- Authorized Setback: Ripple’s request to cut back a $125 million tremendous to $50 million was denied by a U.S. choose, however market response remained muted.

- Technical Rebound: XRP rebounded from $1.65 assist, breaking above the 100-day SMA to $2.65, with bullish momentum forming a possible pattern reversal sample.

- Institutional Push: CME Group will launch commonplace and micro XRP futures on Might 19, opening the door for institutional publicity to the asset.

XRP is discovering new energy after months of bearish stress, buoyed by favorable technical setups, a bullish market backdrop, and hypothesis over institutional curiosity through CME’s futures platform.

Authorized Woes and Resilience

Ripple hit one other authorized snag in its ongoing battle with the SEC. On Thursday, U.S. District Decide Analisa Torres rejected a joint movement from Ripple and the SEC to cut back the civil tremendous from $125 million to $50 million, citing inadequate grounds underneath Rule 60. Regardless of the authorized setback, investor sentiment seems to be stabilizing, with the market displaying restricted response to the ruling.

XRP Rebounds Off Key Assist

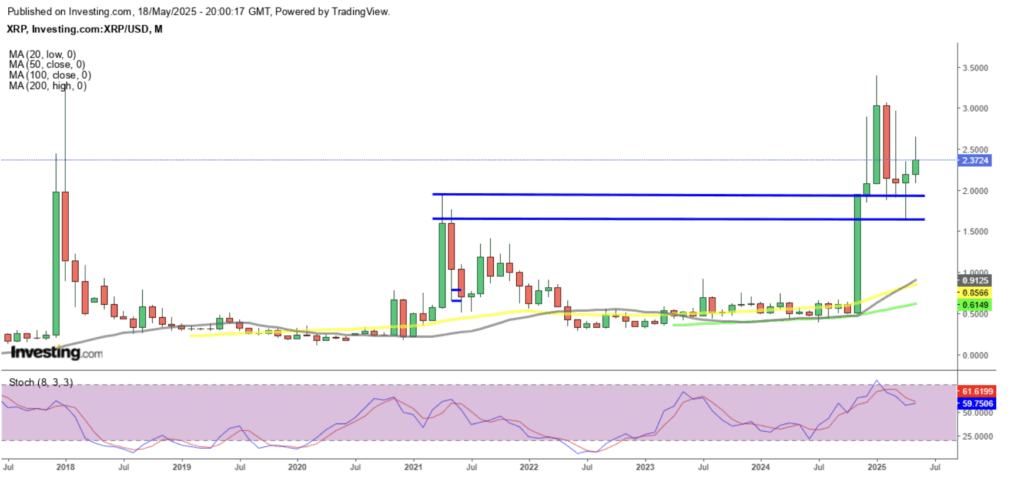

After a 50% drop from its January peak of $3.40 to $1.65, XRP is making a comeback. The $1.65 to $2 zone has confirmed to be a robust assist space, with April’s month-to-month candle forming a bullish hammer sample — a sign typically seen forward of pattern reversals. Since then, XRP has surged to $2.65, breaking above the 100-day SMA, a stage that had beforehand capped its upside since March.

Institutional Enhance: CME Futures Launch

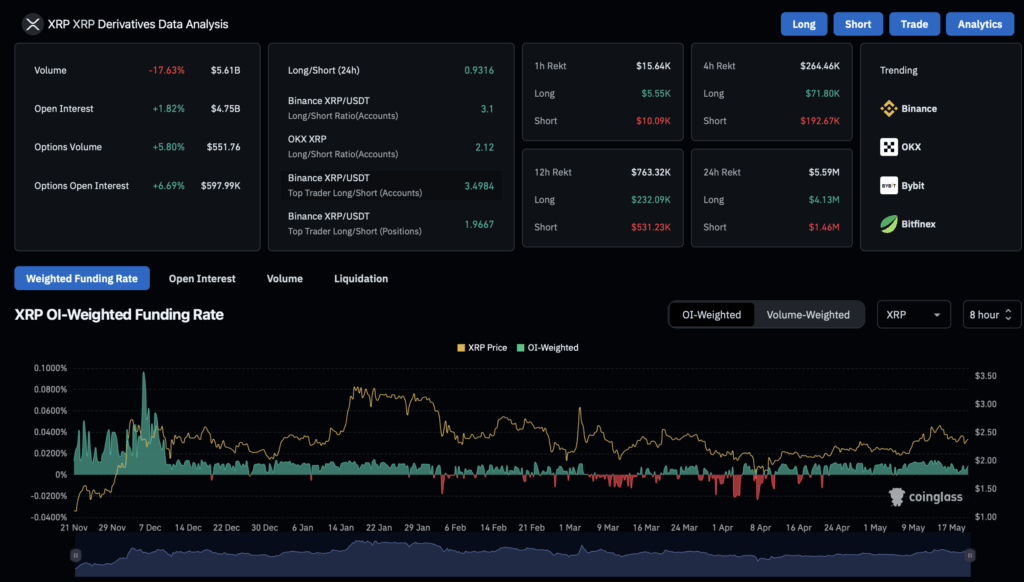

Including gasoline to the rally, CME Group will launch commonplace and micro XRP futures contracts on Might 19, with early entry beginning Might 18 through CME Globex. Institutional buyers will now have regulated publicity to XRP, with full contracts masking 50,000 XRP and micro contracts representing 2,500 XRP — each cash-settled towards the CME CF XRP-Greenback Reference Fee.

Broader Market Tailwinds

XRP’s bounce aligns with a broader market resurgence, led by Bitcoin’s reclaiming of the $100,000 mark. This renewed momentum has reignited curiosity in various digital belongings, with XRP benefiting from the broader bullish sentiment.

Conclusion: Potential for Prolonged Upside

Regardless of ongoing regulatory uncertainty, XRP’s rebound from assist, bullish reversal patterns, and upcoming CME futures launch counsel the potential for additional good points. If optimistic momentum continues, XRP could possibly be organising for a broader pattern continuation, notably if regulatory readability or ETF approval materializes.