Circle’s USDC and Tether’s USDT stay the highest two stablecoins. In 2025, USDC exhibits indicators of robust progress in quantity and market share. Nonetheless, it nonetheless trails behind the market chief, USDT.

This text examines key information on USDC from Kaiko’s newest report and evaluates USDC’s place within the extremely aggressive stablecoin market.

Can USDC Overtake USDT on Centralized Exchanges?

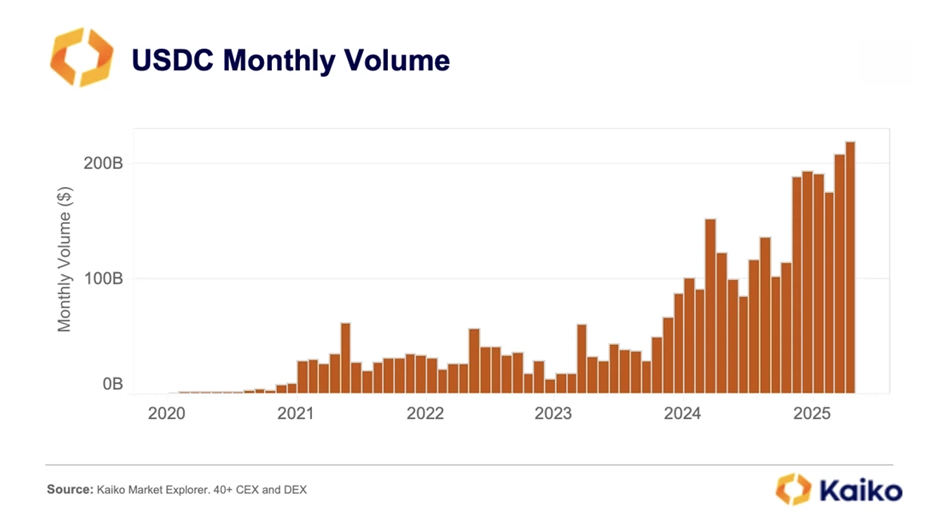

Based on a report from Kaiko Analysis, USDC reached a brand new document in buying and selling quantity with $219 billion in April 2025. That determine is greater than double the $106.5 billion recorded in January 2024.

Binance, the world’s largest crypto trade, performed an important position. Because of a strategic settlement signed with Circle in December 2024, it accounted for over 57% of USDC’s international buying and selling quantity.

Kaiko information signifies that USDC’s market share amongst stablecoins on Binance elevated from 10% on the finish of final 12 months to just about 20% right this moment.

In distinction, USDT’s market share on Binance decreased from 75% on the finish of 2024 to roughly 60% right this moment.

Two predominant elements clarify this spectacular progress in USDC’s quantity and share. First, the partnership with Binance gave USDC entry to a big person base.

Second, USDC benefited from the rising demand for regulatory-compliant stablecoins, particularly in Europe, the place the MiCA framework is now in impact.

“The deal can be extremely worthwhile for Binance, with Circle paying over $60 million upfront plus ongoing incentives, whereas aligning with Binance’s compliance push beneath Europe’s MiCA guidelines.” – Kaiko reported.

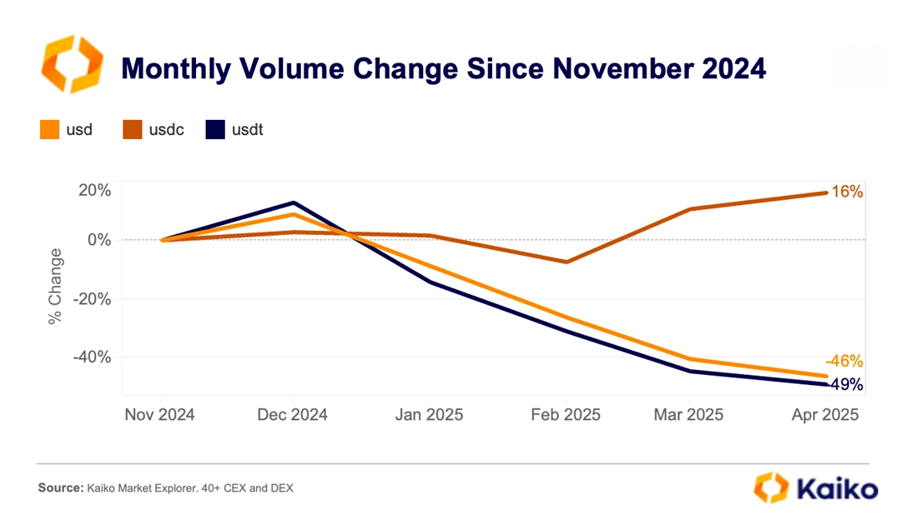

Moreover, when evaluating the amount modifications between USDC and USDT throughout the identical interval, USDC stands out because the stronger performer.

Since November 2024, USDT’s month-to-month quantity has dropped by 49%. In distinction, USDC’s quantity has elevated by 16%.

“Whereas USDC is gaining momentum on centralized exchanges, Tether’s USDT is dealing with headwinds. USDT buying and selling volumes on CEXs have dropped sharply… mirroring a broader contraction in USD-denominated buying and selling exercise. This decline displays persistent risk-off sentiment, weaker retail engagement, and restricted speculative urge for food throughout crypto markets.” – Kaito defined.

Regardless of USDC’s progress, it nonetheless has an extended approach to go earlier than it catches up with USDT. As of Might 2025, USDT’s market capitalization is $152 billion, 2.3 occasions increased than its market cap in July 2022.

In the meantime, USDC’s market cap is $60 billion, solely 12% increased than its July 2022 stage.

Tether, the corporate behind USDT, additionally reported excellent earnings. It earned $13 billion in 2024, in comparison with Circle’s $155 million over the identical 12 months. As well as, USDT nonetheless dominates in off-exchange purposes, particularly in cross-border funds.

USDC and USDT proceed to be the highest stablecoins. Nonetheless, the stablecoin area may change shortly as new rivals emerge. Main monetary establishments like PayPal, World Liberty Monetary, Constancy, Ripple, BlackRock, and Meta have entered the competitors.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.