns higher with current actions, that’s it.

Taking a look at XRP’s weekly chart now, my interpretation is bullish since XRP respects the OS stage at 50 as assist.

Stocktwits Social Sentiment: A Cheat Code?

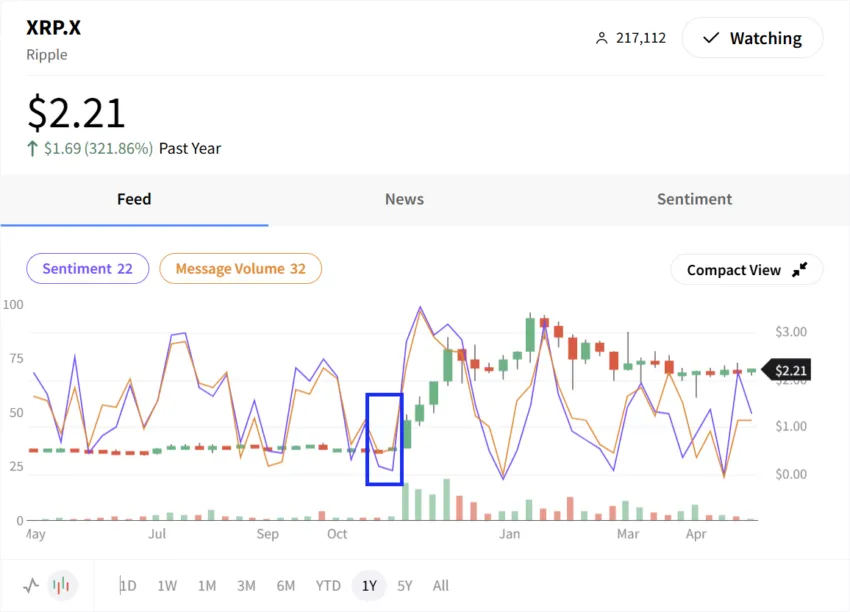

Stocktwits’ social sentiment information is one other highly effective software when attempting to purchase XRP on the backside. Stocktwits captures insights completely from merchants and buyers – no random chatter from common social media.

Right here’s what I’ve discovered particularly invaluable:

- If message quantity rises however sentiment stays flat or drops, I’m on the lookout for bullish setups. Folks usually speak about doing one thing earlier than truly doing it.

November 2024 illustrates this completely:

- Week of October 27, 1014: Sentiment 24, Quantity 30

- Subsequent week: Sentiment drops to 22, Quantity climbs barely to 32

This sentiment/quantity divergence usually alerts upcoming bullish momentum.

Latest XRP Sentiment Exercise

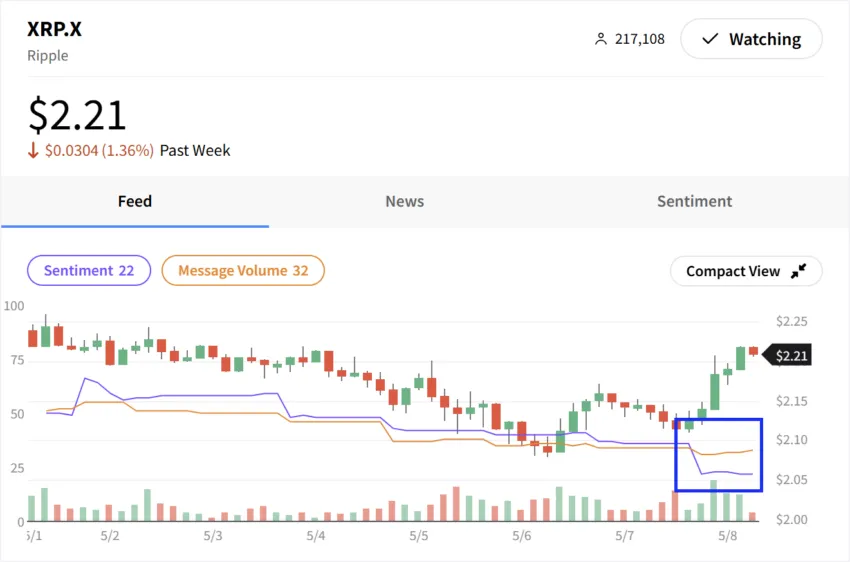

At the moment, there may be an much more dramatic divergence:

One other key sample: When value flattens and sentiment dips steadily, it signifies merchants are late in recognizing market course. For me, that’s not only a sign to hop on – it’s a sign to safe a major seat earlier than everybody else rushes in.

Briefly, figuring out market bottoms isn’t about being first; it’s about understanding context, leveraging up to date evaluation strategies, and decoding nuanced market sentiment. That’s the anatomy of a backside—the XRP version.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.