- Sharpe Ratio Positive aspects: Bitcoin’s Sharpe ratio is catching as much as gold’s, suggesting comparable risk-adjusted returns, with Constancy’s Jurrien Timmer recommending a 4:1 gold-to-BTC ratio.

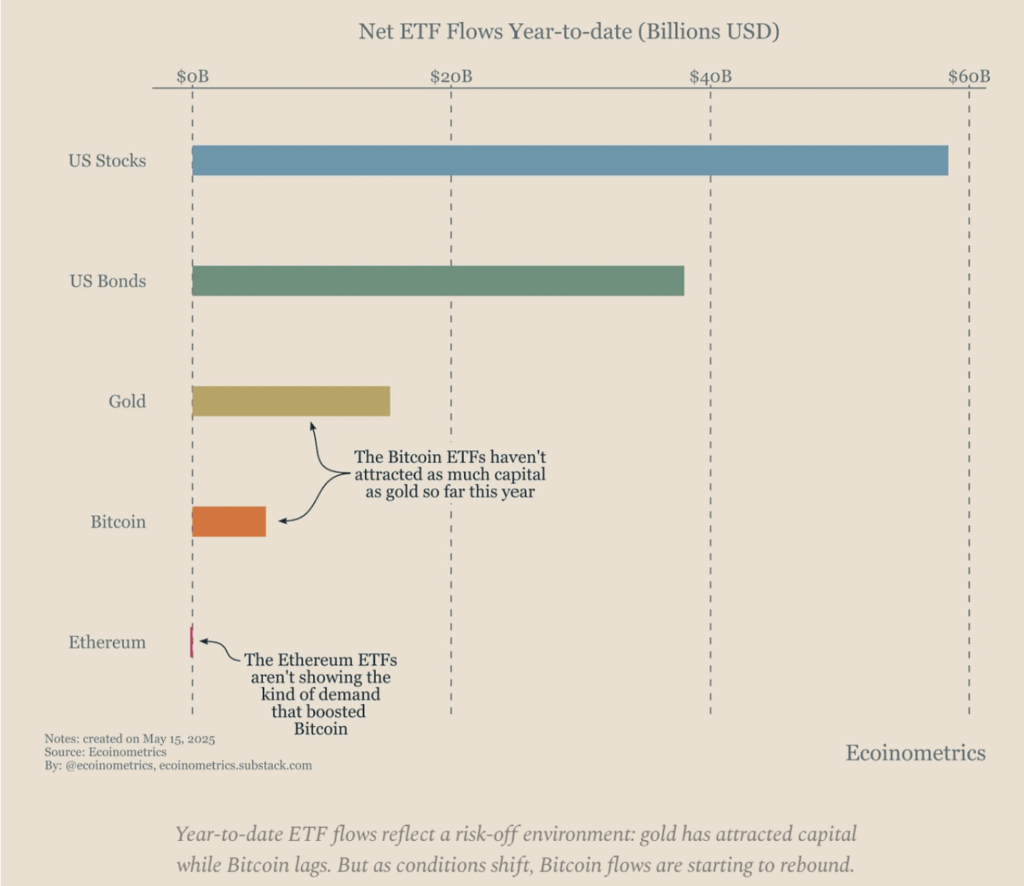

- ETF Flows Shift: Q1 2025 noticed Bitcoin ETF inflows drop to a 3rd of 2024’s $35 billion, whereas gold ETFs gained resulting from financial uncertainty and Fed coverage shifts.

- Bullish Projections: Bitcoin Suisse forecasts BTC reaching $110K to $220K in 2025, with a high-end goal of $444K if it aligns with gold’s market dynamics.

Bitcoin (BTC) is holding robust above $100,000, prompting Constancy’s Jurrien Timmer to recommend it would reclaim its standing as a high store-of-value asset. Timmer’s newest evaluation highlights a convergence within the Sharpe ratios of Bitcoin and gold, implying that their risk-adjusted returns have gotten more and more comparable.

Bitcoin vs Gold: Sharpe Ratio Comparability

Timmer factors to Bitcoin’s Sharpe ratio rising to $15.95 towards gold’s $22.48, closing the hole in relative efficiency. He recommends a 4:1 gold-to-Bitcoin ratio for a balanced SoV hedge. “It’s fascinating that gold stays essentially the most negatively correlated asset to Bitcoin regardless of each being store-of-value performs,” Timmer famous.

ETF Flows and Market Dynamics

Whereas Bitcoin held agency above $100K, Q1 2025 wasn’t all easy crusing. In keeping with Ecoinometrics, Bitcoin ETFs noticed a pointy decline in inflows — only a third of 2024’s $35 billion — whereas gold ETFs gained traction. Analysts attribute this shift to US financial uncertainty and Federal Reserve coverage adjustments, prompting traders to favor gold as a secure haven.

Bitcoin’s Path to New Highs

Bitcoin Suisse tasks a robust outlook for BTC, citing its rising Sharpe ratio as a key driver for potential all-time highs above $110K. With 88% of its provide in revenue, Bitcoin is positioned as a “Swiss military knife asset,” thriving no matter broader market traits. Analysts recommend BTC might hit $220K to $444K by 2025, relying on how its community worth interacts with gold’s market dynamics.