Bitcoin noticed a pointy reversal on Sunday, surging to $107,000 earlier than retracing over 4% in just some hours — a basic fakeout that has left the market shaken. The rejection at native highs has sparked debate amongst high analysts: some warn of a looming correction as BTC struggles to interrupt into value discovery, whereas others stay bullish, anticipating a breakout above the all-time excessive round $109,000. This volatility underscores rising investor uncertainty amid an absence of clear macro drivers.

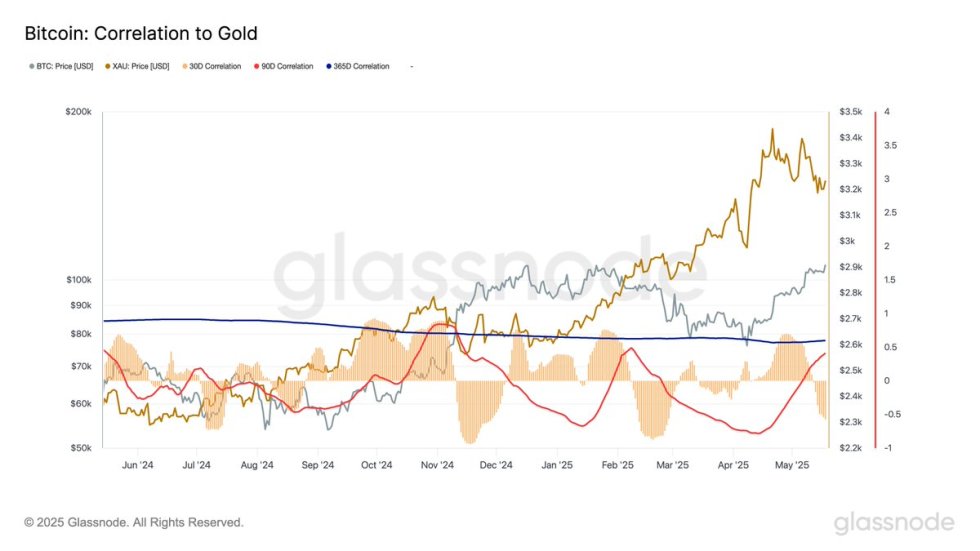

Glassnode knowledge provides an attention-grabbing dimension to this setup: Bitcoin’s short-term correlation to gold has dropped to -0.54 over the previous 30 days, the bottom since February. In different phrases, Bitcoin could also be coming into a novel part the place it trades extra independently of conventional secure havens. As BTC consolidates round key ranges, the approaching days might convey heightened volatility and demanding value motion. The market now watches intently to see if bulls will reclaim momentum — or if a deeper correction is on the horizon.

Bitcoin Assist Faces Strain As Correlation With Gold Hits Low

Bitcoin is presently navigating a essential zone, with bulls urgently defending the $100,000 mark to keep up bullish momentum. After briefly touching $107,000 over the weekend, BTC skilled a pointy 4% retrace, signaling rising indecision and sparking a wave of concern amongst buyers. The worth now hovers close to key short-term assist, and whereas the long-term construction stays bullish, failure to carry $100K might set off additional draw back into decrease demand zones.

Regardless of the sell-off, many merchants consider the trail ahead nonetheless holds upside potential. Liquidity clusters stay simply above the $105,000 stage, and a breakout above this area might ignite a rally into new all-time highs close to $109,000. Nonetheless, the shortage of follow-through following Sunday’s breakout try has shaken market sentiment, with some individuals anticipating a broader correction earlier than any sustained transfer increased.

Glassnode knowledge provides one other layer to the evaluation. Over the previous 30 days, Bitcoin’s short-term correlation to gold has dropped to -0.54, the bottom since February, suggesting BTC is diverging from conventional secure havens within the present macro surroundings. In the meantime, its 90-day and 365-day correlations to gold stay constructive at 0.39 and 0.60, respectively. This means that though Bitcoin nonetheless shares medium- to long-term behavioral patterns with gold, its short-term efficiency is more and more pushed by crypto-native market forces and hypothesis.

As Bitcoin consolidates and prepares for its subsequent transfer, all eyes are on the $100K assist stage and the $105K-$109K resistance zone. If bulls can defend this key construction and reclaim momentum, the stage will likely be set for value discovery. But when assist fails, a deeper retracement might comply with — probably resetting bullish expectations within the brief time period.

Bitcoin Pulls Again After Rejection – Key Assist In Focus

Bitcoin’s value motion on the day by day chart reveals a pointy rejection close to the $107,000 stage, adopted by a swift retracement to the $103,000 zone. The latest wick to the upside marked a possible fakeout above earlier resistance, indicating heavy promoting stress on the highs. This has triggered a 3.36% pullback on the day, with BTC presently buying and selling round $102,943.

Regardless of the drop, the broader construction stays bullish so long as Bitcoin stays above the essential $100,000 assist stage. The 200-day SMA at $92,801 and the EMA at $88,469 provide deeper structural assist, however bulls will goal to defend the psychological $100K mark to keep up momentum. A day by day shut under $100K might invite additional promoting and shake confidence within the present rally.

Quantity on the retracement is notable however not excessive, hinting that the selloff should still be a part of a broader consolidation relatively than a full development reversal. For upside affirmation, BTC should reclaim and maintain the $105,000–$107,000 space to problem its all-time excessive close to $109K. Till then, merchants ought to look ahead to value stability above $100K or threat a deeper correction as volatility stays elevated.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.